Medicare Advantage Study: Oncology Medication Management and Pharmaceutical Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

As oncology medication prices rise and the market becomes more competitive, Medicare Advantage plans continue to focus on cost-effective, value-based care. HIRC's report, Medicare Advantage Study: Oncology Medication Management and Pharmaceutical Manufacturer Engagement, reviews MA plans' perceptions and ratings of manufacturers, approaches to oncology management, and examines the resulting market access landscape across ten cancer types. The report addresses the following:

- How do firms benchmark in contracting and support of oncology-related initiatives?

- Which operational objectives drive MA plans' decision-making in oncology medication management?

- What is the status of MA plans' utilization management tactics across benefits?

- What is the status of clinical pathway adoption and development across cancer types?

- What is the rationale for selecting preferred medications? What are the methods used to promote preferred products across cancer types?

Key Finding: MA plans' top operational objectives in oncology focus on managing total cost of care by encouraging physicians to discuss advance care planning, and ensuring physician use of evidence-based pathways to manage cost.

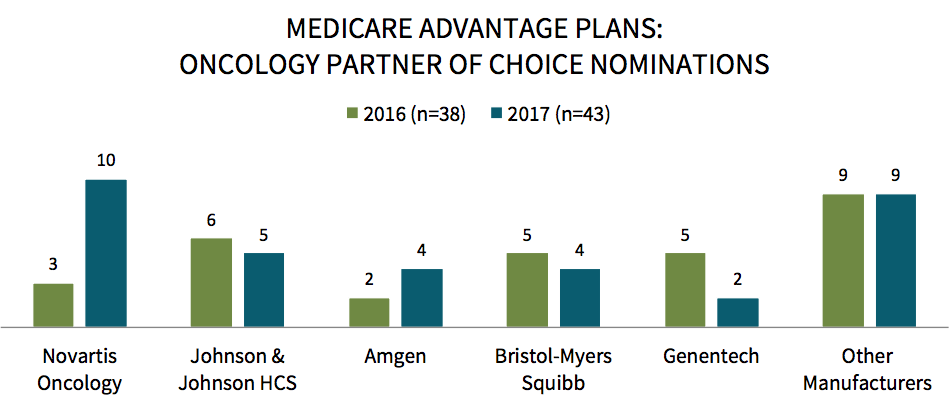

Novartis Oncology Receives the Most Medicare Advantage Plan Oncology "Partner of Choice" Nominations. Novartis Oncology is most frequently nominated as the Medicare Advantage plan oncology partner of choice, followed by Johnson & Johnson HCS, Amgen, and Bristol-Myers Squibb. Novartis Oncology also has the largest increase in number of nominations year-over-year. Notable factors driving nominations include a firm's understanding of plans' needs, willingness to contract, and looking for meaningful partnership opportunities.

The full report includes the complete listing of partner of choice nominations and a detailed analysis of factors driving panelists' selections.

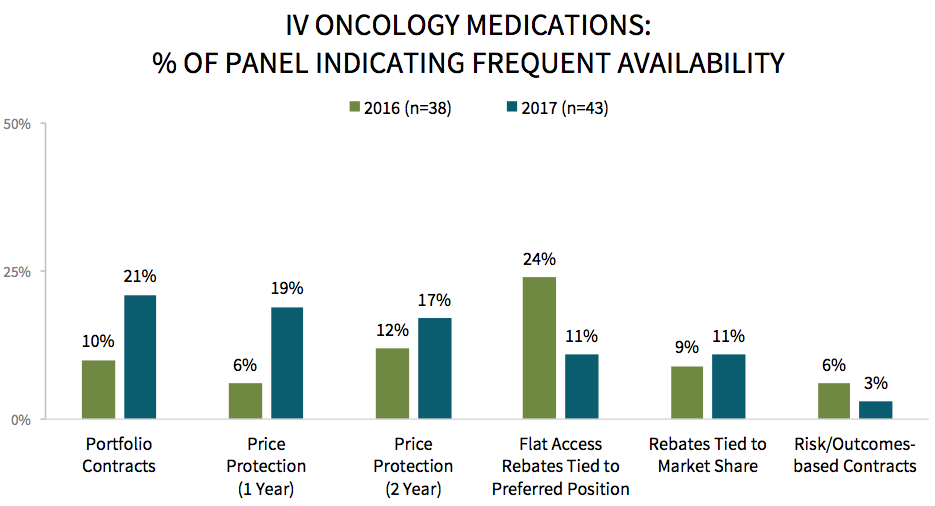

Medicare Advantage Plan Respondents Perceive a Rise in Contract Availability for IV Oncology Medications. Respondents were asked to indicate the availability of contract types currently offered by manufacturers for IV oncology medications. Though contracts for IV medications are rarely offered, Medicare Advantage plans perceive portfolio, price protection, and rebates tied to market share contracts as being offered more frequently in 2017 for IV oncology agents compared to 2016.

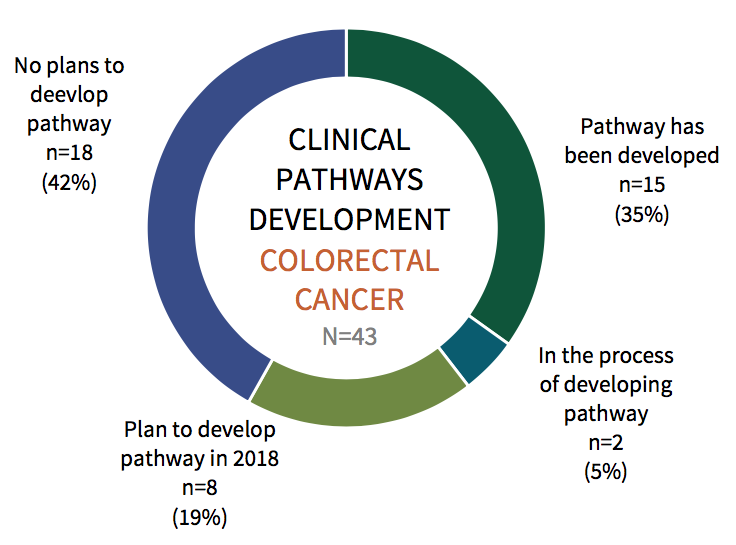

Clinical Pathway Activity is Highest in Colorectal Cancer Among Medicare Advantage Respondents in 2017. Medicare Advantage plan respondents were asked to indicate the status of the plan's clinical pathway adoption across ten cancer types. In colorectal cancer, 35% of MA plans report having a pathway in place in 2017. Approaches to pathway development vary, however, nearly 75% of plans with pathways in place developed their pathways internally, with the remainder partnering with an external vendor.

Research Methodology and Report Availability. In June, HIRC surveyed 43 pharmacy and medical directors from national, regional, and BCBS Medicare Advantage plans representing 4.4 million MA lives. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Medicare Advantage Study: Oncology Medication Management and Pharmaceutical Manufacturer Engagement, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >