Specialty Pharmacy Provider Study: Oncology Medication Manufacturer Engagement and Contracting Trends

Highlights of the report:

Download a PDF of these Highlights

As oncology leads in specialty drug spend, and roughly two-thirds of specialty drugs flow through specialty pharmacies and retail, SPPs are key to oncology medication manufacturers' channel strategies. HIRC's report, Specialty Pharmacy Provider Study: Oncology Medication Manufacturer Engagement and Contracting Trends, reviews SPPs' perceptions and ratings of manufacturers, and examines trends in oncology medication distribution, management, and contracting. The report addresses the following:

- How has U.S. spending on specialty pharmaceuticals changed by specialty TA and distribution channel? What estimated share of SPPs' overall prescription volume is accounted for by oncology medications?

- Which pharmaceutical firms are most frequently nominated as SPPs' overall "Partner of Choice" in oncology? What factors drive panelists' nominations?

- How do manufacturers benchmark with SPPs in account management support and willingness to contract?

- How do SPPs perceive the availability of contracts offered by manufacturers? How does this differ by therapeutic class and type of specialty pharmacy?

Key Finding: SPPs have the ability to shape the brand experience and enhance brand access, and thus contracting for clinical support services has been a key tactic for firms to enhance positioning as strong partners committed to improving cancer care.

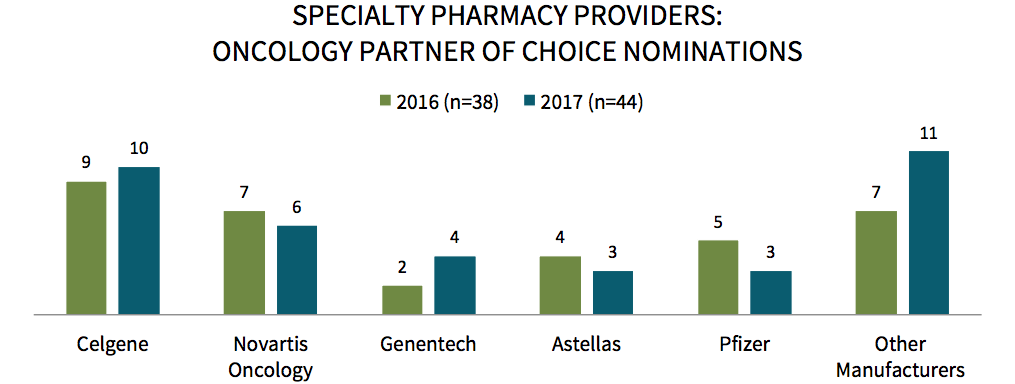

Specialty Pharmacy Providers Choose Celgene as the Overall "Partner of Choice" in Oncology. Celgene is most frequently nominated as the SPP oncology "Partner of Choice" followed by Novartis Oncology, and Genentech. While account support remains the top factor driving nominations, access to product portfolio, as well as forward/innovative thinking are becoming increasingly more important "Partner of Choice" factors for SPPs.

The full report includes the complete listing of partner of choice nominations and a detailed analysis of factors driving panelists' selections.

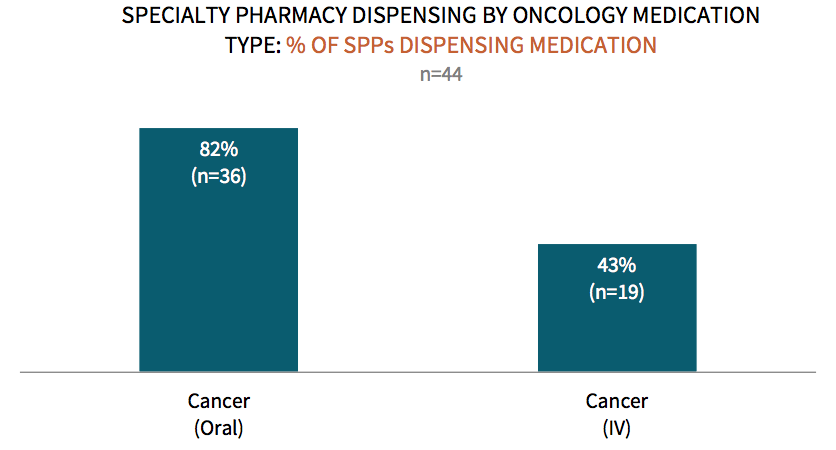

A Majority of SPPs Dispense Oral Oncology Medications. Roughly two-thirds of specialty medications flow through specialty pharmacies and retail, with the remainder flowing through physician offices, clinics, and hospitals. A majority (82%) of SPPs dispense oral oncology medications, compared to about 43% for IV oncology medications. A greater portion of health system and hospital-owned SPPs report dispensing of oral and IV oncology medications compared to HP/PBM-owned specialty pharmacies and independents.

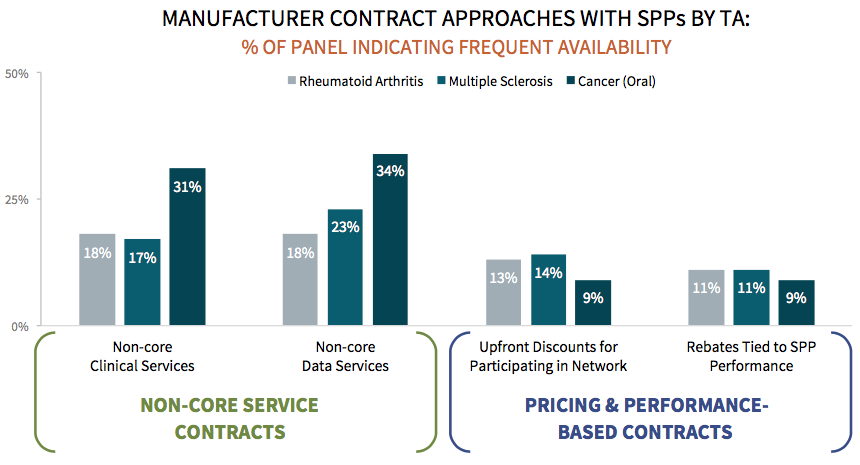

SPPs Perceive Non-core Service Contracts as Most Available for Oral Oncology Medications. SPP respondents were asked to rate the availability of contract types offered by manufacturers across a number of specialty therapeutic areas. 34% of SPPs perceive non-core data service contracts as "frequently" available for oral oncology medications, compared to just 18% and 23% indicating frequent availability for RA and MS, respectively.

Research Methodology and Report Availability. In May/June, HIRC surveyed 44 specialty pharmacy provider key decision makers, representing a variety of ownership types. In addition to extensive secondary research, online surveys and follow-up telephone interviews were used to gather information. The complete report, Specialty Pharmacy Provider Study: Oncology Medication Manufacturer Engagement and Contracting Trends, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights