Medicaid MCOs: Market Landscape Trends, Contracting Environment and Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

The managed Medicaid segment continues to be impacted by policy changes and fluctuations in enrollment post-COVID. HIRC's report, Medicaid MCOs: Market Landscape Trends, Contracting Environment and Manufacturer Engagement, reviews the Medicaid MCO market landscape, the contracting environment, and pharmaceutical manufacturer engagement. The report addresses the following questions:

- What is the nature of the current Medicaid MCO market? Which plans account for the majority of market share?

- What top market trends are impacting the Medicaid MCO segment? Which strategic imperatives are Medicaid MCO leaders working to address over the next 12-18 months?

- What activities are Medicaid MCOs engaging in to better manage drug costs and utilization?

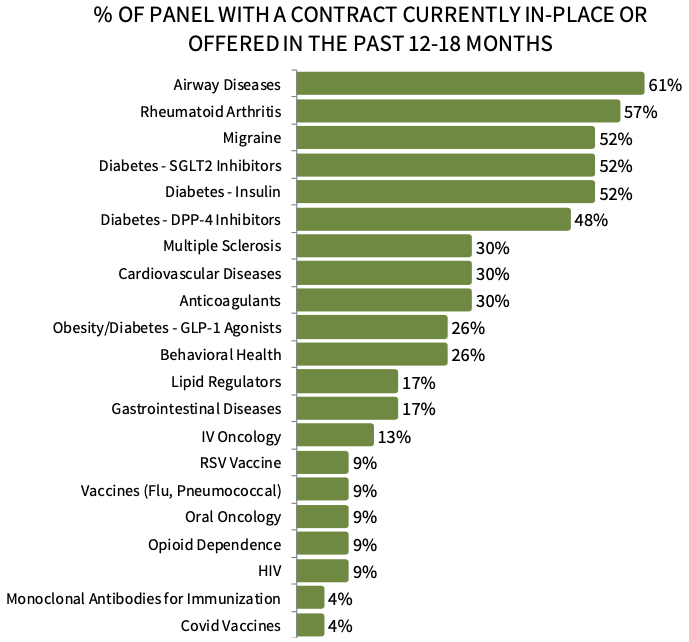

- What is the current contracting environment across 20+ therapeutic areas? Which contract types are most frequently offered and what are the most common rebate/discount amounts?

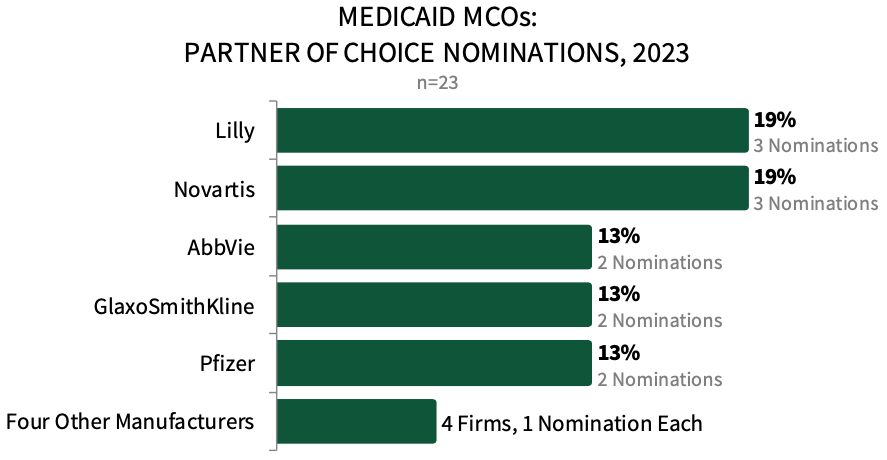

- Which manufacturers are most often nominated as Medicaid MCOs' overall "Partner of Choice"? How do manufacturers benchmark across willingness to offer supplemental discounts/rebates, and overall quality of programs/resources?

Key Finding: Top market trends reported by Medicaid MCOs for 2023/2024 include Inflation Reduction Act (IRA)/Federal & State Regulations, Gene/Orphan Drug Funding, and Medicaid Redetermination & Expansion.

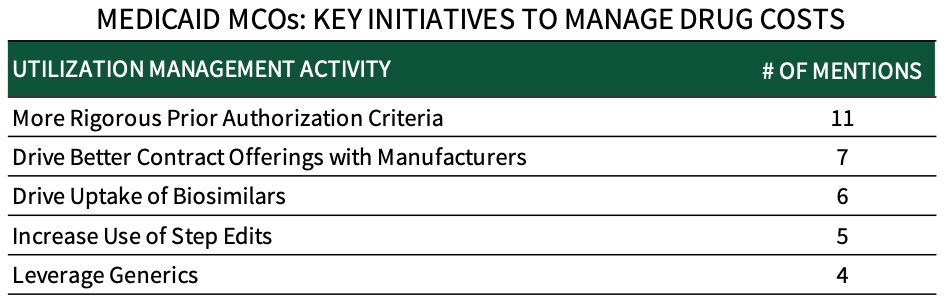

Medicaid MCOs' Utilization Management Strategies in 2023. To better manage drug costs and utilization of medications over the next 12-18 months, Medicaid MCO panelists report focusing on More Rigorous Prior Authorization Criteria, followed by Driving Better Contract Offerings with Manufacturers. Secondary initiatives to manage drug costs include Driving Uptake of Biosimilars, Increasing Use of Step Edits, and Leveraging Generics.

The full report provides a complete listing of Medicaid MCOs' utilization management activities in detail across a listing of 20+ therapeutic areas.

MCOs Report Highest Contracting Activity in Airway Diseases and Rheumatoid Arthritis. Medicaid MCO key decision-makers were asked to consider a list of 20+ therapeutic areas/disease states and indicate if their organization currently has a contract in-place or has been offered a contract in the past 12-18 months, beyond the mandatory required rebate. About 61% of Medicaid MCOs have or have been offered a supplemental contract for airway diseases, followed by rheumatoid arthritis (57% of plans). The full report examines the contracting environment (contract types & supplemental discount amounts) in detail.

Lilly & Novartis Lead as Medicaid MCOs' Top Partners of Choice. Lilly and Novartis are most often nominated as Medicaid MCOs' overall partners of choice in 2023, followed closely by AbbVie, GSK, and Pfizer. Leading companies are willing to contract, have quality account management personnel, and offer broad portfolios. The full report provides benchmark ratings of 40+ manufacturers in presence, willingness to offer supplemental rebates, and quality of programs/resources.

Research Methodology and Report Availability. In October 2023, HIRC surveyed 23 Medicaid managed care organization (MCO) pharmacy and medical directors from national, regional, and BCBS plans. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Medicaid MCOs: Market Landscape Trends, Contracting Environment and Manufacturer Engagement, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >