Pharmacy Benefit Managers: Market Landscape and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

The pharmacy benefit manager (PBM) market continues to rapidly evolve as managed care organizations vertically integrate with health insurers and seek economies of scale in a value-based care landscape. HIRC's report, Pharmacy Benefit Managers: Market Landscape and Strategic Imperatives, examines the current market landscape, PBM executives' strategic imperatives, and views on market trends that could affect the PBM segment. The report addresses the following questions:

- What is the current landscape of the pharmacy benefit manager (PBM) market and which PBMs currently account for the majority of market share?

- What do pharmacy benefit manager panelists identify as the most notable market trends impacting their business in 2019?

- What are pharmacy benefit manager executives' most important strategic imperatives and which operational objectives are of highest priority?

- Which PBMs are viewed as having the strongest ability to limit brand access? Which PBMs are viewed as most willing to partner with manufacturers?

Key Finding: In a rapidly changing market environment, PBMs continue to deploy a variety of means to manage drug benefit costs and stay relevant to payer customers.

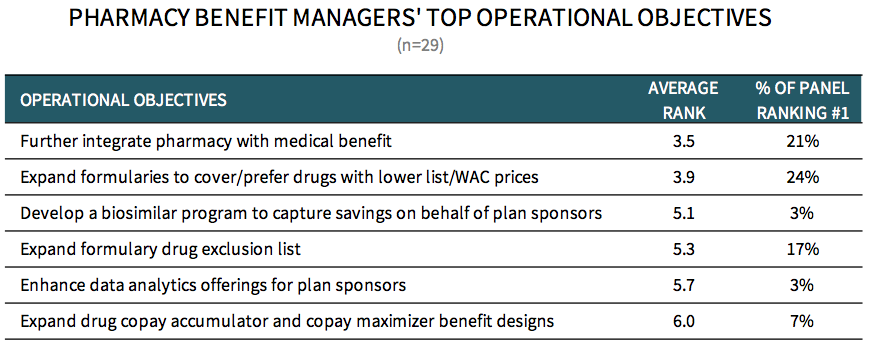

PBMs Report Further Integration of Pharmacy and Medical Benefit as Top Operational Objective. Pharmacy benefit manager executives were asked to consider and rank order a list of operational objectives according to level of priority and investment within the PBM. Respondents rank 'further integrate pharmacy with medical benefit' as their top objective in 2019, followed by 'expand formularies to cover or prefer drugs with lower list/WAC prices and reduce reliance on rebates'.

The full report includes a complete ranking of PBMs' top 10 operational objectives and examines PBMs' activities to achieve their objectives in 2019.

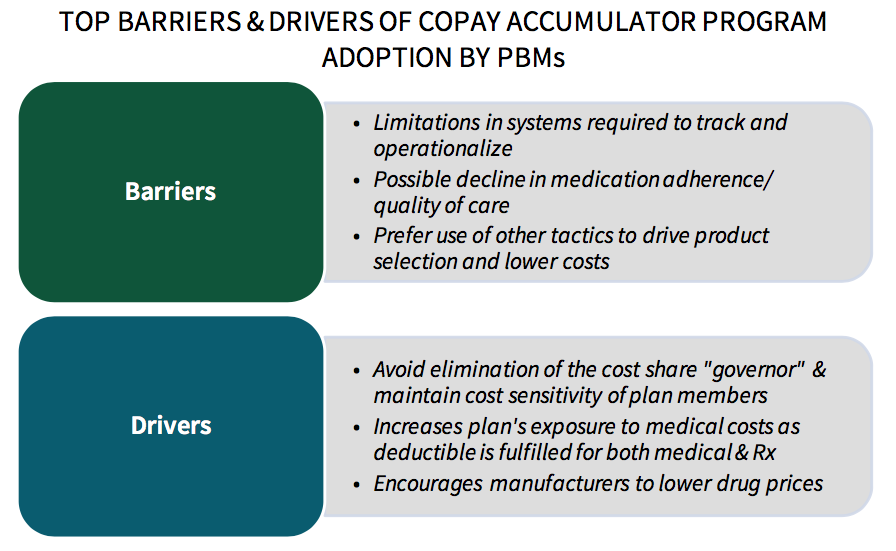

Top Barriers and Drivers of Copay Accumulator Program Adoption by PBMs. PBM respondents were asked to list the top barriers and drivers of copay accumulator program adoption. Respondents report limitations in systems required to track and operationalize copay accumulator programs as the top barrier, followed by possible decline in medication adherence and quality of care. In contrast, panelists report avoiding elimination of the cost share 'governor' & maintaining cost sensitivity of plan members as the top driver, followed by increasing plan's exposure to medical costs as deductible is fulfilled for both medical and pharmacy.

The full report also features the following to support pharmacy benefit manager account planning:

- Detailed profiles for select industry-leading PBMs: CVS Caremark, Express Scripts, OptumRx, Humana Pharmacy Solutions, Prime Therapeutics, and MedImpact.

- Manufacturer ratings of leading PBMs in ability to limit brand access and willingness to partner with pharmaceutical firms.

Research Methodology and Report Availability. In December 2018 and January 2019, HIRC surveyed 29 pharmacy benefit manager executives from stand alone, retail-owned, and health plan-owned PBMs. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Pharmacy Benefit Managers: Market Landscape and Strategic Imperatives, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >