Oncology Medication Management Strategies and Market Access

Highlights of the report:

Download a PDF of these Highlights

As the oncology drug spend rises, health plans continue to pursue opportunities that provide them greater control over the cost and utilization of cancer medications. HIRC's report, "Commercial Health Plans: Oncology Management Strategic Imperatives and Market Access Metrics," assists manufacturers in developing timely strategic responses to health plans' evolving oncology medication management tactics. The report addresses the following questions:

- Which strategic imperatives drive health plans' management of oncology? What operational objectives are top priority for 2015?

- What is the status of commercial payers' management tactics across benefits, adoption of oncology preferred drug lists, and how to plans approach off-label coverage?

- What is the status of clinical pathways development across ten cancer types?

- How do oncology products benchmark against each other in preferred formulary status and payer utilization management control?

Key Finding: Commercial health plans report a wide range of approaches to cancer care and oncology medication management. However, market leaders are beginning to emerge across cancer types in terms of brand access and formulary status.

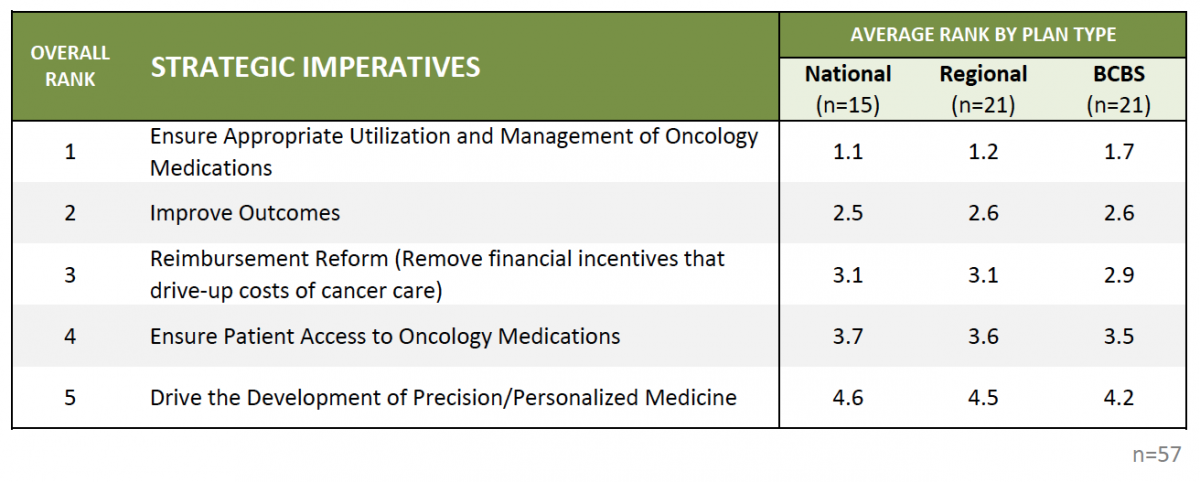

Ensuring Appropriate Use of Oncology Medications is Plans' Core Strategic Imperative Driving Management Decisions. HIRC asked commercial payer decision-makers to rank order five strategic imperatives according to their level of priority within their health plan. Managing to FDA label and making sure that the right product is being used by the right patient is the core strategic imperative driving health plans' market activity and decision-making regarding oncology medication management, followed by improving patient outcomes in oncology.

The full report provides health plan rankings of operational objectives, and their level of investment in managing oncology by cancer type.

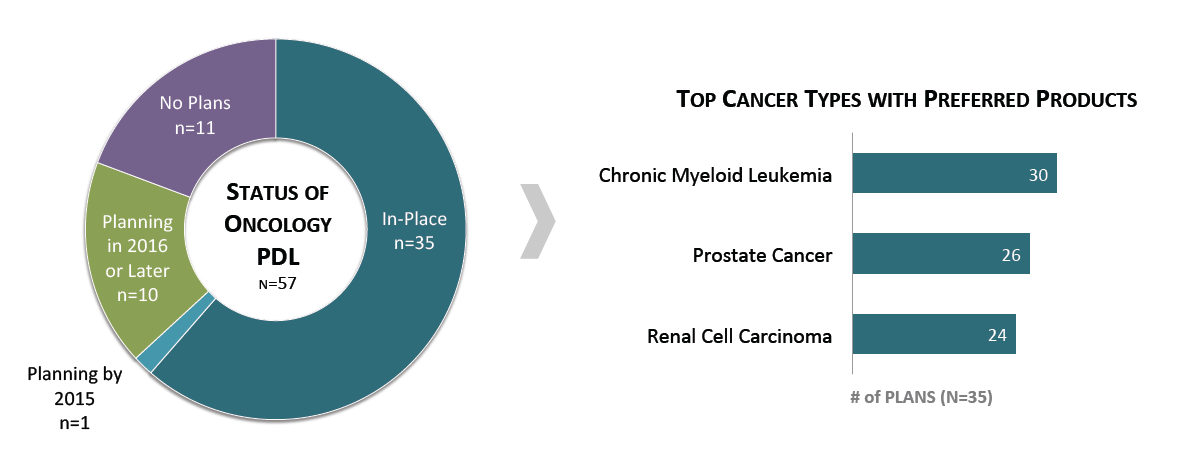

Over 60% of Commercial Health Plans Report Having a Preferred Drug List (PDL) for Oncology Medications. Of the sixty-one percent of commercial payers reporting that they have an oncology medication PDL, 86% have designated preferred products for chronic myeloid leukemia, 74% for prostate cancer, and 69% in renal cell carcinoma. The top factors driving preferred product designations include the strength of guideline recommendations and whether the product shows superior clinical benefit in efficacy and/or outcomes.

The full report provides the formulary status of a market basket of 42 oncology medications across eight cancer types.

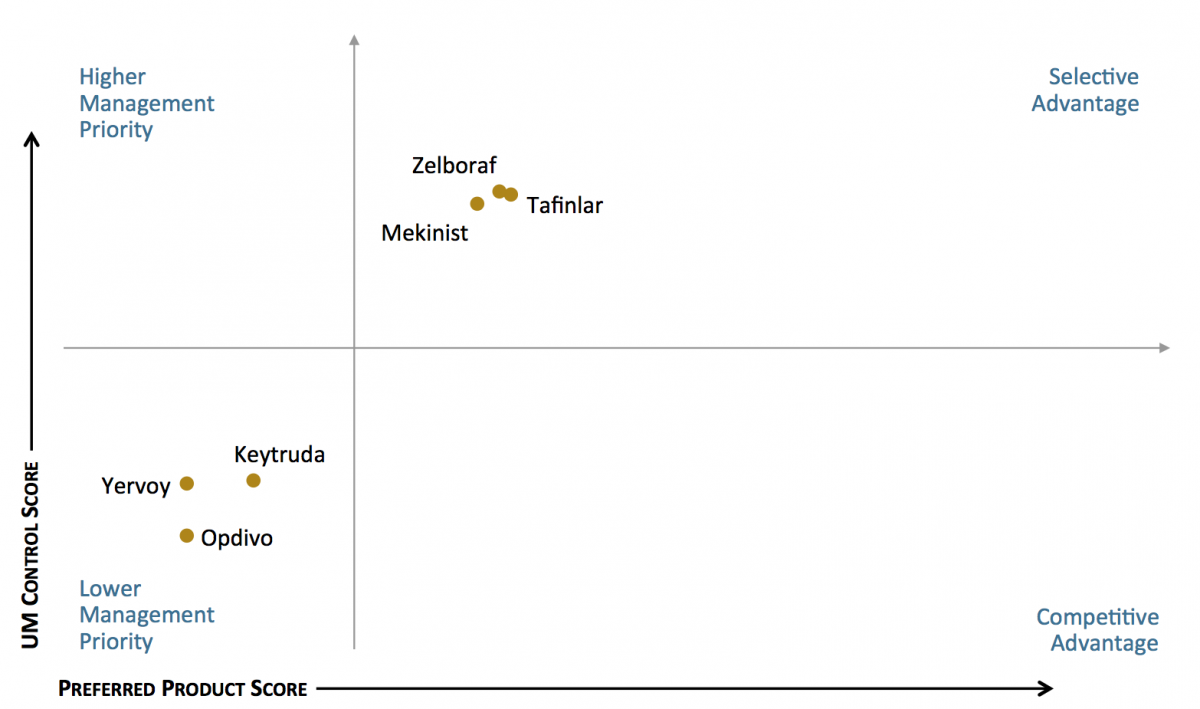

Tafinlar and Zelboraf Hold Favorable Access Position in Commercial Plans for Melanoma. The market access landscape varies by medication class. Some products are more often designated as preferred, while other are subject to higher levels of utilization management (UM) control. In the melanoma segment, Tafinlar and Zelboraf are most often designated as preferred in commercial health plan formularies. However, they are also subject to higher levels of UM control relative to products with coverage on the medical benefit.

Research Methodology and Report Availability. In February-March, HIRC surveyed 57 pharmacy and medical directors from national, regional, and blues plans representing 82 million lives. Online surveys and follow-up interviews were used to gather information. The full report, Commercial Health Plans: Oncology Management Strategic Imperatives and Market Access Metrics, is part of the Managed Oncology Service, and is now available to subscribers at www.hirc.com/summary/mos.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >