Special Report: Biosimilars Adoption & Contracting Trends, 2023

Highlights of the report:

Download a PDF of these Highlights

Biosimilars have changed the competitive environment across key therapeutic areas such as inflammation & immunology, cancer supportive therapies, and oncology. HIRC's report, Biosimilars: Adoption & Contracting Trends, 2023, examines payer and provider adoption and the contracting landscape for biosimilars and brand originators. The report addresses the following questions:

- What is the status of biosimilar adoption among commercial health plans? Which utilization management tactics do plans rely on to drive use of their preferred biosimilars?

- What is the status of biosimilar adoption among providers (e.g., integrated delivery networks, cancer centers)?

- What is the status of contracts with commercial health plans for biosimilars and brand originators? What contract approaches are most common (e.g., flat access rebates, price protection, market share rebates)?

- What are the most common average discount/rebate amounts offered for biosimilars and brand originators? How have discount/rebate amounts changed over time?

- What are commercial health plan and provider perspectives on HUMIRA biosimilars?

Key Finding: Data suggests continued growth in biosimilars adoption among payers and providers, as well as an active contracting environment to gain or maintain market access; the impact of HUMIRA biosimilars is expected to be more noteworthy in 2024 and beyond.

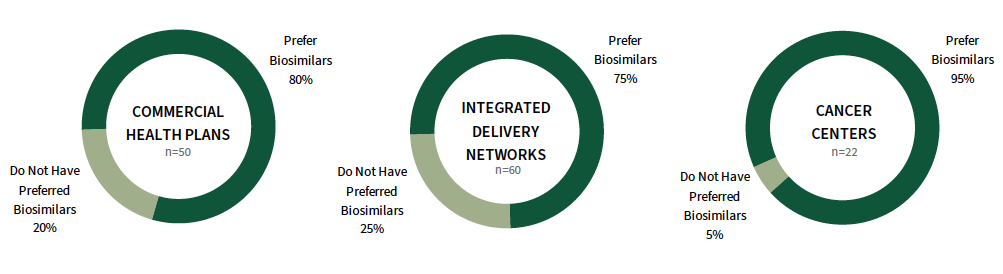

Adoption of Biosimilars Continues to Trend Upwards Among Payers and Select Provider Segments. As of early 2023, 80% of commercial health plans preferred at least one biosimilar on 2023 formularies, 75% of integrated delivery networks preferred at least one biosimilar, and 95% of cancer centers had at least one preferred biosimilar. These figures have steadily increased across most segments year-over-year, with some fluctuation along with the pricing/contracting environment. The status of adoption at the product level varies; XARZIO, MVASI, and RETACRIT are preferred most often.

The full report provides the status of adoption for a listing of 20+ biosimilars spanning inflammation & immunology, cancer supportive therapies, and oncology, as well as payer utilization management tactics to promote use of their preferred biosimilars.

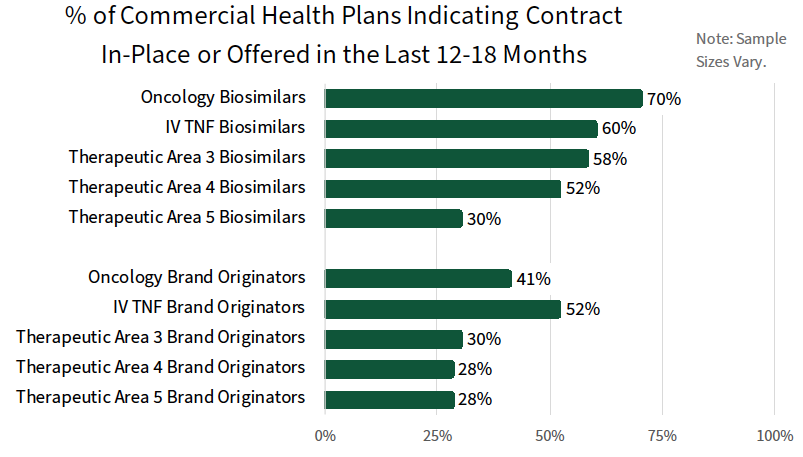

Payers Report an Active Contracting Environment for Both Biosimilars and Brand Originators. A greater percentage of commercial plans report contracts in-place or offered in the last 12-18 months for biosimilars relative to brand originators across the therapeutic areas queried. For example, 70% of plans report a contract in-place or offered for oncology biosimilars, compared to 41% for brand originators and 60% of plans report a contract in-place for IV TNF inhibitor biosimilars, compared to 52% for the brand originator.

The complete report also reviews contract types offered for biosimilars and brand originators by as well as the most common rebate/discount amounts offered.

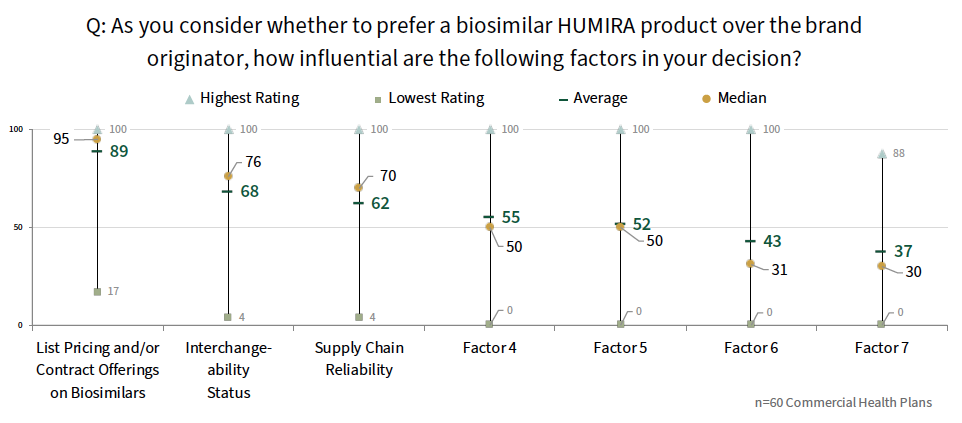

Early Insights on HUMIRA Biosimilars. While it is too early to gauge the true impact of recently launched HUMIRA biosimilars in 2023, customer ratings suggest that net pricing, interchangeability status, and perceptions of supply chain reliability will be the most influential factors driving health plan decisions. Plans are likely to cover select biosimilar(s) and the brand originator at parity to begin with.

Research Methodology and Report Availability. Special reports draw upon data across HIRC services, allowing readers to glean insights into high level topics across varying market segments, channels, and/or therapeutic areas. HIRC's report, Biosimilars: Adoption & Contracting Trends, 2023, includes survey and qualitative follow-up interview insights from various commercial health plan and provider panels, collected in early 2023. Please note that all primary data was collected prior to the launch of most HUMIRA biosimilars. The report is available now to HIRC’s Special Report Series subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >