Pharmacy Benefit Managers: Market Landscape and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

In light of increasing regulatory pressures shaping the Pharmacy Benefit Manager landscape, PBMs are strategically focusing on moderating drug spend and utilization while prioritizing patient affordability and access. HIRC's report, Pharmacy Benefit Managers: Market Landscape and Strategic Imperatives, reviews the current market landscape, PBM executives' strategic imperatives and objectives, and examines views on top market trends. The report addresses the following questions:

- What is the current landscape of the pharmacy benefit manager (PBM) market and which PBMs currently account for the majority of market share?

- What are the most notable market trends impacting PBMs in 2024?

- What are PBM executives' most important strategic imperatives?

- Which activities are of highest priority to manage cost and utilization of traditional medications?

- What is the status of PBM-owned GPOs?

- Which PBMs are viewed as having the strongest ability to limit brand access? Which are viewed as most willing to partner with manufacturers?

Key Finding: PBMs' top strategic imperatives for 2024 include moderating specialty drug spend, enhancing/maintaining patient affordability & access, and controlling the GLP-1 trend.

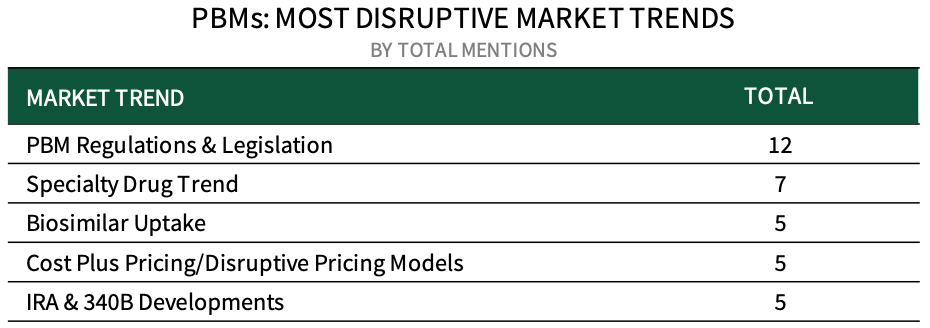

Panelists Identify PBM Regulations & Legislation as the Most Disruptive Market Trend in 2024. When asked to list the market trends/dynamics with the highest potential to change the pharmacy benefit manager business, respondents identify PBM Regulations & Legislation as the most disruptive trend in 2024, followed by the Specialty Drug Trend, Biosimilar Uptake, Cost Plus Pricing/Disruptive Pricing Models, and developments pertaining to the Inflation Reduction Act and 340B.

The full report includes a complete listing of pharmacy benefit manager executives' most disruptive market trends and top strategic imperatives in 2024.

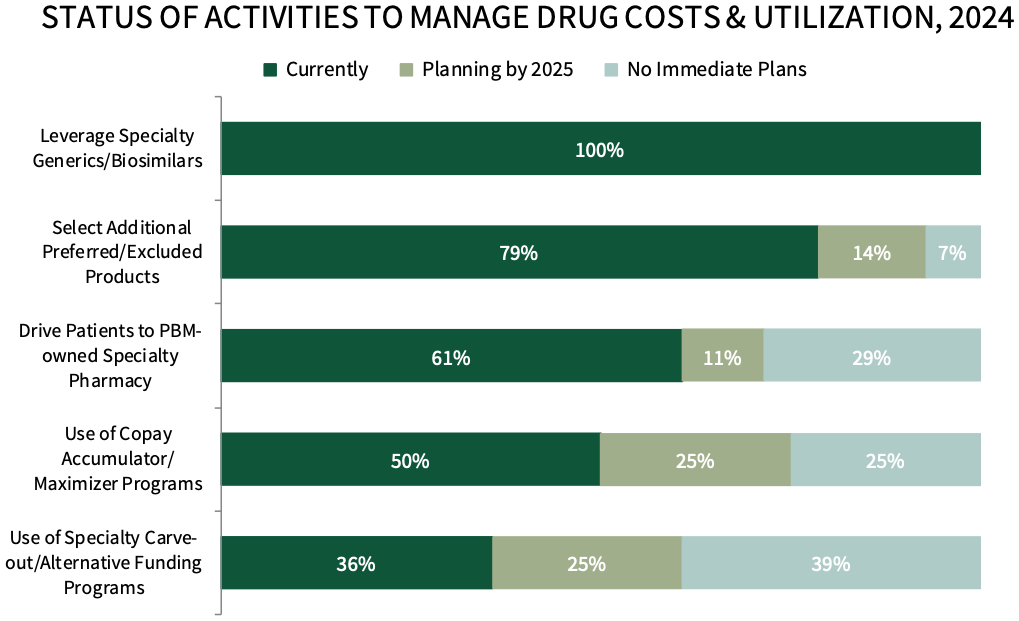

PBMs Most Often Leverage Specialty Generics & Biosimilars to Manage Cost & Utilization of Medications. When asked which key activities are used to manage the cost and utilization of medications, PBM respondents in HIRC's sample report formulary management tactics, such as leveraging specialty generics & biosimilars to drive down costs/enhance contract offerings, followed by selecting additional preferred/excluded products.

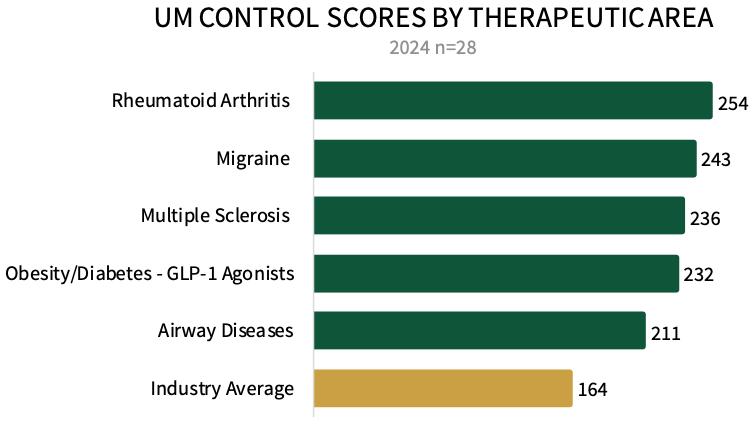

Utilization Management Control Score Across TAs, 2024. HIRC calculates a UM control score across 20+ therapeutic areas, which is based on PBMs' use of prior authorization, quantity limits, and product preferencing tactics in each category. Rheumatoid arthritis and migraine medications have the highest management priority scores, followed by multiple sclerosis, GLP-1 agonists, and airway disease products.

Research Methodology and Report Availability. In December 2023 and January 2024, HIRC surveyed 28 pharmacy benefit manager key decision-makers from very large, mid-size, and small/upcoming PBMs. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Pharmacy Benefit Managers: Market Landscape and Strategic Imperatives, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >