Managed Markets Headcount & Organization Study 2023/2024

Highlights of the report:

Download a PDF of these Highlights

Pharmaceutical manufacturers continue to evolve managed markets staffing structures to meet customer needs as the market landscape changes due to continued consolidation and government policy changes. HIRC's report, Managed Markets Headcount and Organization Study, assists pharmaceutical manufacturers in understanding trends in headcount across very large, large, and mid-size firms. Select key findings include:

- Overall headcount across firms increased overall year-over-year due to growth in all functional areas in 2023.

- Account Management represents the largest portion of pharmaceutical manufacturer headcount and is comprised mainly of account managers covering organized provider accounts (40%), payer accounts (35%), and distribution channel accounts (12%).

- Government Policy & Advocacy increased by 24%, with all segments rising including State Government Policy, Federal Government Policy, and Patient Advocacy.

Key Finding: Pharmaceutical firms' overall managed markets headcount increased 11% year-over-year; reported changes reflect firms' addition of Marketing headcount focused on market strategy and pricing, access & value, as well as increased Government, Policy & Advocacy headcount.

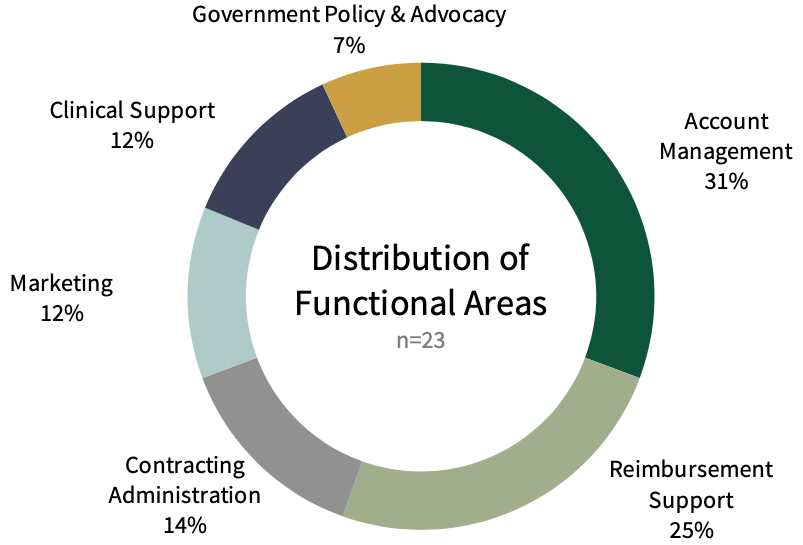

Account Management and Reimbursement Staff Comprise Over Half of the Typical Managed Markets Organization. Pharmaceutical managed markets organizations are comprised mostly of Account Management and Reimbursement Support staff, together accounting for 56% of total managed markets personnel, followed by Contracting Administration (14%), Marketing (12%), Clinical Support (12%), and Government Policy & Advocacy (7%).

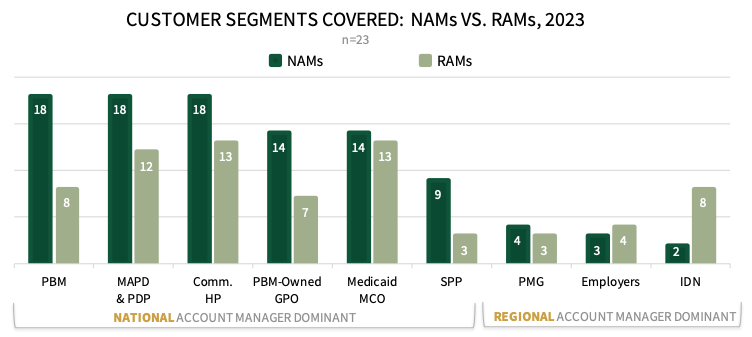

Customer Segments Covered by National & Regional Account Managers, 2023. Panelists were asked to indicate which customer segments are covered by their National Account Managers (NAMs), and which are covered by their Regional Account Managers (RAMs). HIRC's sample of 23 pharmaceutical manufacturers in 2023 report their National Account Managers typically cover Pharmacy Benefit Manager (PBM) and Medicare Advantage accounts, while Regional Account Managers more often cover Employer and Integrated Delivery Network accounts.

The full report includes detailed analyses of typical managed markets organizations of very large, large, and mid-size firms, as well distribution of and year-over year changes in managed markets headcounts across the following six functional areas:

- Account Management

- Marketing

- Reimbursement Support

- Contracting Administration

- Clinical Support

- Government Policy, and Advocacy

Research Methodology and Report Availability. HIRC surveyed leading pharmaceutical companies during fall 2023 to gain insights concerning their managed markets headcount, organizational structures, and the key issues driving their staffing investments. Each company’s data are privacy-protected, and results are only reported in aggregate to ensure confidentiality. The complete report, Managed Markets Headcount and Organization Study, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >