Integrated Delivery Networks: Manufacturer Account Engagement and Competitive Positioning

Highlights of the report:

Download a PDF of these Highlights

Engagement with integrated delivery networks (IDNs) is an important component of manufacturers' market access strategies, especially as the reimbursement landscape shifts from volume to value. HIRC's report, Integrated Delivery Networks: Manufacturer Account Engagement and Competitive Positioning, reviews manufacturer presence with IDN accounts as well as IDNs' Partners of Choice and relational status ratings. The report addresses the following questions:

- What level of access do key pharmaceutical manufacturer personnel types (e.g., account manager, sales rep, MCSL) have to IDN decision-makers?

- Which pharmaceutical manufacturers have the highest presence with IDN accounts?

- Which manufacturers do IDN decision-makers select as their overall "Partner of Choice"? What key factors drive panelist selections?

- How do IDNs rate their relational status with 35+ manufacturers, from distant/tactical to collaborative/strategic?

- How can manufacturers drive towards more collaborative or strategic relationships with IDNs?

Key Finding: To foster more collaborative & strategic partnerships with IDN accounts, IDN decision-makers recommend coming prepared with an understanding of the customer and its needs, finding strategic alignment, and being proactive in providing support and demonstrating value.

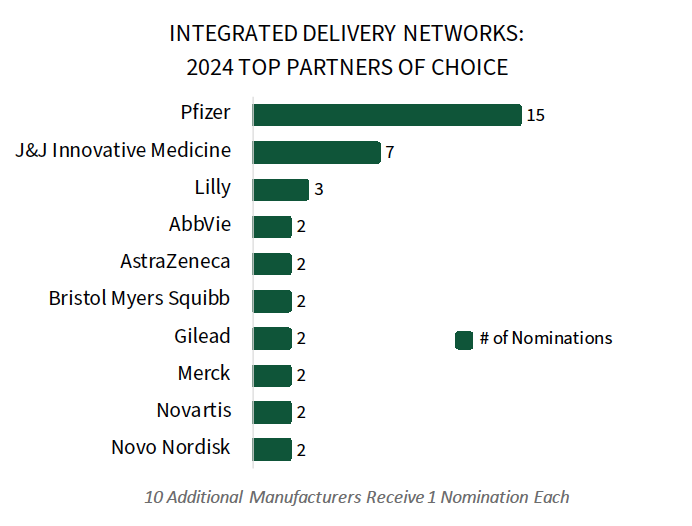

Pfizer Retains its Position as the Clear Manufacturer “Partner of Choice” Among IDN Decision-makers. IDN decision-makers were asked to nominate a single pharmaceutical manufacturer as their overall Partner of Choice. Pfizer is the clear leader with 15 nominations, maintaining its leadership position over the last three years. IDNs recognize Pfizer’s account management personnel that work to ensure product access and successful launch efforts.

Johnson & Johnson Innovative Medicine and Lilly round out IDNs' top three Partners of Choice followed by several Very Large or Large manufacturers with two nominations each. The complete report reviews the full list of manufacturers nominated as Partner of Choice and the critical factors driving panelists' nominations.

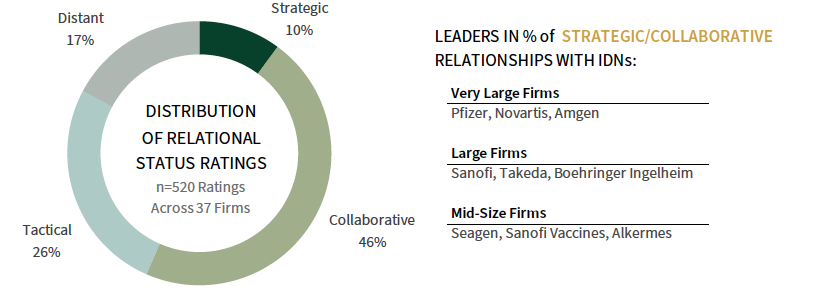

Relational Status Ratings for 35+ Manufacturers. IDN executives were asked to consider and rate pharmaceutical manufacturers based on their relational status from distant, tactical, collaborative, to strategic. Overall, IDN key decision-makers rate 10% of relationships as strategic, 46% as collaborative, 26% as tactical, and the remaining 17% as distant.

Pfizer leads the Very Large size cohort in its percentage of strategic and collaborative relationships with IDNs, followed by Novartis and Amgen. Sanofi, Takeda, and Boehringer Ingelheim lead the Large firm cohort, and Seagen, Sanofi Vaccines, and Alkermes lead among Mid-size firms. The full report provides ratings for a listing of 35+ manufacturers.

Key Account Managers Have Greatest "Regular" Access to IDN Decision-Makers. IDN executives report that they most frequently interact with pharmaceutical manufacturer account managers and sales representatives on a regular basis (monthly, quarterly, or annually), while technical personnel (MCSLs, FRMs, HEOR, population health roles) are most often seen on an “as needed” basis.

Research Methodology and Report Availability. In December and January, HIRC surveyed 54 IDN pharmacy directors and senior leaders. Online surveys and follow-up telephone interviews were used to gather information. The full report, Integrated Delivery Networks: Manufacturer Account Engagement and Competitive Positioning, is part of the Organized Providers Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >