April 2024. Examines the current market landscape, PBM executives' strategic imperatives going forward, and views on market trends that could impact the segment further.

Managed Markets

2024 Research

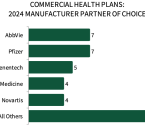

March 2024. Reviews the commercial health plan contracting landscape and pharmacy and medical directors' evaluation of manufacturers willingness to contract.

February 2024. Examines the PBM contracting landscape and PBM key decision-makers' evaluation of manufacturers willingness to contract.

January 2024. Provides pharmaceutical firms' ratings of key Pharmacy Benefit Manager, PBM-owned GPOs, Commercial Health Plan, Medicare Advantage, and Medicaid MCO accounts in ability to limit brand access and willingness to partner with manufacturers. Examines respondents' rationales driving ratings.

January 2024. Assists pharmaceutical manufacturers in understanding trends in headcounts across very large, large, and mid-size firms.

2023 Research

November 2023. Examines the Medicaid MCO market landscape, current contracting landscape, reviews Medicaid MCO executives' evaluation of manufacturer engagement, and identifies partnership opportunities.

August 2023. Examines the current Medicare Advantage market landscape, market trends, and contracting environment, and reviews Medicare Advantage executives' evaluation of manufacturers' willingness to contract and quality of programs/resources, and identifies partnership opportunities.

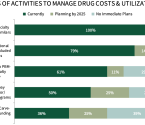

May 2023. Examines the current market landscape, health plan executives' strategic imperatives going forward, and views on market trends that could impact the segment further.

-

In light of increasing regulatory pressures shaping the Pharmacy Benefit Manager landscape, PBMs are strategically focusing on moderating drug spend and utilization while prioritizing patient...

-

Market access in the commercial health plan segment remains critical as plans seek alternative contracting approaches and opportunities to meaningfully collaborate with pharmaceutical manufacturers....

-

Partnerships with pharmacy benefit managers (PBMs) are critical to maintaining favorable pharmaceutical product market access. HIRC's report, Pharmacy Benefit Managers: Contracting Landscape and...

-

Vertical integration between Plans, PBMs, GPOs, Specialty Pharmacies, and Providers continues to challenge pharmaceutical manufacturer access and partnership opportunities. An understanding of the...

-

Pharmaceutical manufacturers continue to evolve managed markets staffing structures to meet customer needs as the market landscape changes due to continued consolidation and government policy changes...

-

The managed Medicaid segment continues to be impacted by policy changes and fluctuations in enrollment post-COVID. HIRC's report, Medicaid MCOs: Market Landscape Trends, Contracting Environment and...

-

As the Inflation Reduction Act (IRA) poses new challenges, Medicare Advantage plans seek aggressive contracting opportunities as well as increased UM and formulary management to control costs. HIRC's...

-

Vertical integration between plans, PBMs, GPOs, specialty pharmacies, and providers has increased the control of insurers across the health care supply chain. HIRC's report, Commercial Health Plans:...

Managed Markets

Research Overview

Current and emerging market trends in health care continue to impact pharmaceutical firms' key customers. For over 30 years, HIRC's Managed Markets Service has monitored the activity impacting pharmaceutical market access and has provided strategic insights for clients to engage in effective account management of key payer customers.

The service provides manufacturers a comprehensive resource to guide account planning and access strategies through its triangulated research design, utilizing a combination of primary survey data, interview insights, and in-depth secondary research.

For more information or to subscribe, contact Josh Mader via email or at (408) 884-8560.

Comprehensive Approach to Managed Markets Access

Insights from commercial pharmacy and medical directors, PBM leaders, and Medicaid MCO and Medicare executives are gathered to assess current and future market trends, customer needs and challenges, and the competitive landscape. Pharmaceutical industry leaders are also surveyed to assist in driving managed markets headcounts decisions and to assess the access and partnership landscape of key commercial and government accounts.

- Pharmaceutical Manufacturers: Managed Markets Headcounts and Organizational Study

- Pharmaceutical Manufacturers: Access and Partnership Landscape for Key Accounts

- Market: Commercial Health Plans

- Market: Commercial PBMs

- Market: Medicare Advantage Plans

- Market: Medicaid MCOs

Bringing Value to Subscribers

HIRC's data and insights enable subscribers to understand and track market dynamics and trends critical to optimal product and value-added program positioning as the health care delivery market evolves.

Through detailed analyses, key implications, and strategic recommendations from experienced HIRC researchers, subscribers to the Managed Markets Service are able to monitor and evaluate critical market trends, benchmark manufacturer contracting and resources, identify and understand managed care needs, and act upon partnership opportunities.