Specialty Medication Market Access Metrics - Utilization Management and Formulary

Highlights of the report:

Download a PDF of these Highlights

Payers rely heavily on formulary and utilization management tactics to moderate specialty drug spend, and continue to adjust their strategy as the market evolves and as specialty categories become more crowded. HIRC’s report, Commercial Health Plans: Specialty Medication Market Access Metrics, examines the formulary status of and utilization management tactics applied to 42 medications across eight high profile therapeutic classes. The report addresses the following questions:

- What is the coverage and location of benefit landscape across specialty therapeutic classes?

- Which specialty medications are most often designated as preferred in commerical health plan formularies? Why?

- How do plans define "value" when evaluating new and existing specialty medications?

- Which utilization management tactics are most often applied to products across specialty therapeutic classes? How has this evolved?

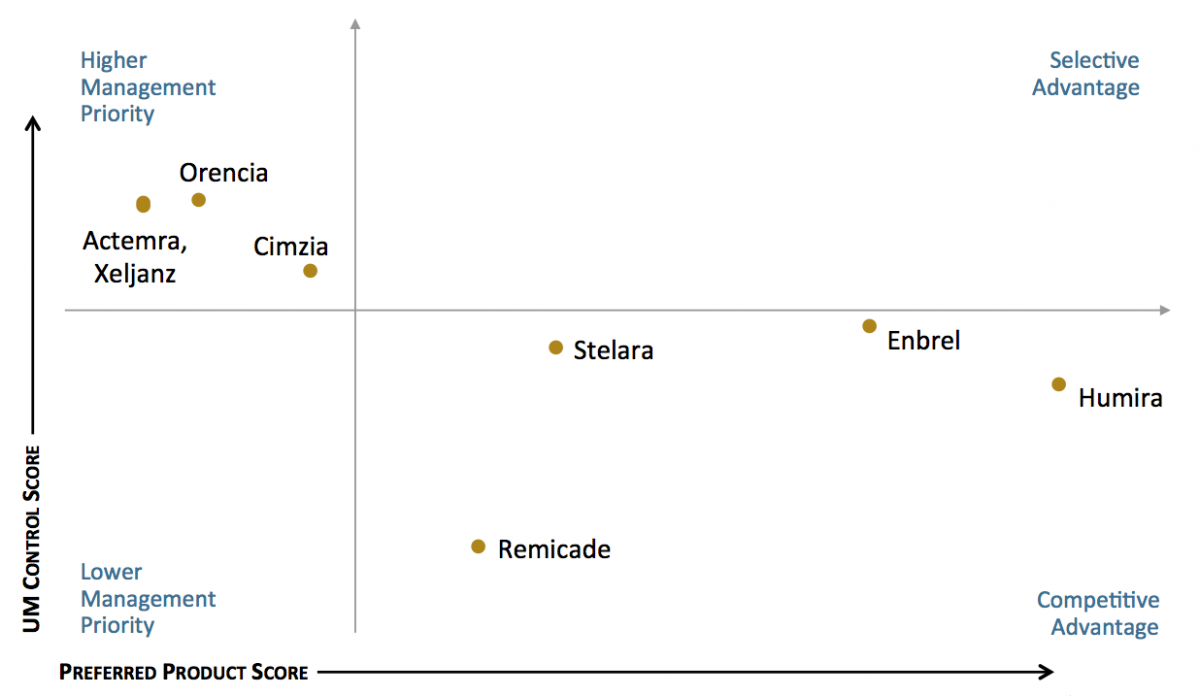

Key Finding: The market access landscape varies by therapeutic class, revealing competitive advantages and areas of opportunity for specialty brands as the market evolves and therapy classes become more crowded.

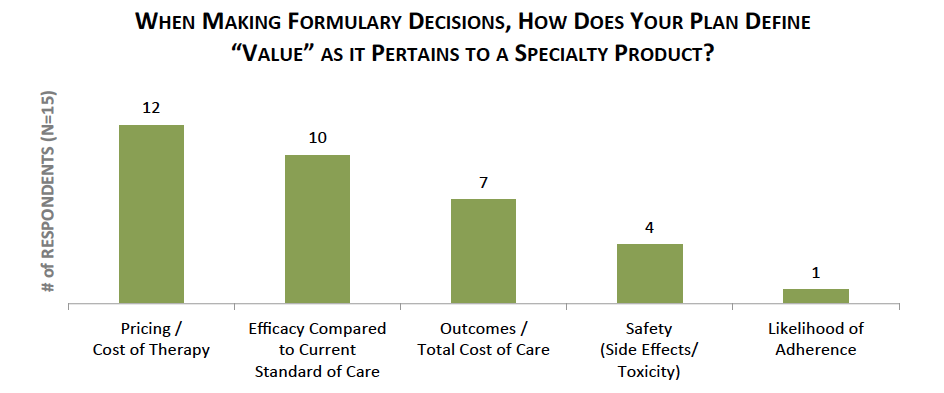

Cost of Therapy, Clinical Efficacy, and Outcomes Considered as Plans Evaluate Specialty Medication Value. Health plans consider a number of factors when evaluating and making formulary status determinations for specialty medications. Qualitative interviews with commercial pharmacy and medical directors reveal that the three most critical factors considered in determining the overall value of a specialty product include: 1) Pricing / cost of therapy, 2) Clinical efficacy compared to the current standard of care, and 3) Impact on outcomes and/or total cost of care.

The full report provides the formulary status for a market basket of 42 specialty medications across eight therapeutic areas, as well as the factors driving preferred formulary status for each product.

Humira and Enbrel Maintain Favorable Access Position in Rheumatoid Arthritis Segment. The utilization management (UM) and access landscape varies by class. Some products dominate as preferred in health plan formularies, while others are subject to higher levels of UM control by payers. In the rheumatoid arthritis / psoriasis / Crohn's disease segment, Humira and Enbrel are most often designated as preferred products and are subject to relatively lower levels of UM control.

The full report examines further insights into plan approaches to managing rheumatoid arthritis, multiple sclerosis, and hepatitis C, and provides market access benchmark metrics for the following specialty therapeutic classes and medications:

- Rheumatoid Arthritis / Psoriasis / Crohn's Disease: Actemra, Cimzia, Enbrel, Humira, Orencia, Remicade, Stelara, Xeljanz

- Multiple Sclerosis: Aubagio, Avonex, Betaseron, Copaxone, Gilenya, Lemtrada, Plegridy, Rebif, Tecfidera, Tysabri

- Hepatitis C: Harvoni, Olysio, Sovaldi, Viekira Pak

- HIV / AIDS: Complera, Intelence, Stribild, Tivicay, Triumeq

- Pulmonary Arterial Hypertension: Adempas, Letairis, Opsumit, Orenitram, Tracleer

- Cystic Fibrosis: Cayston, Kalydeco, Pulmozyme

- Erythropoiesis-stimulating Agents (ESAs): Aranesp, Procrit, Epogen

- White Blood Cell Stimulants: Granix, Leukine, Neulasta, Neupogen

Research Methodology and Report Availability. In January - February, HIRC surveyed 57 pharmacy and medical directors from national, regional, and blues plans representing 84 million lives. Online surveys and follow-up telephone interviews were used to gather information. The Commercial Health Plans: Specialty Medication Market Access Metrics report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com/summary/sp.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >