Specialty Pharmacy Providers: Market Landscape Trends and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

While very few vertically-integrated firms control the majority of specialty pharmacy market share, the market landscape is nothing short of dynamic as health systems enhance access and regulatory activity continues to emerge and develop. HIRC’s report, Specialty Pharmacy Providers: Market Landscape Trends and Strategic Imperatives, examines recent market trends, key players, and specialty pharmacy provider (SPP) strategic imperatives. The report addresses the following questions:

- What notable market trends are impacting the specialty pharmacy channel?

- What are the latest trends in specialty drug dispensing and distribution (e.g., limited distribution trends, white bagging)?

- How has the market evolved in regards to specialty pharmacy market share and the number accredited specialty pharmacies operating in the U.S.?

- What is the status and impact of the health system-owned specialty pharmacy sector?

- What do SPPs describe as their most urgent strategic imperatives for 2023 and how does this vary by ownership type (e.g., PBM-owned vs. independent)?

- How common is it for various SPP services to be provided as a core service vs. at an additional cost to manufacturers and payers?

Key Finding: While market share is largely dominated by a few large specialty pharmacies, health systems now account for 50% of all accredited SPPs. The diversity of SPPs by ownership type continues to require complex channel management to build and maintain the optimal network for a given product.

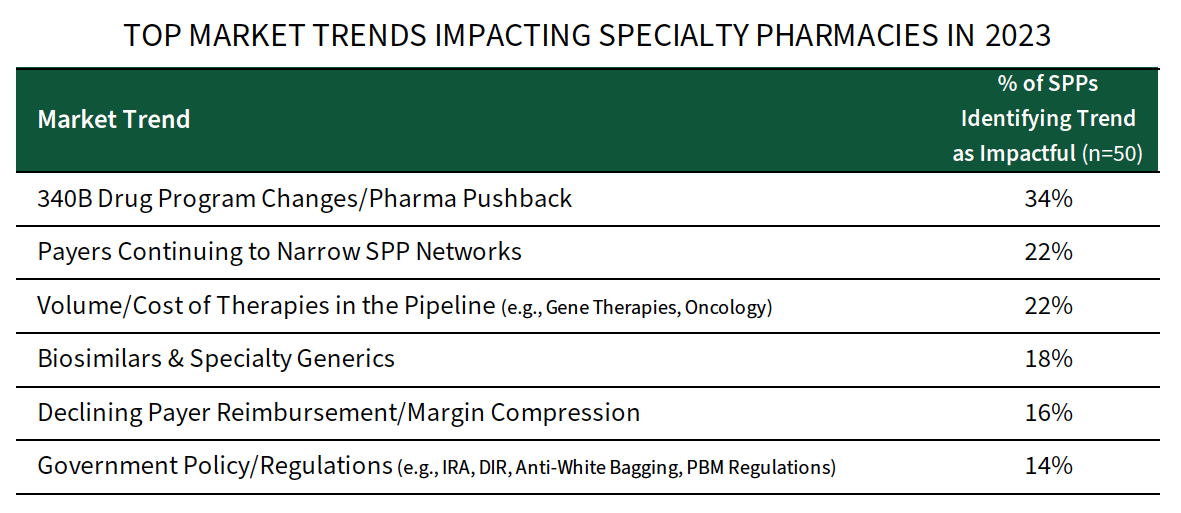

340B, Drug Pipeline, and Payer Influence Identified as Top Market Trends Impacting SPPs. SPPs report several market trends impacting their industry and businesses in 2023. Topping the list are 340B activity/pushback, rare disease and biosimilar drugs, payers' continued narrowing of networks, and margin & reimbursement pressures. Several regulatory issues are also top of mind in 2023, especially pertaining to DIR fees and newer PBM regulations.

The full report examines the complete list of market trends in detail, in addition to how specialty pharmacies are responding and positioning themselves.

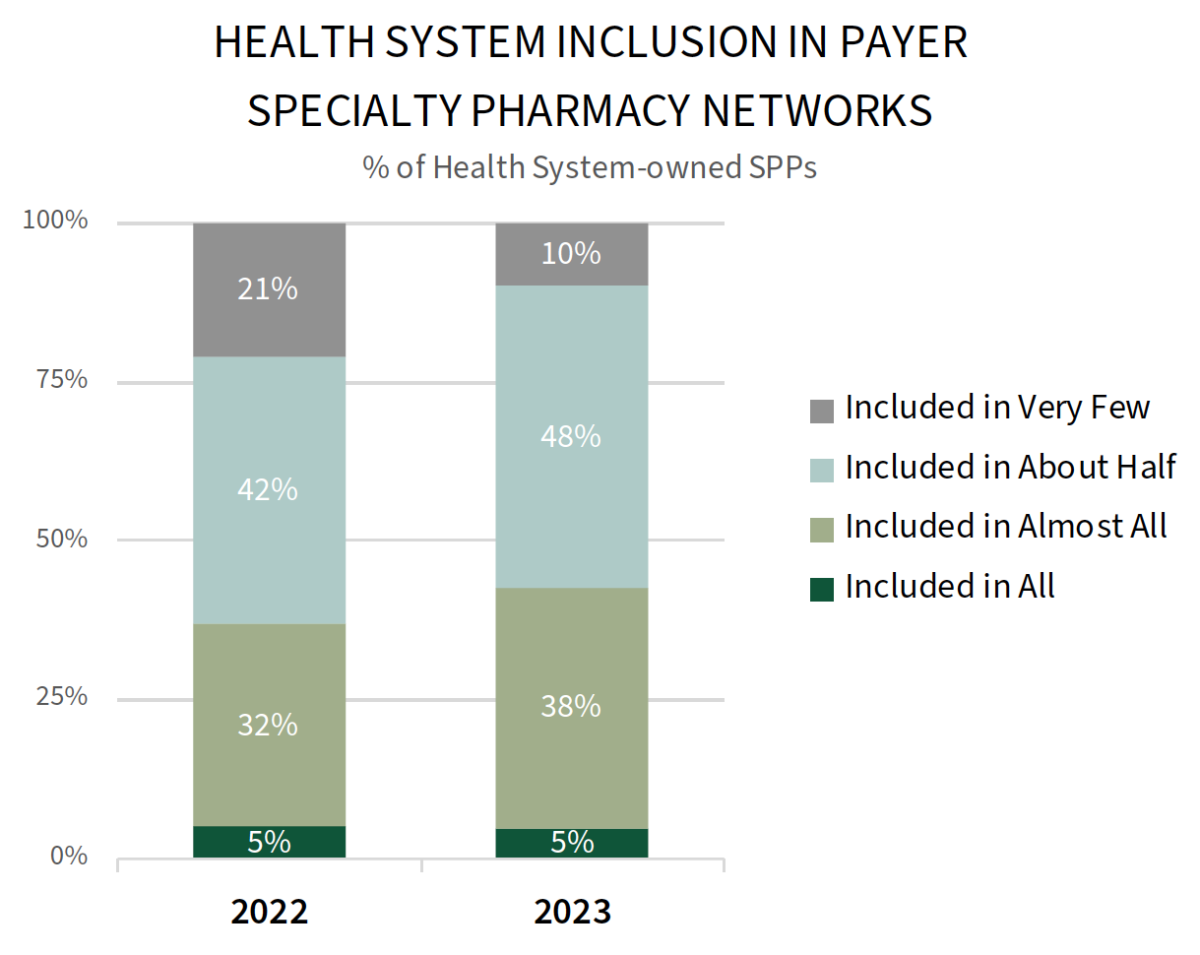

Health System-owned Specialty Pharmacies Make Inroads. HIRC analyses of specialty pharmacy accreditation databases finds that the total number of provider-led specialty pharmacy organizations has surpassed 400 in 2023. And, HIRC primary research findings suggest that up to 80% of IDNs now have an internal specialty pharmacy (up from 54% in 2017). Health system-owned SPPs’ access to payer networks may be opening modestly. Just under half (43%) report inclusion in 'all' or 'almost all' payer networks in their region in 2023, up from 37% in 2022.

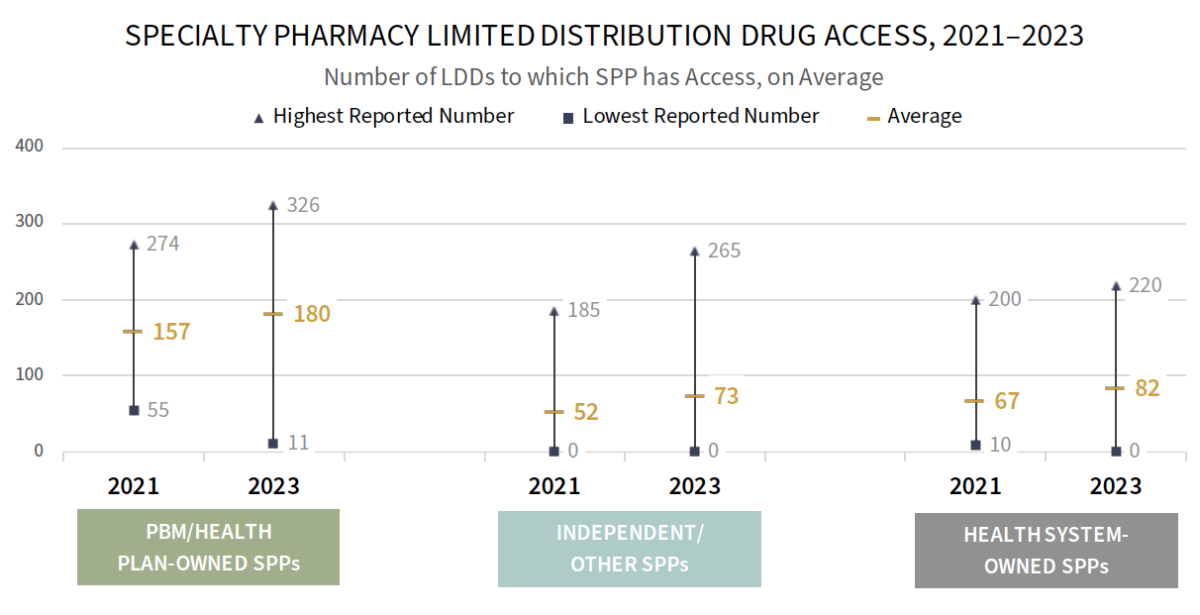

PBM/Health Plan-owned SPPs Maintain Advantage in Limited Distribution Drug Access. There are over 250 more limited distribution drugs on the market in 2023 compared to 2017. PBM and health plan-owned specialty pharmacies report access to a greater number of limited distribution drugs on average, leaving health systems and independents at a disadvantage, though both report an increase in access to LDDs in 2023.

The full report reviews trends in limited distribution, as well as distribution trends by therapeutic class and therapy type.

Profiles of the top industry-leading SPPs, dispensing trends, service offerings, and strategic imperatives are segmented by the following in the complete report:

- PBM/Health Plan-owned Specialty Pharmacies (n=9)

- Independent and Other Specialty Pharmacies (e.g., Retail, Wholesaler-owned) (n=18)

- Health System-owned Specialty Pharmacies (n=23)

Research Methodology and Report Availability. In March & April, HIRC surveyed 50 specialty pharmacy provider executives, representing a variety of ownership types. In addition to extensive secondary research, online surveys and follow-up telephone interviews were used to gather information. The report, Specialty Pharmacy Providers: Market Landscape Trends and Strategic Imperatives, is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >