Commercial Health Plans: Specialty Medication Management and Market Access

Highlights of the report:

Download a PDF of these Highlights

The specialty pharmaceuticals market environment continues to grow increasingly crowded with new approvals, expanded indications, and a growing list of biosimilar alternatives. HIRC’s report, Commercial Health Plans: Specialty Medication Management and Market Access, examines plans' evolving management tactics across 12 high profile specialty therapeutic areas and their top priorities for 2024. The report addresses the following questions:

- What are commercial plans' top activities to better manage the cost and utilization of specialty drugs in 2024? Which therapeutic areas are highest priority for management?

- How are plans modifying their formularies for specialty drugs?

- How are plans' utilization management tactics evolving?

- What is the status of benefit design programs such as accumulators, maximizers, and alternative funding programs?

- What is the current status of biosimilars adoption and enforcement? How are plans responding to the launch of multiple HUMIRA biosimilars?

- What are plans doing to better manage drugs covered under the medical benefit?

- How are plans optimizing their specialty pharmacy provider networks?

Key Finding: Commercial plans are highly focused on their biosimilar strategy in 2024, in addition to increasing their use of formulary exclusions and continuing to work to find their ideal mix of utilization management tactics appropriate in each therapeutic class.

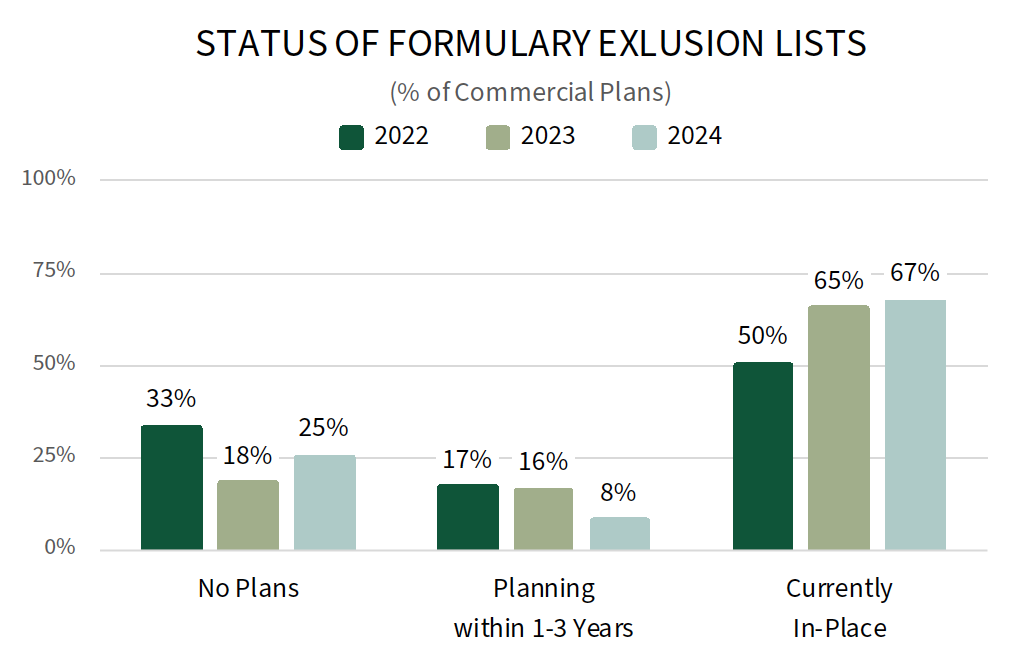

Commercial MCOs Continue to Increase of Formulary Exclusions for Specialty Drugs. Commercial health plans report a number of activities to better manage specialty medications in 2024, with efforts centered around modifying their formulary and utilization management strategies. Longitudinal data suggest that plans are increasing their use of formulary exclusions or closed formulary plan designs; 67% of commercial plans offer a formulary exclusion list in 2024, up from 50% in 2022. Increasingly crowded categories and those with biosimilar or specialty generic alternatives are most often targeted for exclusion. New entries into already crowded classes with competitive contracting are likely to face pressure if not notably clinically differentiated. The complete report provides the status of formulary exclusions across 12 specialty therapeutic categories.

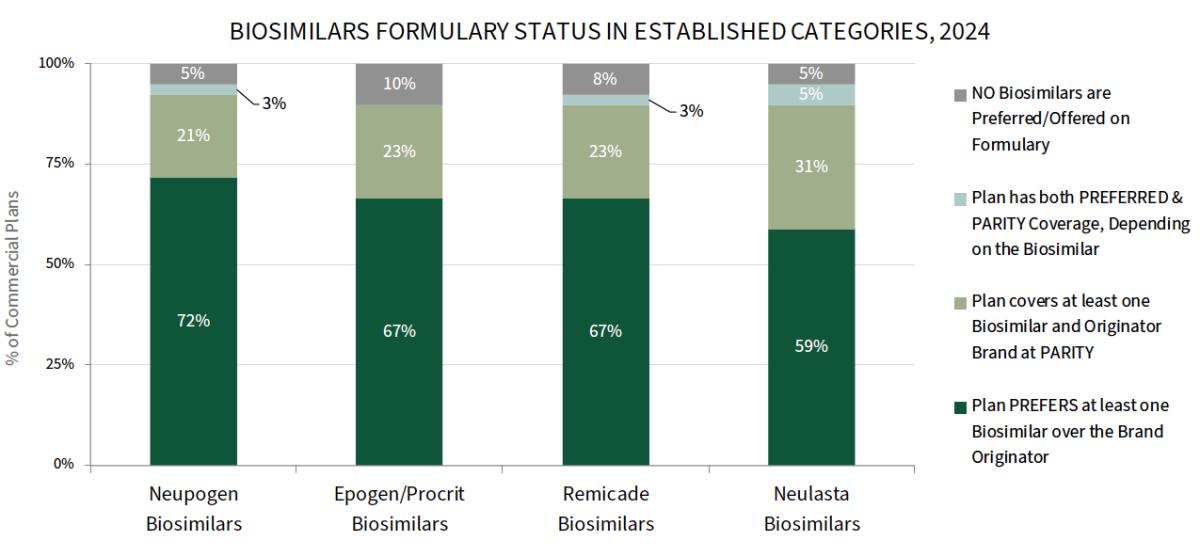

Plans' Biosimilars Strategies Vary by Therapeutic Class. Commercial health plans report high levels of biosimilar adoption in categories with longer-established biosimilars; plans most often report preferring NEUPOGEN, EPOGEN/PROCRIT, and REMICADE biosimilars over their reference brands. The full report also reviews adoption of LUCENTIS and HUMIRA biosimilars, where a higher percentage of plans report covering biosimilars at parity with the brand originator. While some plans intend to ultimately go with a HUMIRA biosimilar over brand strategy, they may be slow to do so while they navigate the complexities of existing contracts and patients that are comfortable on branded HUMIRA.

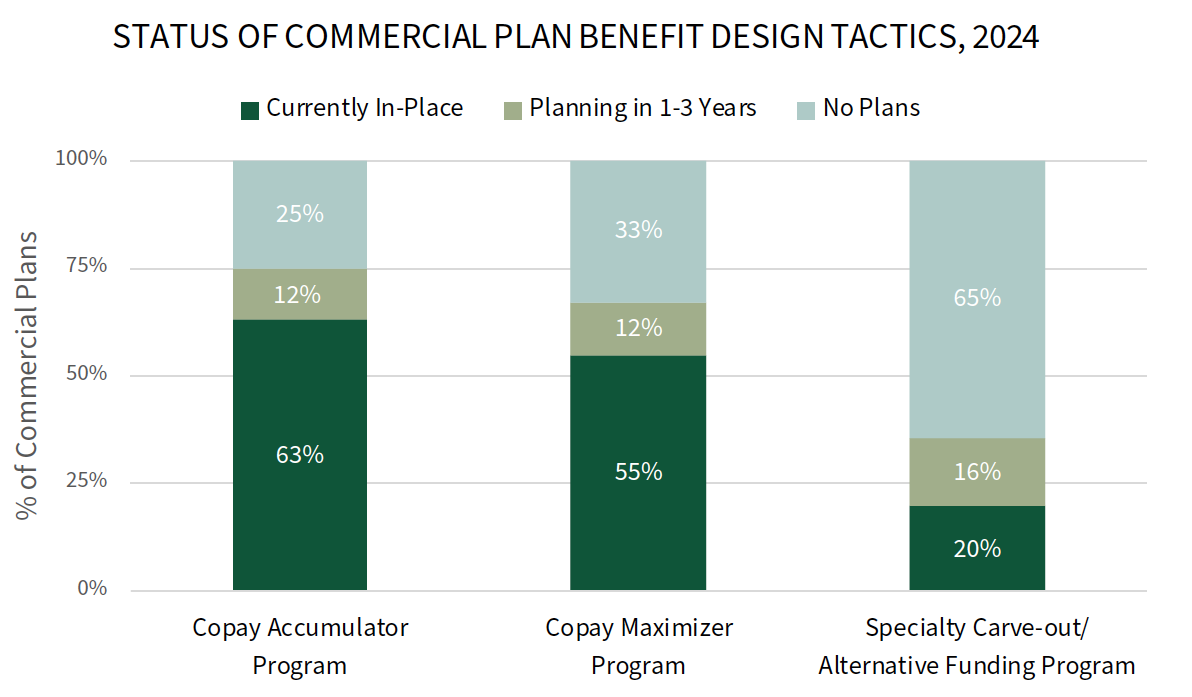

Status of Accumulators, Maximizers, and Alternative Funding Programs. Accumulator and maximizer programs have swiftly entered the mainstream of the many benefit design tactics commercial health plans engage in; however, accumulators have been the target of significant legal push back. Plans report that they are maintaining their copay accumulator program offerings although they recognize their instability. Meanwhile, a notably greater percentage of plans report offering copay maximizers in 2024 compared to 2023. The full report reviews the status of these offerings as well as plans' use of specialty tier structures, point-of-sale rebates, and patient financial incentives.

Research Methodology and Report Availability. In January and February 2024, HIRC surveyed 51 pharmacy and medical directors from national, regional, and BCBS plans representing 99 million lives. Online surveys and follow-up telephone interviews were used to gather information. The Commercial Health Plans: Specialty Medication Management and Market Access report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >