Medicare Advantage Plans: Specialty Rx Mgt., Contracting, and Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

Looking ahead to the full implementation of the Inflation Reduction Act, Medicare Advantage (MA) plans are working to tighten formulary & utilization management and enhance contracting with manufacturers for specialty medications. HIRC’s report, Medicare Advantage Plans: Specialty Medication Management, Contracting, and Best-in-Class Manufacturer Engagement, examines the current UM tactics impacting seniors taking specialty drugs, the contracting environment, and MA plan nominations for top-tier manufacturers engaging the segment. The report addresses the following:

- What impact might the Inflation Reduction Act (IRA) have on the specialty medication management and contracting landscape in Medicare?

- What are MA plans' top activities to better manage the cost and utilization of specialty medications in 2023/2024? What is the status of key formulary & utilization management tactics across 14 specialty therapeutic areas?

- What is the nature of the contracting environment for specialty medications in Medicare Advantage?

- Which manufacturers stand out as best in Medicare Advantage plan engagement to support their specialty portfolios?

Key Finding: Medicare Advantage plans have a growing list of tools that they are leveraging to manage the cost and utilization of specialty drugs; this is likely to intensify as we draw closer to 2025, requiring renewed contracting & engagement efforts to retain market access.

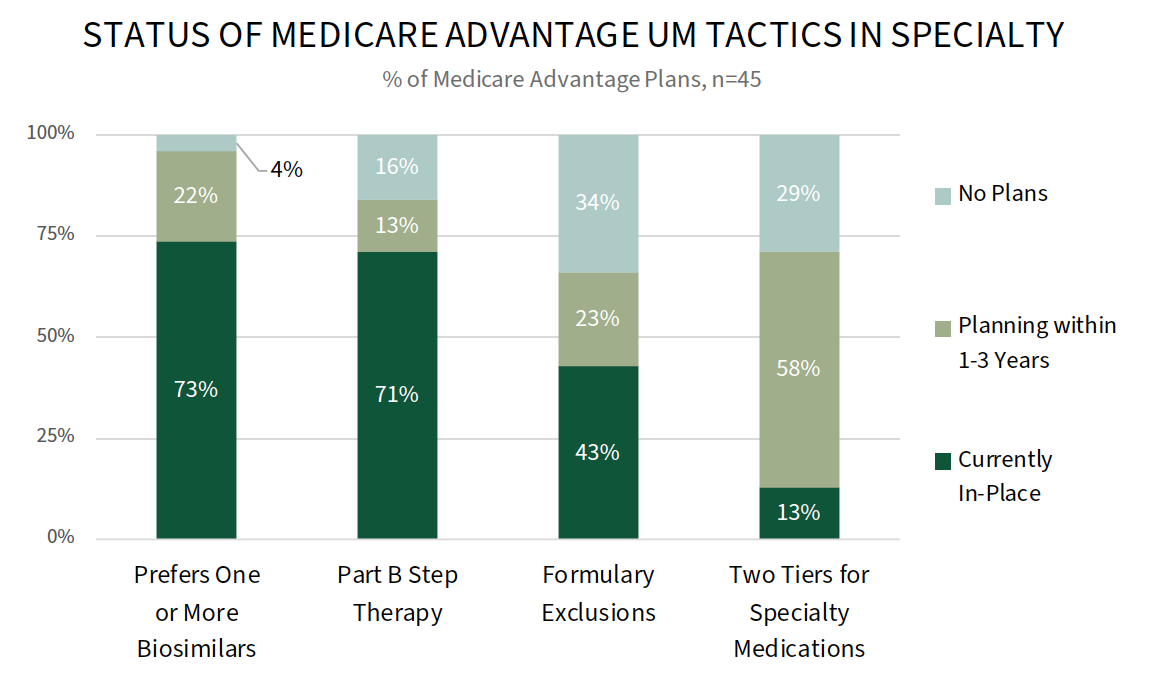

Medicare Advantage Plans Are Looking to Biosimilars and Step Therapy to Better Manage Specialty Drugs. The introduction of biosimilars and changes to policy around Part B step therapy and tier structures have given MA plans additional tools to manage specialty drug costs. In 2023, 73% of MA plans now prefer at least one biosimilar and 71% have actively implemented Part B step therapy, with a notable share of MA plans reporting cross-benefit step therapy. Formulary exclusions are less common, but may increase as plans take on more cost share responsibility as a result of the IRA.

The full report examines MA plans' specialty drug management activities in detail.

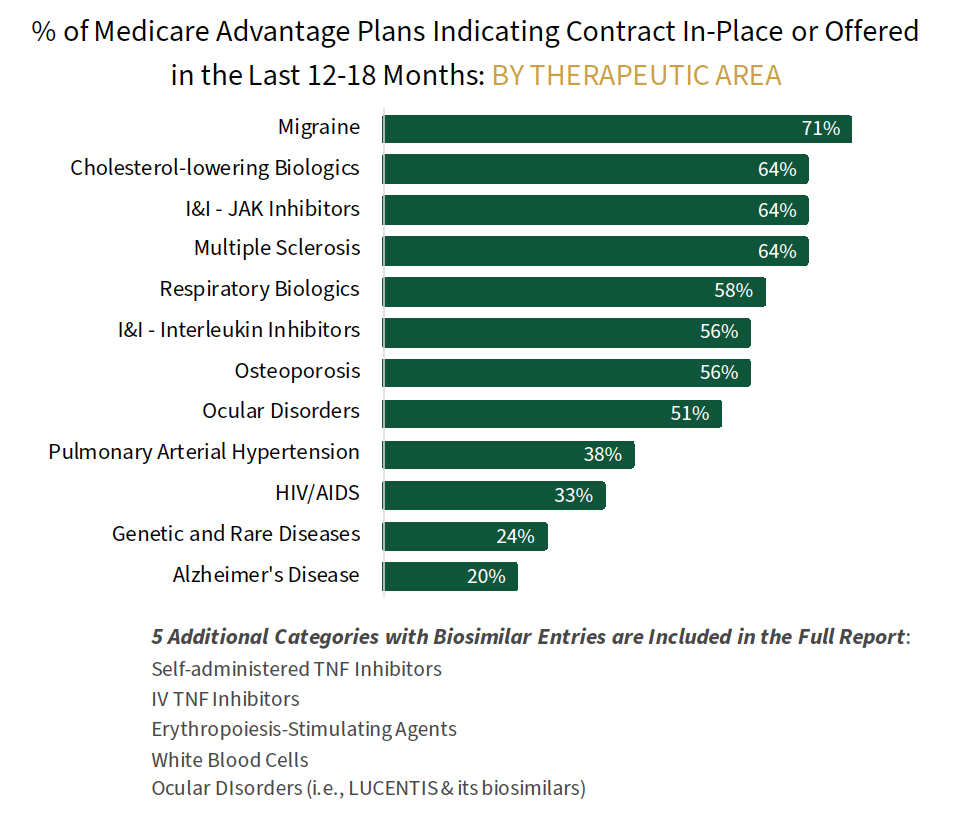

The Contracting Environment for Specialty Medications in Medicare Advantage is Active. Medicare Advantage plan leaders report a relatively competitive contracting environment for specialty medications, depending on the therapeutic class. More contracting is observed in crowded classes, or classes with biosimilars competition, whereas far less contracting is observed in rare diseases & Alzheimer's. Contracting prevalence and approach varies by therapeutic area – flat access rebates/discounts with price protection is the most common type of contract reported.

The full report examines contract types and most common rebate/discount amounts across a listing of 16+ specialty categories.

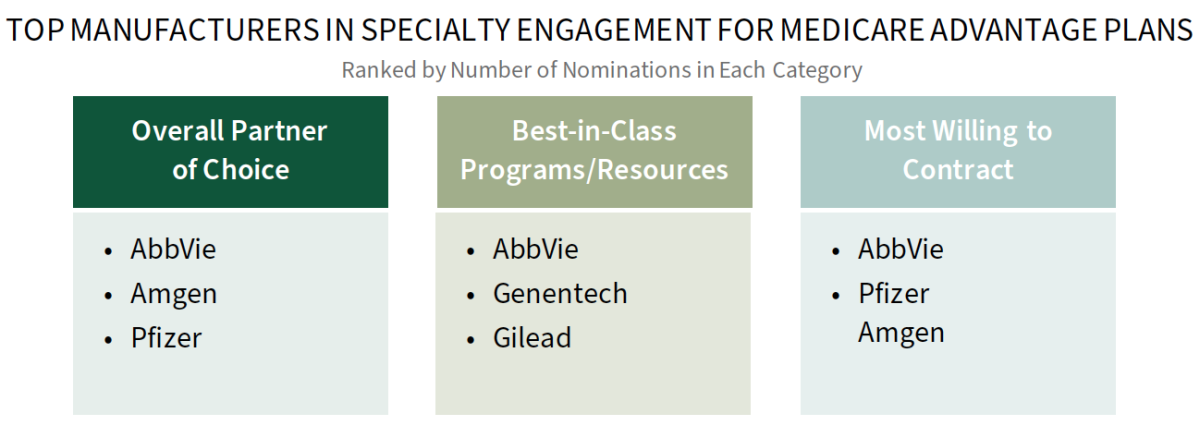

AbbVie, Amgen, and Pfizer Stand Out in Specialty Support for Medicare Advantage Plans. Medicare Advantage plan decision-makers were asked to nominate a manufacturer in three key areas: 1) Overall Partner of Choice in Specialty, 2) Best-in-Class Programs/Resources in Specialty, and 3) Most Willing to Contract. AbbVie, Amgen, and Pfizer are consistently among the leaders nominated in as best-in-class across categories. AbbVie, for example, is recognized for its account support team, patient-centered resources, and willingness to contract for inflammation & immunology portfolio.

Research Methodology and Report Availability. In August/September, HIRC surveyed 45 pharmacy and medical directors from national, regional, and BCBS Medicare Advantage plans representing 21.2 million lives. Online surveys and follow-up telephone interviews were used to gather information. The Medicare Advantage Plans: Specialty Medication Management, Contracting, and Best-in-Class Manufacturer Engagement report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >