Medicare Advantage: Manufacturer Engagement and Oncology Medication Management and Market Access

Highlights of the report:

Download a PDF of these Highlights

Cost effective cancer care is a top priority among Medicare Advantage (MA) plan sponsors, especially as the number and pace of new oncology medication introductions accelerates. HIRC's report, Medicare Advantage Plans: Manufacturer Engagement and Oncology Medication Management and Market Access, reviews MA plan decision-maker perceptions and ratings of oncology medication manufacturers and examines the market access landscape for cancer medications. The report addresses the following questions:

- How do oncology companies benchmark in oncology-related support?

- Which operational objectives drive MA plans' decision-making in oncology medication management?

- What is the status of Medicare Advantage plans' management tactics across benefits?

- What is the status of preferred drug list (PDL) development and oncology clinical pathways adoption across ten cancer types?

- Which oncology products are most often designated as preferred across cancer types? How are preferred oncology products advantaged?

Key Finding: MA plans' investment in resources to better manage cancer therapies and improve patient outcomes is higher overall in 2016 compared to previous years. Unmet needs remain and serve as an access point to drive manufacturer collaborative opportunities.

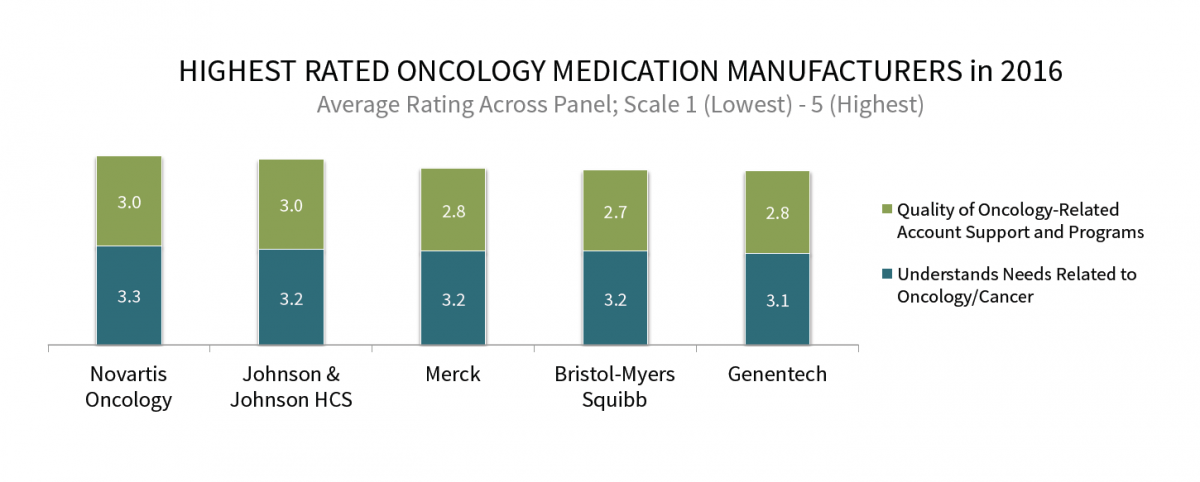

Novartis Oncology and Johnson & Johnson HCS are Among the Top Tier in Oncology Support for MA Plans. From 2014-2016, Johnson & Johnson HCS, Genentech, Bristol Myers Squibb, and Novartis Oncology received the most overall partner of choice nominations from MA plan key decision-makers. In addition, Novartis Oncology and Johnson & Johnson HCS earn the highest cumulative ratings in truly understanding Medicare Advantage plans' needs in oncology and in quality of oncology-related account support and programs.

The full report benchmarks 22 manufacturers active in oncology and provides customer insights and perspectives of the leading companies.

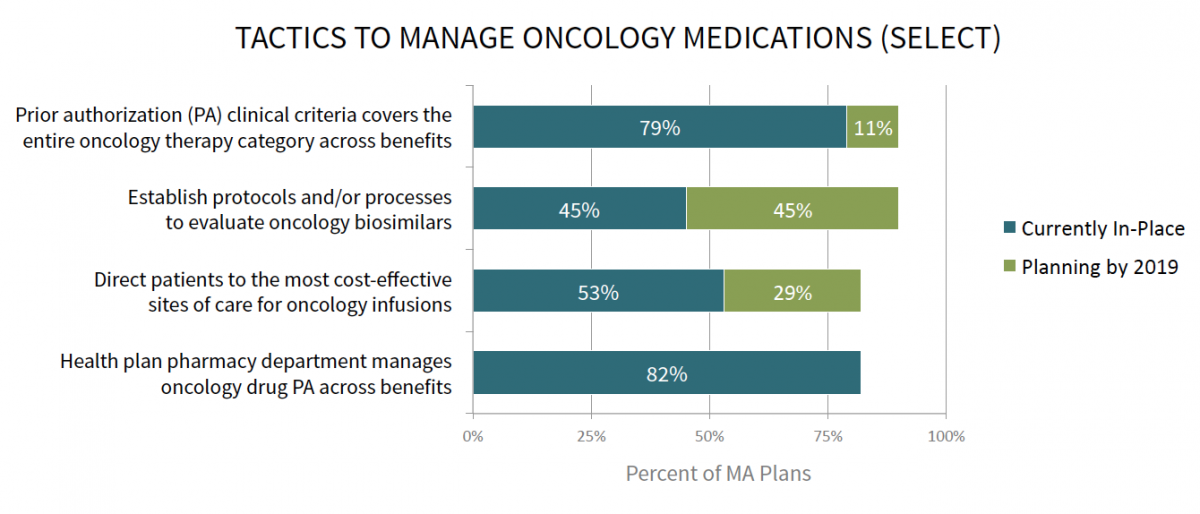

Current and Future Management Tactics Include Site of Care Initiatives and Protocols for Biosimilars. Medicare Advantage plans have adopted several strategies to better manage oncology medications. Those with a higher reported prevalence in 2016 than in 2015 include having the health plan pharmacy department manage the oncology drug PA across the pharmacy and medical benefits and directing patients to the most cost effectives sites of care for oncology infusions. And by 2019, 90% of MA plans may have established protocols and processes for evaluating oncology biosimilars.

The full report provides the status of a listing of over ten management tactics and reveals the top five tactics that Medicare Advantage plans look to implement by 2019.

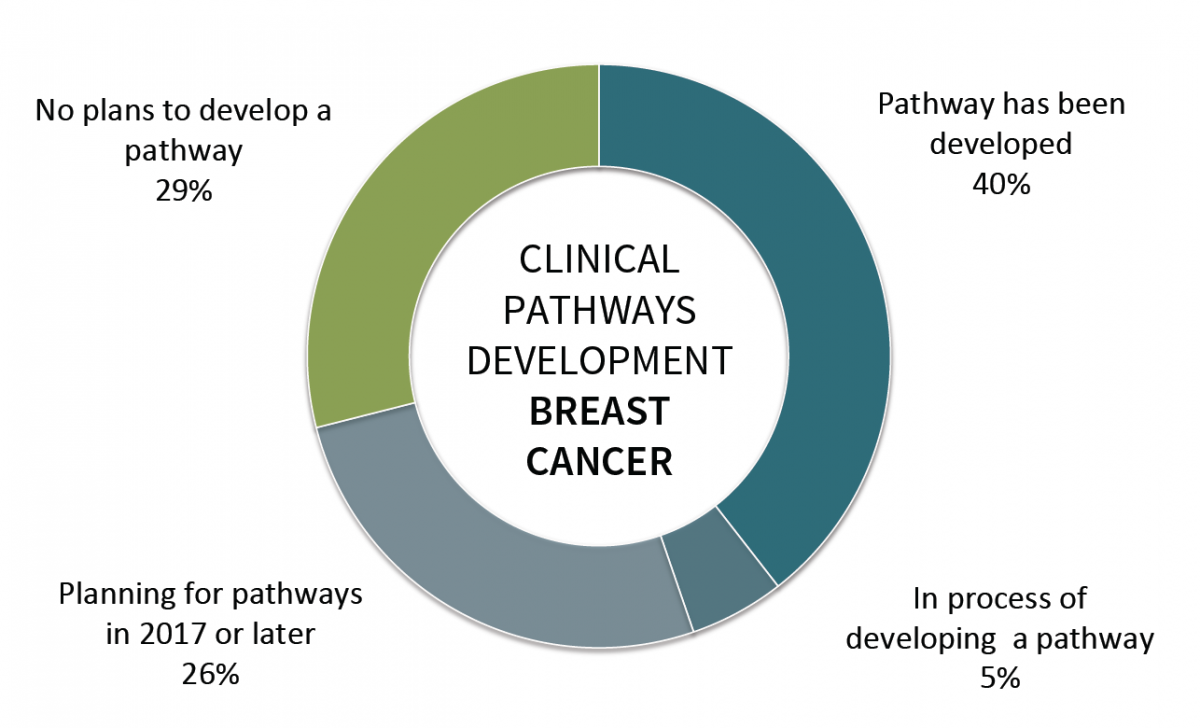

Clinical Pathway Activity is Higher in 2016 Compared to Previous Years. Medicare Advantage plans continue to implement clinical pathway programs in an attempt facilitate appropriate utilization of oncology medications. In breast cancer, for example, 40% of plans report having a pathway in-place in 2016, compared to 30% of MA plans in 2015. Approaches to pathway development vary; over half of plans with pathways in-place developed their pathways internally, with the remainder partnering with an external vendor.

The full report examines clinical pathway activity across ten cancer types and the incentive programs that plans use to encourage adherence to clinical pathways.

Research Methodology and Report Availability. In May, HIRC surveyed 38 pharmacy and medical directors from national, regional, and blues Medicare Advantage plans representing 8.5 million Medicare lives. Online surveys and follow-up interviews were used to gather information. The full report, Medicare Advantage Plans: Manufacturer Engagement and Oncology Medication Management and Market Access, is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >