Commercial Health Plans: Market Landscape and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

Vertical integration between plans, PBMs, GPOs, specialty pharmacies, and providers has increased the control of insurers across the health care supply chain. HIRC's report, Commercial Health Plans: Market Landscape and Strategic Imperatives, reviews the current market landscape, commercial health plans' strategic imperatives and objectives, and examines views on top market trends. The report addresses the following questions:

- What is the current landscape of the commercial health plan market, and which plans currently account for the majority of market share?

- What are the most notable market trends impacting commercial health plans in 2023?

- What are commercial health plans' most important strategic imperatives? Which activities are of highest priority to manage cost and utilization of traditional medications?

- How are commercial health plans driving the shift towards value-based care?

- Which plans are viewed as having the strongest ability to limit brand access? Which are viewed as most willing to partner with manufacturers?

Key Finding: Commercial health plans' top strategic imperatives for 2023 include membership growth and customer retention, cost control and profitability, and improving patient affordability, access, and support services.

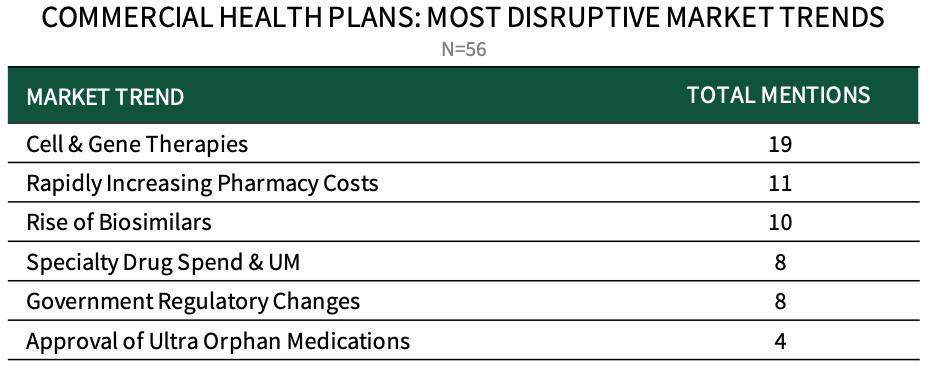

Panelists Identify Cell & Gene Therapies as the Most Disruptive Market Trend in 2023. When asked to list the market trends/dynamics with the highest potential to change the commercial health plan business, respondents identify Cell & Gene Therapies as the most disruptive trend in 2023, followed by Rapidly Increasing Pharmacy Costs, the Rise of Biosimilars, Specialty Drug Spend and Utilization, and Government Regulatory Changes.

The full report includes a complete listing of commercial health plan executives' most disruptive market trends and top strategic imperatives in 2023.

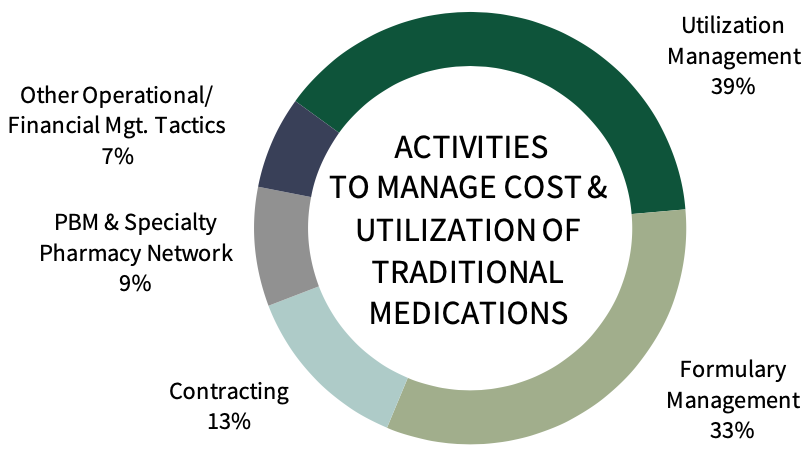

CHPs Most Often Employ Utilization & Formulary Management Tactics to Manage Traditional Medications. When asked which key activities are used to manage the cost and utilization of traditional medications, CHP respondents report utilization management tactics, such as more restrictive prior authorization requirements, followed by formulary management activities, such as expanding use of closed formularies and excluded product lists. The full report includes a complete listing of plans' cost and utilization activities in 2023.

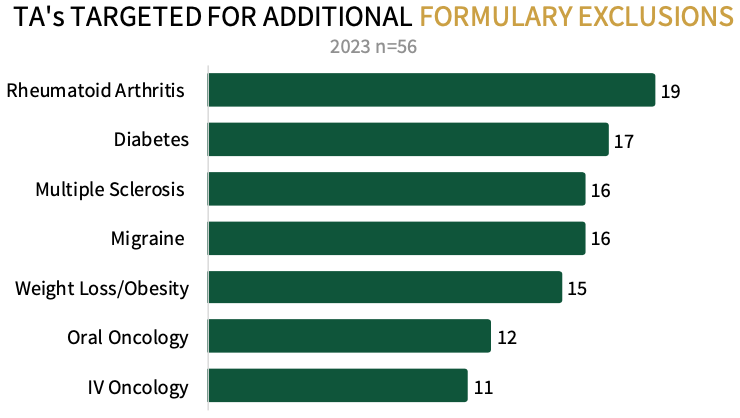

Top Areas Targeted for Additional Formulary Exclusions. Respondents were asked which therapeutic areas are of highest priority for their plan to target for additional formulary exclusions in the next 12-18 months. Rheumatoid arthritis, diabetes, multiple sclerosis, and migraine medications are most often targeted for additional formulary exclusions, followed by weight loss/obesity, and oncology agents. The full report provides a detailed analysis of excluded and preferred products, as well as UM trends across 18 therapeutic areas.

Research Methodology and Report Availability. In December 2022 and January 2023, HIRC surveyed 56 commercial health plan pharmacy and medical directors from national, regional, and BCBS plans. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Commercial Health Plans: Market Landscape and Strategic Imperatives, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >