Specialty Medication Patient Cost Share and Access: Evolution and Future Trends

Highlights of the report:

Download a PDF of these Highlights

Patient cost sharing for costly specialty and oncology medications can impact product access and compliance. HIRC’s report, Specialty Medication Patient Cost Share and Access: Evolution and Future Trends, examines the evolution of patient cost sharing as health plans work to increase patients' engagement in health care decision-making within the current regulatory environment. The report addresses the following questions:

- What is the regulatory landscape pertaining to specialty cost share and how does it impact plans' abilities to optimize specialty cost share structures?

- Which types of copays (fixed dollar or coinsurance) are most common and how do plans expect to cover these medications in the future?

- How have out-of-pocket (OOP) limits evolved in recent years?

- What is the status of deductible usage and amounts?

Key Finding: Commercial payers are working to optimize their cost share structures and keep patients engaged in health care decision-making with higher "upfront" costs for specialty drugs in the form of deductibles, higher fixed copay amounts, and more coinsurance.

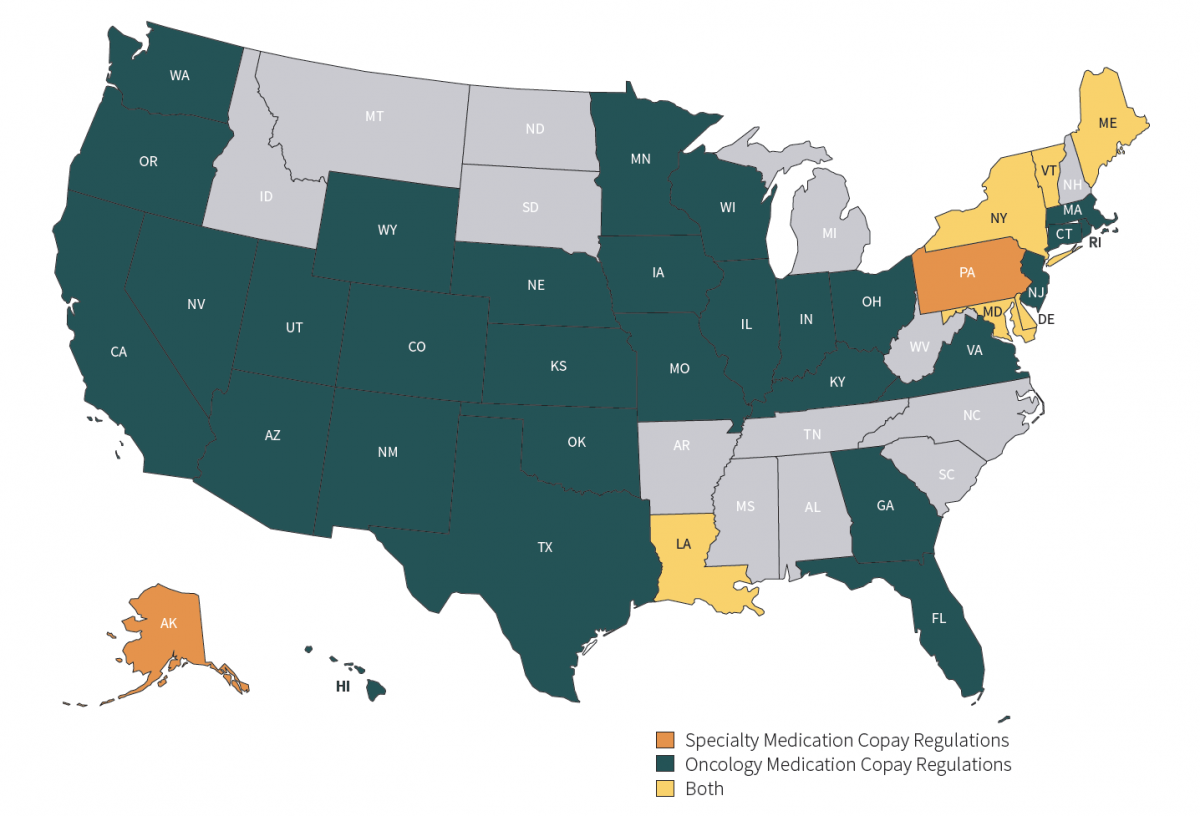

States Continue to Step in to Protect Patients from High Specialty and Oncology Medication Copays. Regulations to protect patient affordability and access to therapies have become prevalent in recent years. Eight states have enacted laws restricting specialty medication cost sharing and/or tier usage, and 35 states have passed legislation pertaining to oncology medications, most commonly requiring parity in cost share for oral and IV oncology therapies.

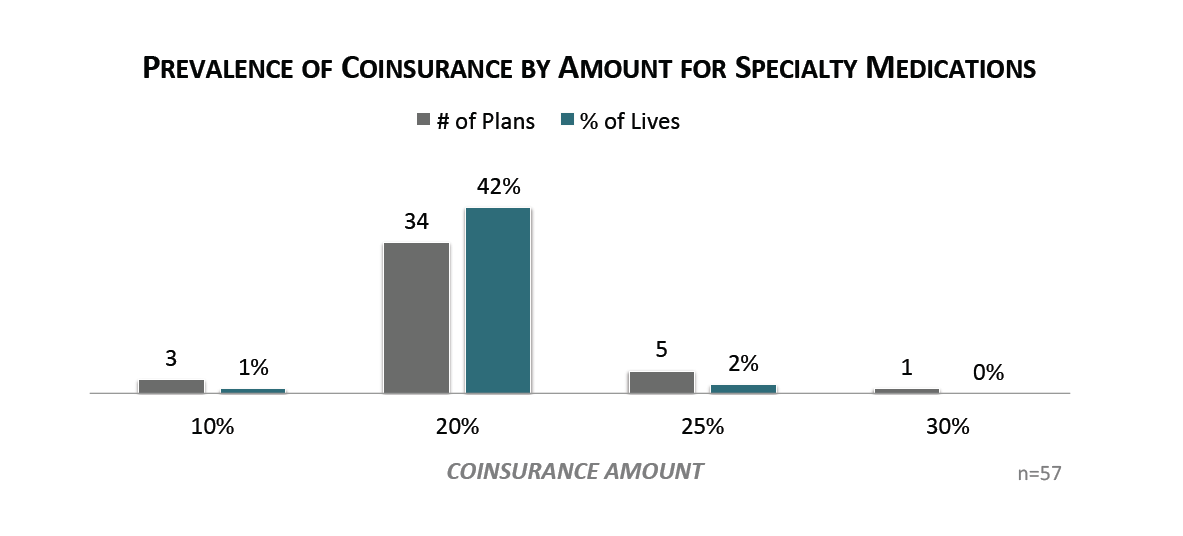

More than 40% of Commerical Lives are Responsible for 20%+ Coinsurance for Specialty Drugs on the Medical Benefit. While some plans are limited to a per perscription fixed copay amount for specialty and oncology medications due to state legislation, other commercial payers continue to incorporate more coinsurance for specialty and oncology medications on the medical benefit. Coinsurance amounts have remained stable, with over 40% of commercial members subject to a 20% coinsurance amount for specialty drugs.

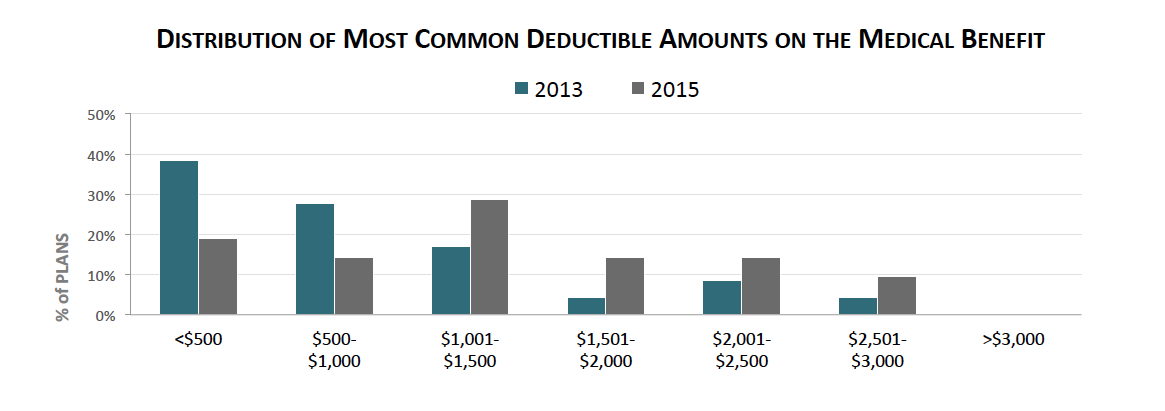

Average Pharmacy and Medical Deductible Amounts Are Increasing. A majority of commercial members (41%) have a combined medical and pharmacy deductible of about $2,100 on average. Annual deductible amounts for members with separate deductibles on the medical and pharmacy benefit have increased on average in 2015, with medical deductibles reaching $1,512 in on average 2015, compared to $1,061 in 2013.

Research Methodology and Report Availability. In January - February, HIRC surveyed 57 pharmacy and medical directors from national, regional, and blues plans representing 84 million lives. Online surveys and follow-up telephone interviews were used to gather information. The Specialty Medication Patient Cost Share and Access: Evolution and Future Trends report is part of the Managed Oncology Service, and is now available to subscribers at www.hirc.com/summary/mos.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >