Medicare Advantage Plans: Market Landscape Trends, Contracting Environment and Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

As the Inflation Reduction Act (IRA) poses new challenges, Medicare Advantage plans seek aggressive contracting opportunities as well as increased UM and formulary management to control costs. HIRC's report, Medicare Advantage Plans: Market Landscape Trends, Contracting Environment and Manufacturer Engagement, reviews the current market landscape, Medicare Advantage plan executives' strategic imperatives, pharmacy and medical directors' evaluation of manufacturers, and focuses on trends in contracting. The report addresses the following questions:

- What is the current landscape of the Medicare Advantage market, and which plans account for the majority of market share?

- What are Medicare Advantage plans' most important strategic imperatives for 2023 and what are the most disruptive market trends? What are Medicare Advantage plans' top concerns and challenges regarding implementation of the IRA?

- Which manufacturers are most often nominated as Medicare Advantage plans' overall "Partner of Choice"? How do manufacturers benchmark across willingness to contract and overall quality of programs/resources?

- What is the current contracting environment across 20 therapeutic areas? Which contract types are most frequently offered and what are the most common rebate/discount amounts?

Key Finding: The top market trends identified by Medicare Advantage key decision-makers in 2023 include changes brought forth by the IRA, such as risk adjustment, drug price negotiations, and rebate changes.

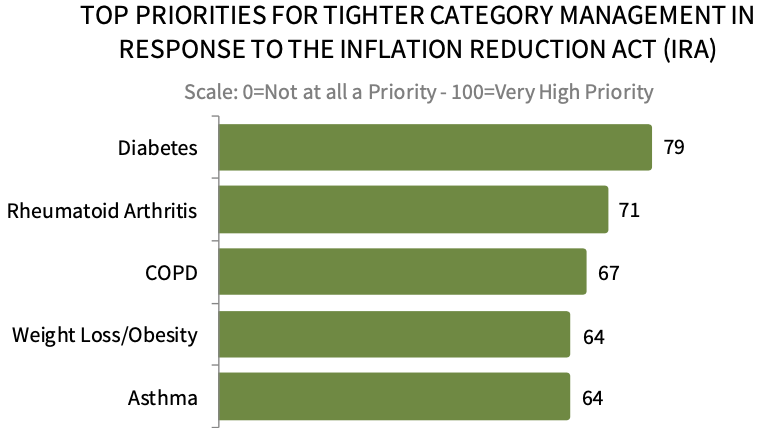

Therapeutic Area Management in Response to the IRA. Medicare Advantage key decision-makers were asked to rate their plan's level of priority for tighter UM and formulary management across therapeutic areas in response to implementation of the Inflation Reduction Act (IRA). Panelists report diabetes as their top priority for tighter UM and formulary management, followed by rheumatoid arthritis and COPD. The full report examines Medicare Advantage plans' UM & formulary activity across 20 therapeutic areas.

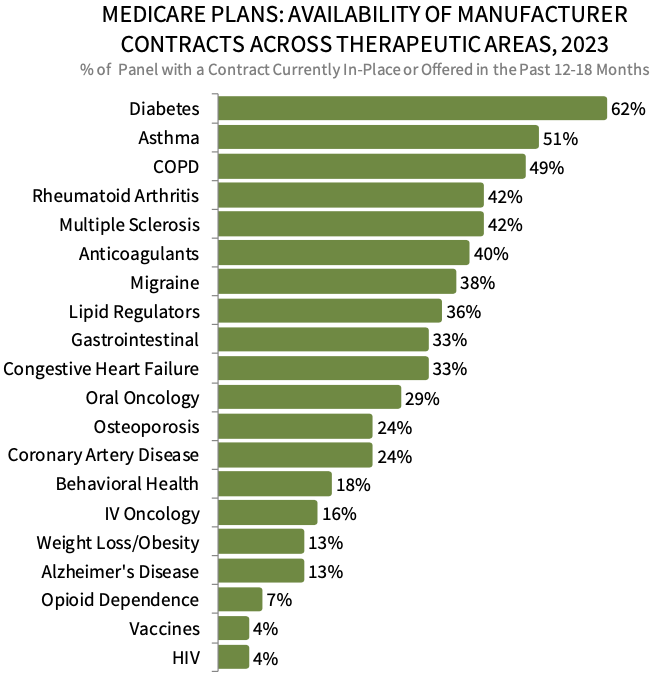

Medicare Advantage Plans Report Highest Contracting Activity Across Diabetes and Asthma Medications. Medicare Advantage plan key decision-makers were asked to consider a list of twenty therapeutic areas/disease states and indicate if their organization currently has a contract in-place or has been offered a contract in the past 12-18 months. About 62% of HIRC's panel indicate their plan currently has a contract in-place or has been offered a contract for diabetes, followed by asthma (51%) and COPD (49%). The full report examines the contracting environment (contract types & discount/rebate amounts) in detail.

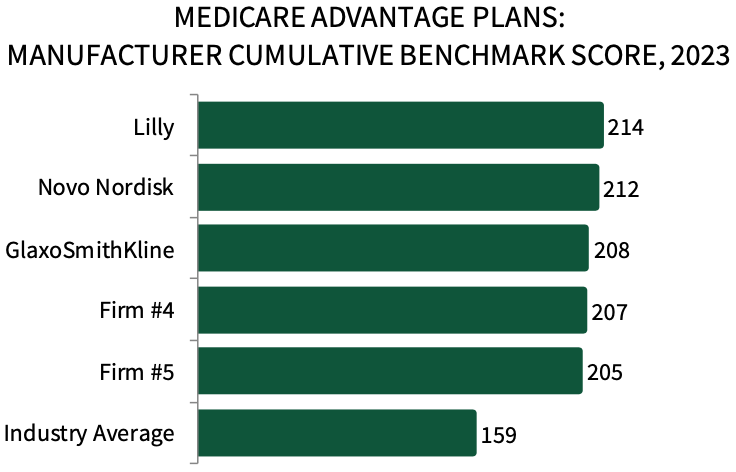

Lilly, Novo Nordisk & GlaxoSmithKline Lead in Overall Manufacturer Benchmark Ratings. HIRC's cumulative manufacturer benchmark score consists of a firms' Presence, Quality of Programs and Resources, and Willignness to Contract. In 2023, Lilly receivied the highest cumulative manufacutrer benchmark score across Medicare Advantage respondents, followed by Novo Nordisk and GlaxoSmithKline. The full report provides manufacturer benchmark ratings across 40+ manufacturers as well as Partner of Choice nominations and partnership opportunities.

Research Methodology and Report Availability. In August 2023, HIRC surveyed 45 Medicare Advantage plan pharmacy and medical directors from national, regional, and BCBS plans. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Medicare Advantage Plans: Market Landscape Trends, Contracting Environment and Manufacturer Engagement, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >