Medicare Advantage Plans: Oncology Medication Management, Contracting, and Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

Looking ahead of the implementation of the Inflation Reduction Act (IRA), Medicare Advantage plans are working towards more aggressive contracts as well as tighter cost and utilization management of oncology medications. HIRC's report, Medicare Advantage Plans: Oncology Medication Management, Contracting, and Manufacturer Engagement, examines current management approaches, the contracting environment, and best-in-class manufacturer support in oncology. The report addresses the following questions:

- What is the anticipated impact of the IRA to Medicare Advantage plans?

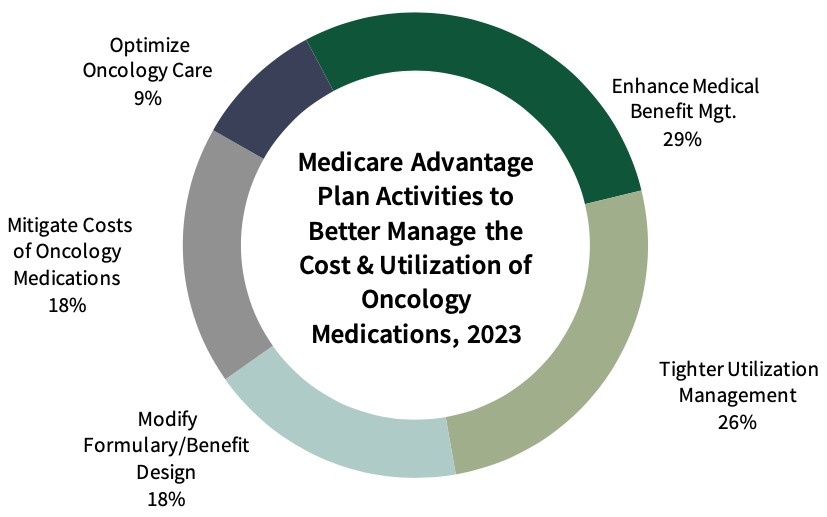

- What are MA plans' top activities to better manage the cost and utilization of oncology medications in 2023/2024?

- What is the status of Part B step therapy implementation, biosimilar uptake, and oncology clinical pathway adoption? What is the status of UM tactics and preferred products across cancer types?

- What is the current contracting landscape for oncology medications in Medicare Advantage? What are the most common approaches and rebate/discount amounts?

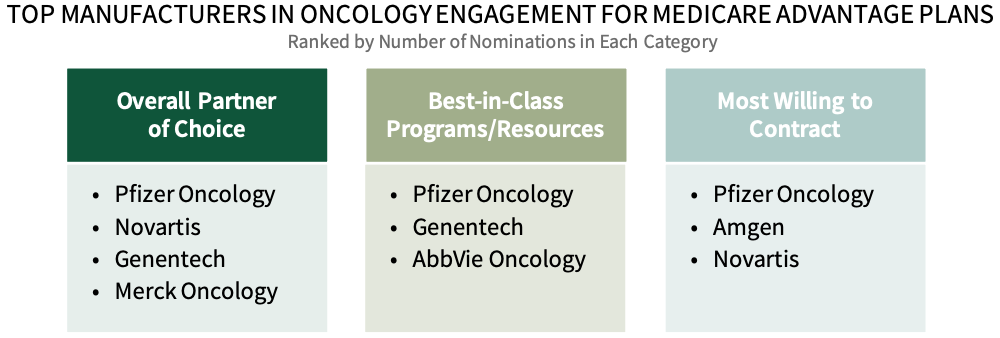

- Which firms are most often nominated as MA plans' Partner of Choice in oncology? Which firms provide the best program and resource offerings to MA plans, and which are most willing to contract for oncology drugs covered in Parts D & B?

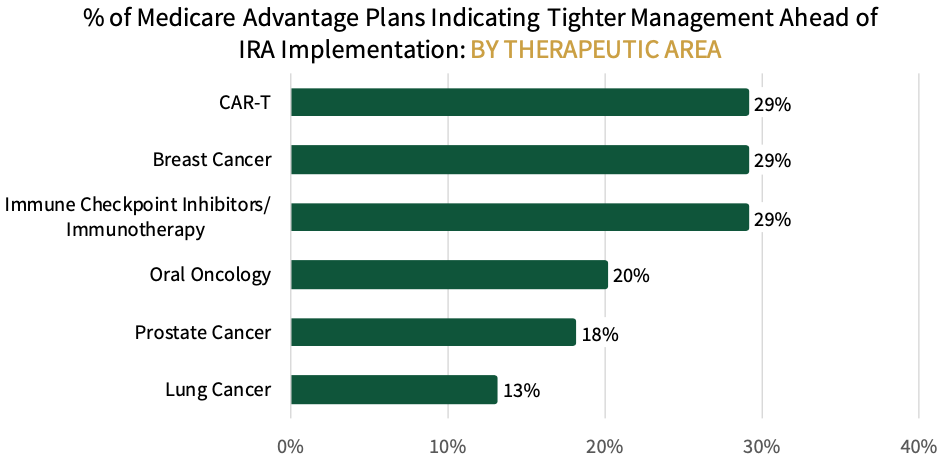

Key Finding: Medicare Advantage plans are targeting CAR-T Cell therapies, breast cancer medications, and immune checkpoint inhibitors for tighter management ahead of the IRA.

Tighter Utilization Management of Oncology Medications is a High Priority for Medicare Advantage Plans. Medicare Advantage plans report a number of activities to better manage the cost and utilization of oncology medications. Top initiatives include expanding use of prior auth to additional products/therapeutic categories, driving use of generics and/or biosimilars, and seeking aggressive contracting opportunities with manufacturers.

MA Plans Target CAR-T, Breast Cancer, and Immunotherapies for Additional Management. Medicare Advantage respondents were asked which oncology therapeutic areas and/or products they will be targeting for tighter management ahead of the IRA's implementation. Respondents indicate that CAR-T Cell therapies, breast cancer medications, and immune checkpoint inhibitors will be targeted most for tighter management (29% of plans), followed by oral oncology (20%), prostate cancer (18%), and lung cancer products (13%). The full listing includes twelve categories/products targeted for additional management.

Pfizer Oncology Leads as Most Supportive Oncology Manufacturer for Medicare Advantage Plans. Medicare Advantage plan decision-makers were asked to nominate a manufacturer in three key areas: 1) Overall Partner of Choice in Oncology, 2) Best-in-Class Programs/Resources, and 3) Most Willing to Contract for medications covered under Medicare Part D and Part B. Pfizer Oncology, Genentech, and Novartis are consistently among the leaders nominated in best-in-class across categories.

Research Methodology and Report Availability. In September, HIRC surveyed 45 pharmacy and medical directors from national, regional, and BCBS plans representing 21.2 million Medicare lives. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Medicare Advantage Plans: Oncology Medication Management, Contracting, and Manufacturer Engagement, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >