Commercial Health Plans: Manufacturer Account Engagement and Contracting for Specialty Drugs

Highlights of the report:

Download a PDF of these Highlights

As commercial MCOs navigate heightened financial pressure and competitive specialty markets, manufacturers are being evaluated not only on contracting strength, but on the credibility and strategic depth of their engagement. HIRC’s report, Commercial Health Plans: Manufacturer Account Engagement and Contracting for Specialty Pharmaceuticals, examines the current contracting environment and managed care decision-makers' evaluations of pharmaceutical manufacturer account support. The report addresses the following questions:

- Which manufacturers are most often nominated as commercial health plans' overall "Partner of Choice" in specialty? Which specialty-specific program and resource offerings are nominated as best? Which manufacturers are most willing to contract?

- How do 35+ specialty medication manufacturers benchmark in Presence, Willingness to Contract, and Quality of Account Support as it pertains to their specialty portfolios?

- What is the nature of the contracting environment for specialty pharmaceuticals across 15 therapeutic classes?

- Which contract types are most frequently executed and what are the most common rebate/discount amounts? How common are alternative contract types for specialty medications, such as portolfio-, risk/outcomes- and indication-based approaches?

- What opportunities exist to enhance account engagement for specialty brands?

Key Finding: Commercial specialty contracting intensity is driven primarily by therapeutic competition, but plans elevate manufacturers who pair competitive rebates with strategic, credible engagement and sustained value demonstration.

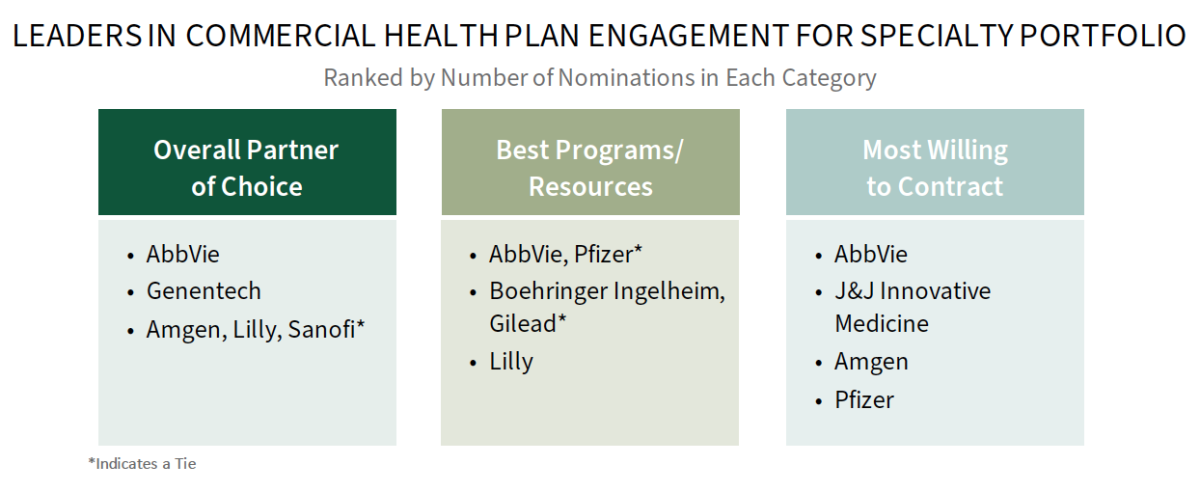

AbbVie Leads in Specialty Portfolio Support for Commercial Health Plans in 2026. Managed care decision-makers were asked to nominate a "best" pharmaceutical manufacturer in specialty across three key categories: 1) Overall Partner of Choice, 2) Best Programs/Resources, and 3) Most Willing to Contract. AbbVie is consistently nominated most across categories, suggesting continued significant resources dedicated to specialty product market access in the managed care sector.

The full report provides benchmark ratings of 35+ manufacturers in specialty account engagement with commercial plans.

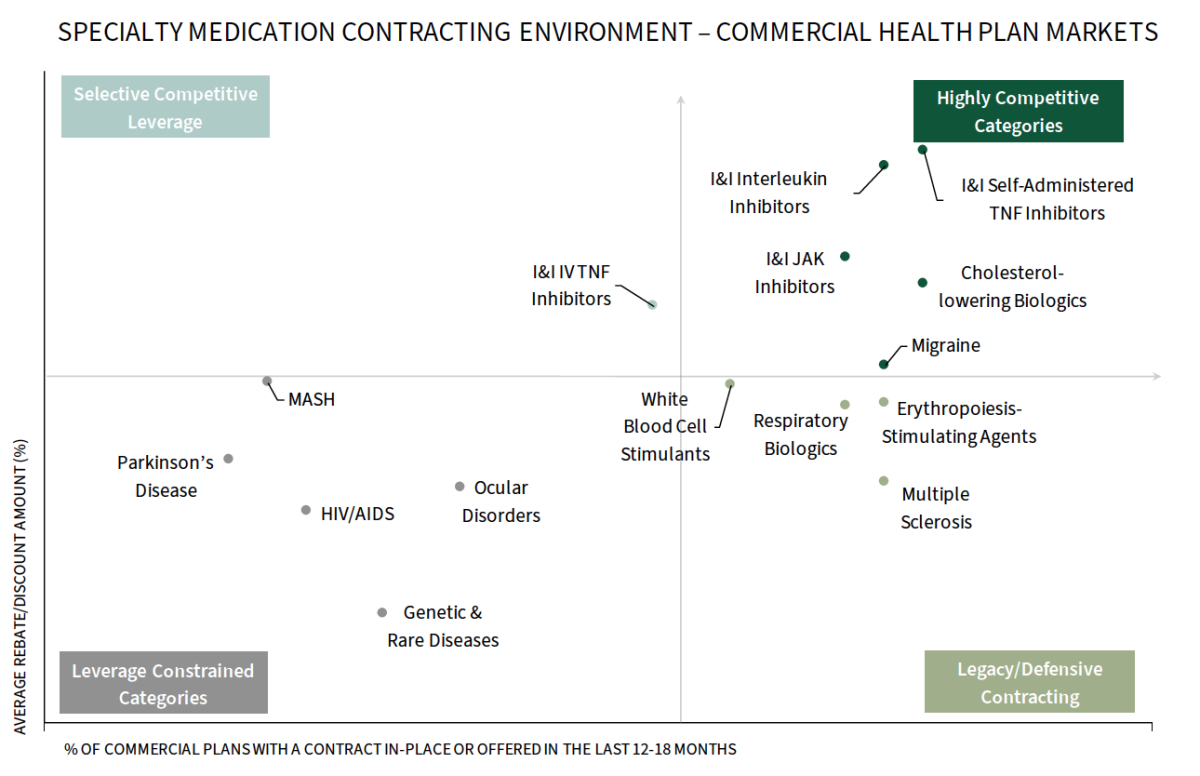

Specialty Contracting is Often Shaped by Competitive Density. Drawing on survey data from commercial health plans, the below chart maps contract prevalence (share of plans with a contract in-place or offered) against average reported rebate levels across specialty therapeutic areas. Data suggest that rebate escalation is concentrated in highly competitive categories–and accelerated by biosimilars–while lower-competition markets or those with unique leverage constraints remain more insulated.

The full report provides a deep dive into contracting trends for the above therapeutic classes, examining:

- Prevalence, contract types/approaches, and most common rebate/discount amounts

- Prevalence of alternative contracting approaches, such as portfolio, risk/outcomes, and indication-based contracts

- Impact of federal government pricing benchmarks (e.g., MFP, MFN) on negotiations in commercial markets

Research Methodology and Report Availability. In January, HIRC surveyed 49 pharmacy and medical directors from national, regional, and BCBS plans representing 107 million lives. Online surveys and follow-up telephone interviews were used to gather information. The Commercial Health Plans: Manufacturer Account Engagement and Contracting for Specialty Pharmaceuticals report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >