Commercial Health Plans: Oncology Medication Management and Market Access

Highlights of the report:

Download a PDF of these Highlights

Commercial health plans are working to manage the cost of oncology medications more aggressively as utilization of oncology drugs and the overall cost of cancer care increases. HIRC's report, Commercial Health Plans: Oncology Medication Management and Market Access, reviews plans' approaches to oncology management and examines the resulting market access landscape. The report addresses the following questions:

- What key oncology-related market trends are commercial health plans currently monitoring?

- What is the status of payers' utilization management tactics across oncology medication types (e.g., targeted therapies, checkpoint inhibitors, biosimilars, CAR-T)?

- What is the status of oncology preferred drug lists (PDL), exclusion lists, and clinical pathway adoption across cancer types?

- How are plans managing oncology medication distribution (e.g., preferred specialty pharmacy, white bagging, site of care management)?

Key Finding: Restrictive formularies, PDLs, and product exclusions are the most common activities used by health plans to manage cost and utilization of oncology medications, followed by tighter PA requirements, and contracting with oncology manufacturers.

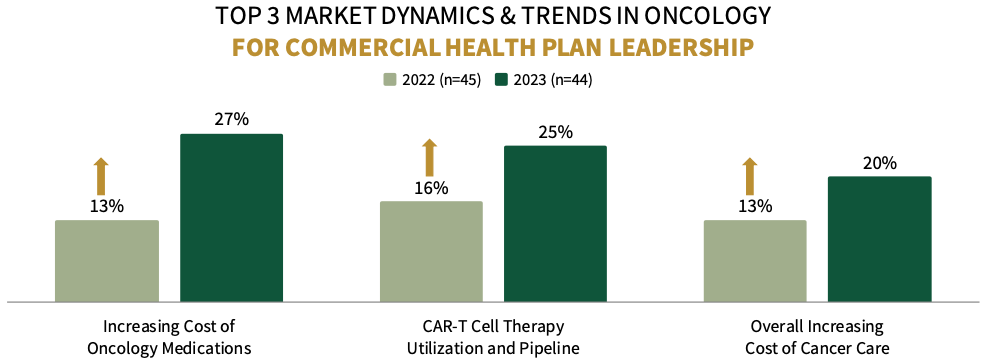

Increasing Cost of Oncology Medications Among Top Market Trends for Commercial Health Plan Leadership. Commercial health plan decision-makers were asked to identify the top oncology-related market trends impacting their business. The top trend identified is the increasing cost of oncology medications, followed by two other cost-related trends. A greater percentage of plans mentioned these trends in 2023, compared to 2022.

The complete report examines the full listing of 21 market trends identified by health plan leadership.

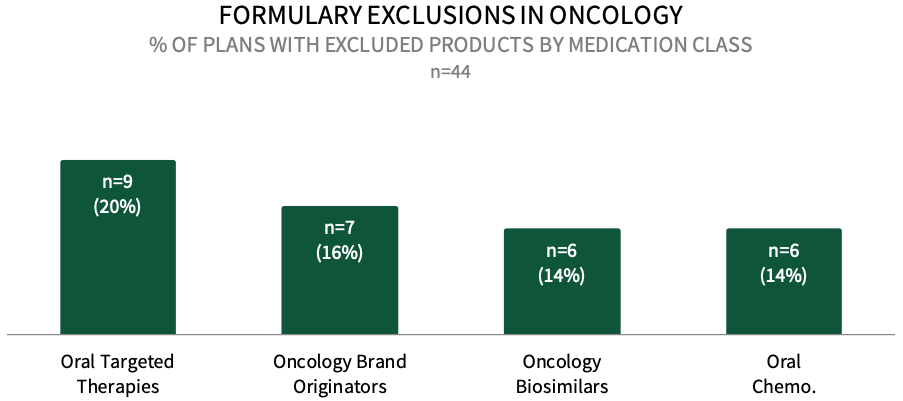

Formulary Exclusions in Oncology. While the prevalence of formulary exclusions in oncology remains low, about 20% of respondents in HIRC's commercial health plan sample indicate that their plan currently has formulary exclusions across oral targeted cancer therapies, followed by 16% with exclusions in oncology brand originators, 14% with exclusions across oncology biosimilars, and 14% with excluded products across oral conventional chemotherapies. The full report examines formulary exclusions across eight oncology treatment/therapeutic categories.

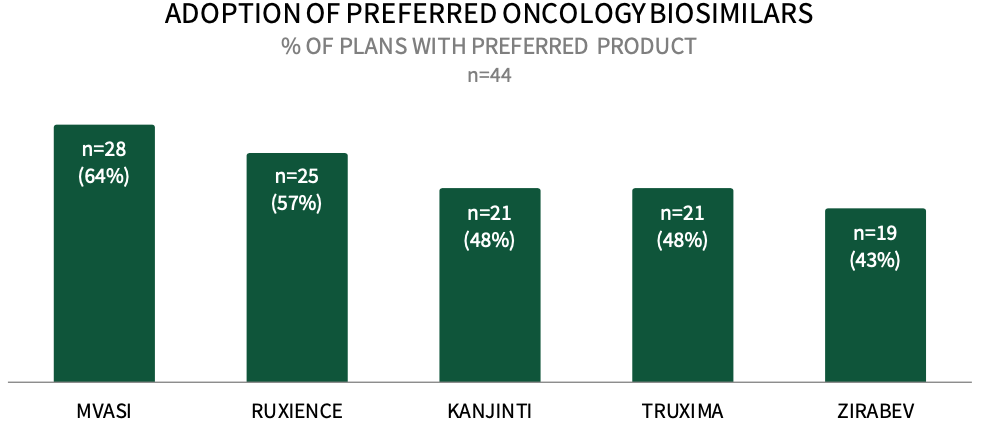

Commercial Payers are Actively Adopting Preferred Products Across Oncology Biosimilars. About 64% of respondents in HIRC's sample report that their plan designates MVASI as preferred in 2023, followed by 57% preferring RUXIENCE, 48% preferring KANJINTI and TRUXIMA, and 43% preferring ZIRABEV. The full report examines the status of uptake across 12 oncology biosimilars and the utilization management tactics used to promote the use of plans' preferred biosimilars .

Research Methodology and Report Availability. In June 2023, HIRC surveyed 44 pharmacy and medical directors from national, regional, and BCBS plans representing 69 million commercial lives. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Commercial Health Plans: Oncology Medication Management and Market Access, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >