Community Oncology Practices: Market Trends and Manufacturer Competitive Assessment

Highlights of the report:

Download a PDF of these Highlights

Oncology drug costs are rising as providers transition to value-based reimbursement, leading to an increase in activity that can impact oncology medication market access. HIRC's report, Community Oncology Practices: Market Trends and Manufacturer Competitive Assessment, reviews market trends, community oncology practices' strategic imperatives driving decision-making, and perceptions of manufacturers and the reimbursement environment across ten cancer types. The report addresses the following:

- What are community oncology practices' most urgent strategic imperatives and operational objectives driving decision-making?

- What is the status of preferred drug lists and clinical pathways across ten cancer types?

- What is the perceived reimbursement environment for top IV brands across ten cancer types? Which brands demonstrate a competitive advantage?

- Which manufacturers are most often nominated as community oncology practices' "Partner of Choice" in oncology? Which factors drive panelists' selections?

- How do manufacturers benchmark in the quality of their reimbursement support services and oncology-related account support and programs?

Key Finding: Oncology medication manufacturers are actively engaging the community oncology practice segment as they adjust to value-based reimbursement and an increased emphasis on quality improvement.

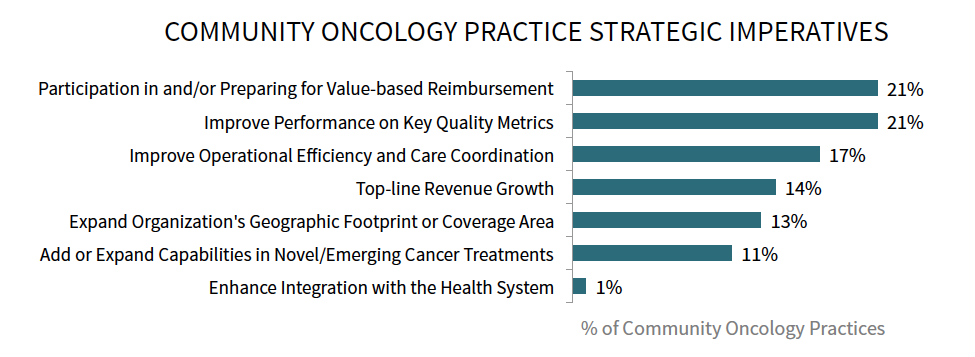

Value-based Reimbursement and Quality Performance Identified as Top Strategic Imperatives for Oncology Practices. Community oncology practices identify a number of strategic imperatives of high priority to senior leadership, with 21% reporting their top strategic imperative as participation in and/or preparation for value-based reimbursement and another 21% stating improving performance on key quality metrics.

The full report examines market trends impacting the businesses of community oncology practices and the operational objectives driving decision-making in an increasingly complex market environment.

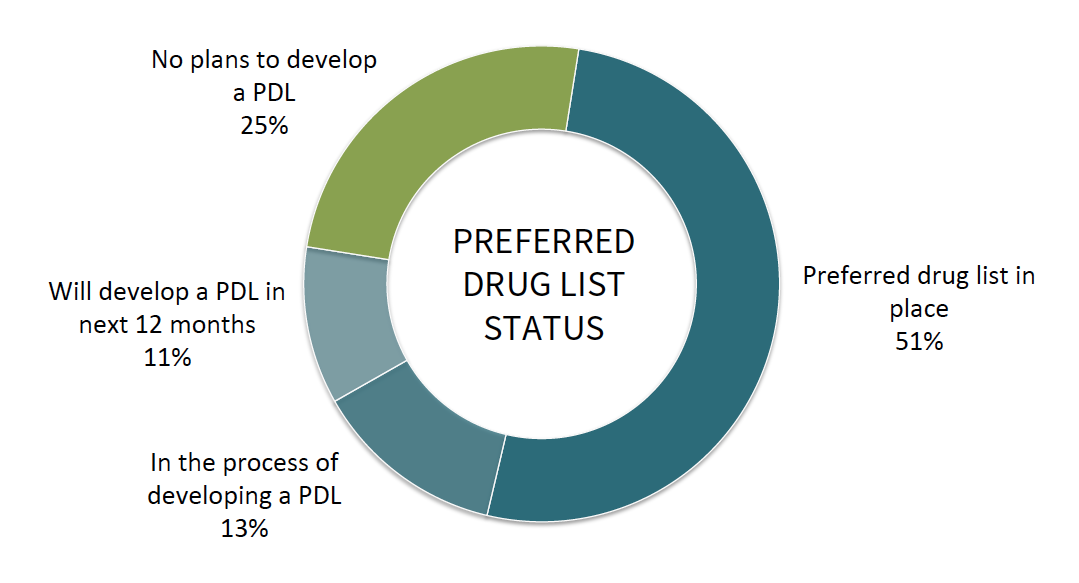

Over Half of Community Oncology Practices Report Having a Preferred Drug List in Place for Oncology Medications. Fifty-one percent of community oncology practices report having a preferred drug list in-place for oncology medications, most notably in the areas of breast, colorectal, and lung cancers. An additional 24% of community practices are in the process of developing a PDL or will develop a PDL in the next 12 months.

The full report examines the status of clinical pathways and PDL adoption for the following:

- Breast Cancer

- Chronic Lymphocytic Leukemia (CLL)

- Chronic Myeloid Leukemia (CML)

- Colorectal Cancer

- Lung Cancer

- Melanoma

- Multiple Myeloma

- Pancreatic Cancer

- Prostate Cancer

- Renal Cell Carcinoma

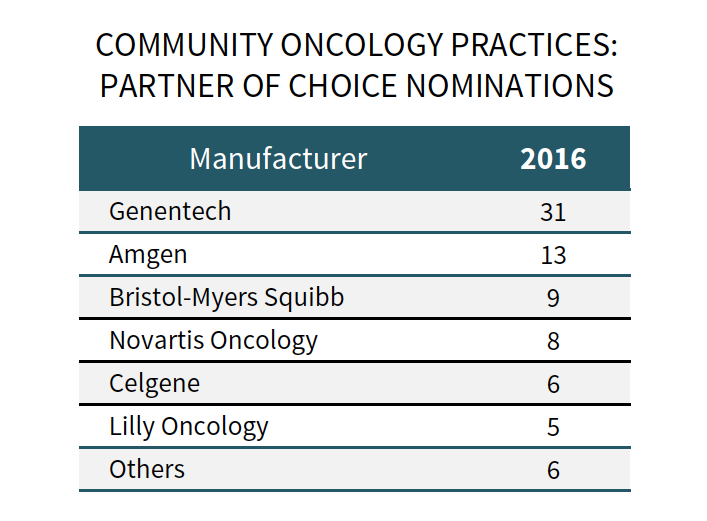

Community Oncology Practices Select Genentech, Amgen, and Bristol-Myers Squibb as Partners of Choice. Genentech is nominated most often as community oncology practices' top partner of choice for the third year in a row, followed by Amgen and Bristol-Myers Squibb. The quality of account management support/personnel and demonstrating an understanding of community oncology practice needs were among the top factors driving panelists selections in 2016.

The full report benchmarks over 20 oncology medication manufacturers on three independent parameters, such as the quality of the firm's reimbursement support services, and identifies opportunities for partnership.

Research Methodology and Report Availability. In July, HIRC surveyed 84 community oncology practice executives, 77 from privately-owned community oncology practices, and 7 from hospital/health system-owned community oncology practices. Online surveys and follow-up interviews were used to gather information. The full report, Community Oncology Practices: Market Trends and Manufacturer Competitive Assessment, is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >