Integrated Delivery Networks: Market Landscape and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

Integrated Delivery Networks (IDNs) report a number of market challenges impacting their businesses in 2023; however, this comes alongside some positive signals of pandemic recovery. HIRC's report, Integrated Delivery Networks: Market Landscape and Strategic Imperatives, provides a market overview of IDNs/systems, including recent market activity, the status of value-based reimbursement, and IDNs' most urgent strategic imperatives for 2023. The following questions are addressed:

- What is the latest news and market activity in the IDN/health system segment? Which key market trends are driving IDN decision-making and overall strategy?

- What are IDN decision-makers' most urgent strategic imperatives to address as they adjust to a complex and dynamic market landscape?

- What is the status of IDN/systems' risk-bearing activities, such as health system-owned health plans, ACOs, insurer joint ventures, and level of participation in government and commercial value-based payment model programs?

- How are IDNs enhancing access to care across the continuum?

- What is the scope of IDNs' pharmacy services? What is the status of IDN/health system-owned specialty pharmacies?

Key Finding: Workforce challenges, continued 340B developments, and site of care shifts are driving IDNs' cost containment and growth strategies in 2023; meanwhile, focus returns to quality and value-based care as the pandemic resolves.

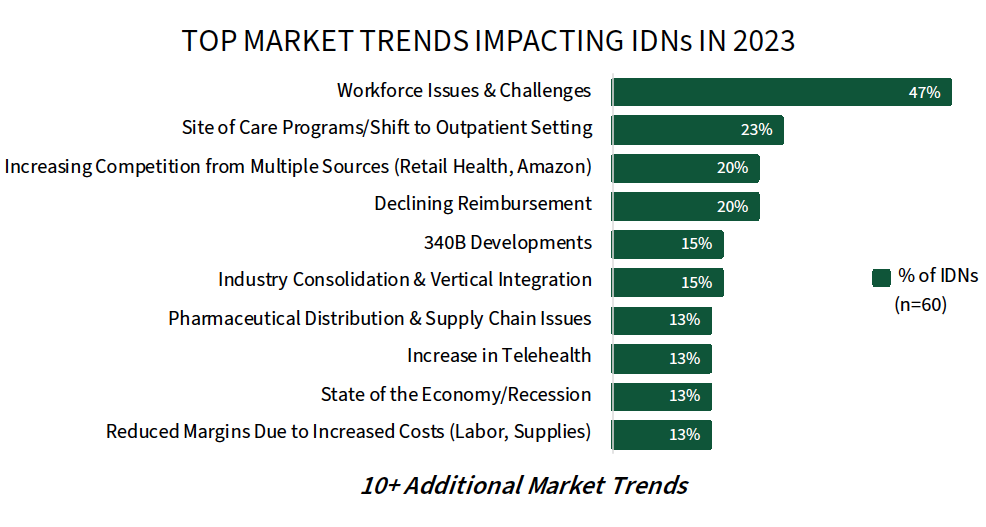

Staffing Shortages and Site of Care Shifts Top the List of Market Trends Most Impactful to IDNs in 2023. IDNs identify workforce issues and site of care shifts as the top most impactful market trends this year, followed by competitive issues and declining reimbursement. IDNs are responding to these trends with many activities aimed at cost containment and revenue growth. The complete list of trends, as well as IDNs' response and strategic imperatives, are examined in detail in the complete report.

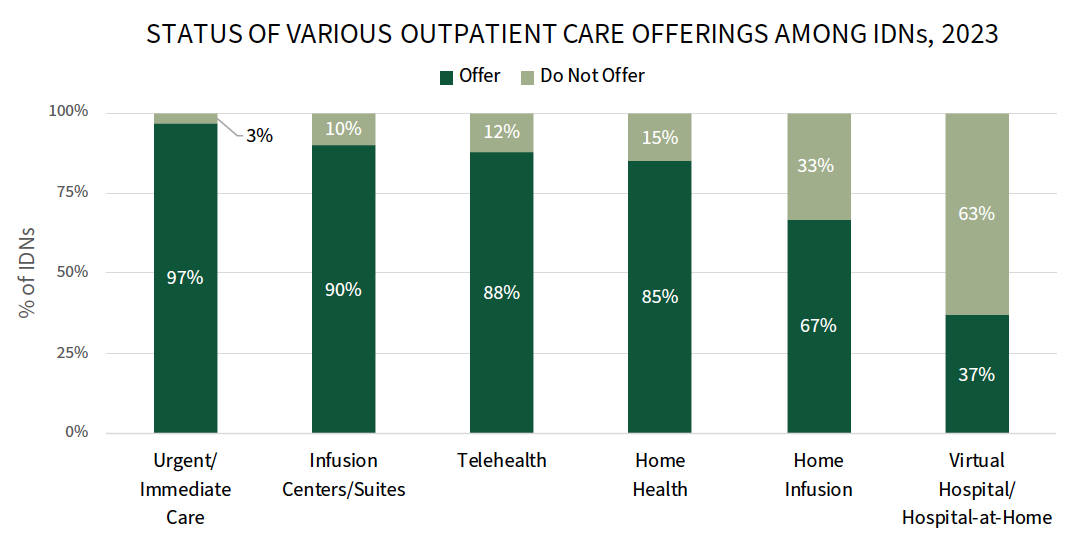

IDNs Actively Investing in Ambulatory Capacity as Site of Care Initiatives Drive Patients to Outpatient Settings. Investment in outpatient care is evident as IDNs actively try to manage utilization of high cost care settings and ensure access to convenient/primary care options. Nearly all IDNs (97%) offer urgent care, 90% offer ambulatory infusion, 88% offer telehealth, and another 85% offer home health care. Over one-third of IDNs (37%) have gone as far as to offer a virtual hospital or hospital-at-home option when appropriate.

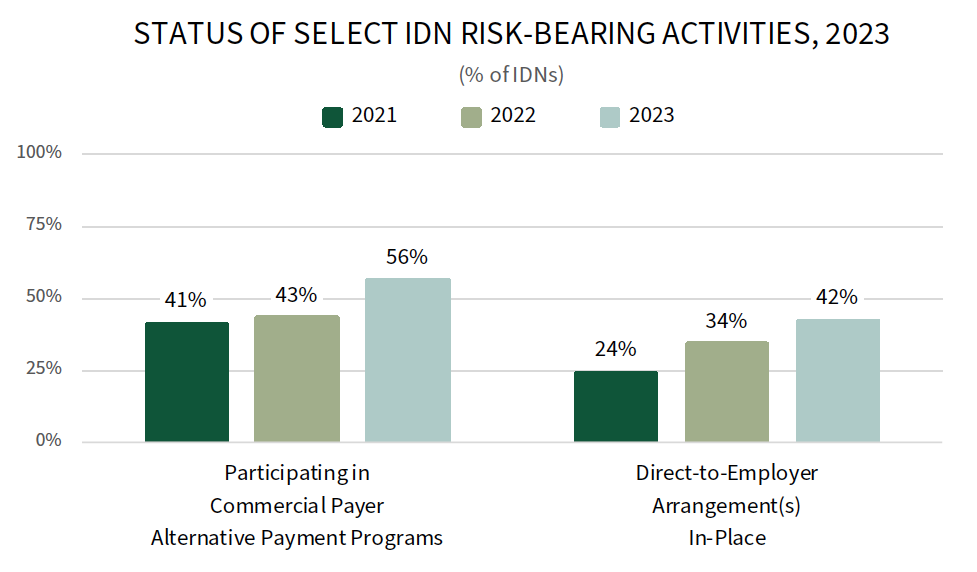

IDN Risk-Bearing Activity on the Rise. There are a number of ways IDNs may take risk for the care they provide and costs they incur, ranging from health system-led health plans, alternative payment model participation with payers, and direct-to-employer agreements. HIRC observed an increase in IDN participation in commercial payers' alternative payment programs in 2023, after a shift in focus towards pandemic related activities for the last 2-3 years. IDNs are also pursuing direct-to-employer arrangements, which enable them to combat the impact of vertically-integrated payers and payers entering the provider space. The full report examines several IDN risk-bearing activities and the status of value-based reimbursement in detail.

Research Methodology and Report Availability. In December and January, HIRC surveyed 60 IDN senior leaders and pharmacy and medical directors. In-depth secondary research, online surveys, and follow-up telephone interviews were used to gather information. The full report, Integrated Delivery Networks: Market Landscape and Strategic Imperatives is part of the Organized Providers Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >