Pharmacy Benefit Managers: Contracting Landscape and Manufacturer Competitive Positioning

Highlights of the report:

Download a PDF of these Highlights

Collaborative partnerships with Pharmacy Benefit Managers (PBMs) are imperative to maintaining market access as PBMs work hard to keep costs low for members. HIRC's report, Pharmacy Benefit Managers: Contracting Environment and Manufacturer Competitive Positioning, examines the current contracting landscape, reviews PBMs' evaluation of manufacturer engagement and support, and identifies opportunities for partnership. The report addresses the following questions:

- Which contract types are most commonly offered by manufacturers for traditional, specialty, and oral oncology medications?

- Which therapeutic classes are likely targets for future formulary exclusions?

- Which manufacturers are most often nominated as PBMs' overall "Partner of Choice"?

- Which manufacturers lead in PBMs' evaluation of flexibiliy in negotiating contracts and value of resources and programs?

- Which areas of opportunity exist to foster collaborative working relationships with PBM accounts?

Key Finding: Collaborative partnerships with PBMs are imperative as cost savings efforts intensify; opportunities exist for manufacturers to meaningfully engage PBMs and address unmet customer needs.

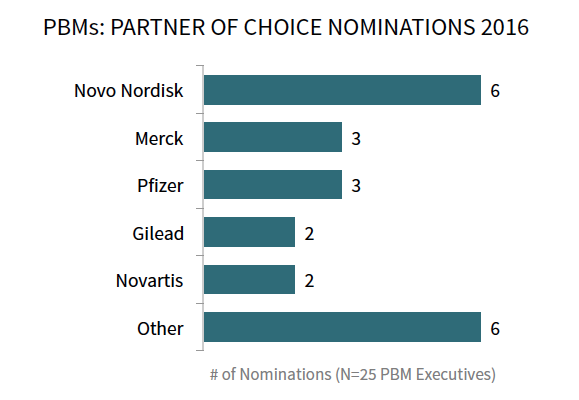

Novo Nordisk is PBMs' Overall Partner of Choice. Novo Nordisk is most frequently nominated by PBM decision-makers as overall manufacturer partner of choice, followed by Merck and Pfizer. The primary factors driving partner of choice nominations include the quality of the firm's account management personnel and the company's willingness to contract. Novo Nordisk is recognized as a strategic partner that demonstrates an understanding of payer needs and responds with relevant and useful partnership opportunities.

The complete report provides an in-depth analysis of the factors driving partner of choice nominations and customer insights about the leading companies.

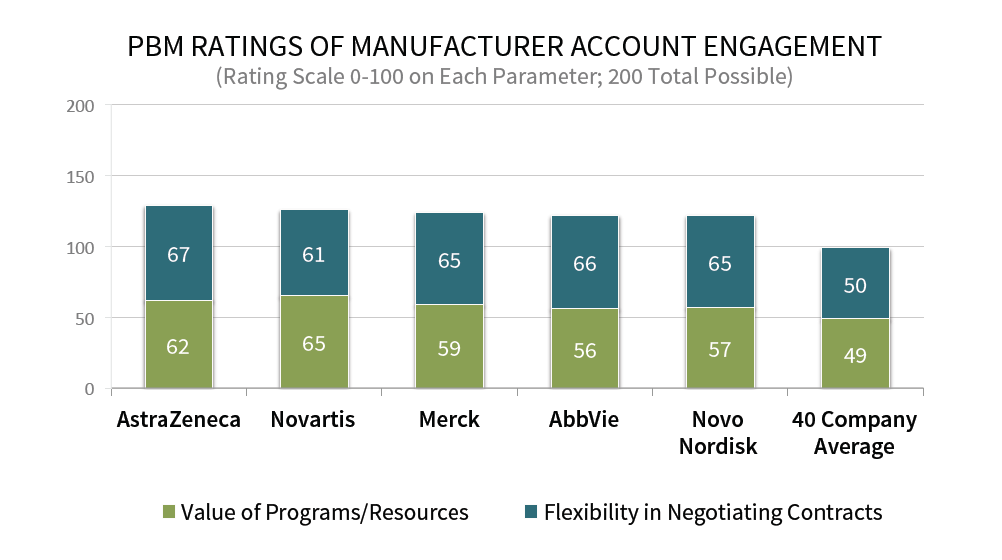

AstraZeneca and Novartis Lead in the PBM Segment in Value of Resources and Flexibility in Negotiating Contracts. PBM decision-makers were asked to consider and rate 40 very large, large, and mid-size pharmaceutical firms based on the value of the firm's programs and resources and its flexibility in negotiating contracts. AstraZeneca and Novartis earn the highest combined ratings from PBMs, followed by Merck, AbbVie, and Novo Nordisk.

The full report includes ratings for the complete listing of 40 companies, as well as in-depth profiles for the top 10 highest-rated manufacturers.

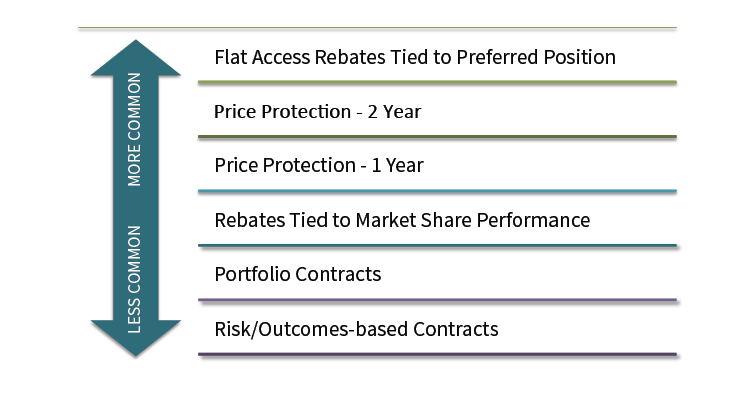

PBM Perceptions of the Contracting Environment Examined. PBM executives were asked to consider and rate the availability of six contract types across traditional, specialty, and oral oncology medications. Flat access rebates were reported as most common, while risk/outcomes-based contracts are rarely offered. Most PBMs have implemented an excluded product list and report targeting high cost specialty therpeutic areas for additional exclusions over the next 12-18 months.

Research Methodology and Report Availability. In December and January, HIRC surveyed 25 PBM executives representing 16 stand alone, retail-owned, and health plan-owned PBMs. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Pharmacy Benefit Managers: Contracting Environment and Manufacturer Competitive Positioning, is available now to HIRC’s Managed Markets and National Accounts subscribers at www.hirc.com/summary/na.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >