Medicaid MCOs: Market Access Landscape and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

The Medicaid managed care organization (MCO) market is growing modestly (2%) as the economy improves and states see fewer ACA expansion enrollees. HIRC's report, Medicaid MCOs: Market Landscape and Strategic Imperatives, examines the current market landscape, Medicaid MCO executives' strategic imperatives, and views on market trends that could impact the segment further. The report addresses the following questions:

- What is the current landscape of the Medicaid MCO market and which insurers account for the majority of the market share?

- What do MCOs identify as the most notable market trends impacting their business in 2017?

- What are Medicaid MCO executives' most urgent strategic imperatives? What are the differences in priorities by plan and role type?

- Which quality metrics are Medicaid MCOs utilizing to track and benchmark quality of care performance?

- Which therapeutic areas are most tightly managed? How are Medicaid MCOs investing to manage cost and utilization of medications?

Key Finding: Medicaid MCO respondents identify the ACA repeal and replace as the top government related market trend, and specialty drug spend as the top non-government related market trend in 2017.

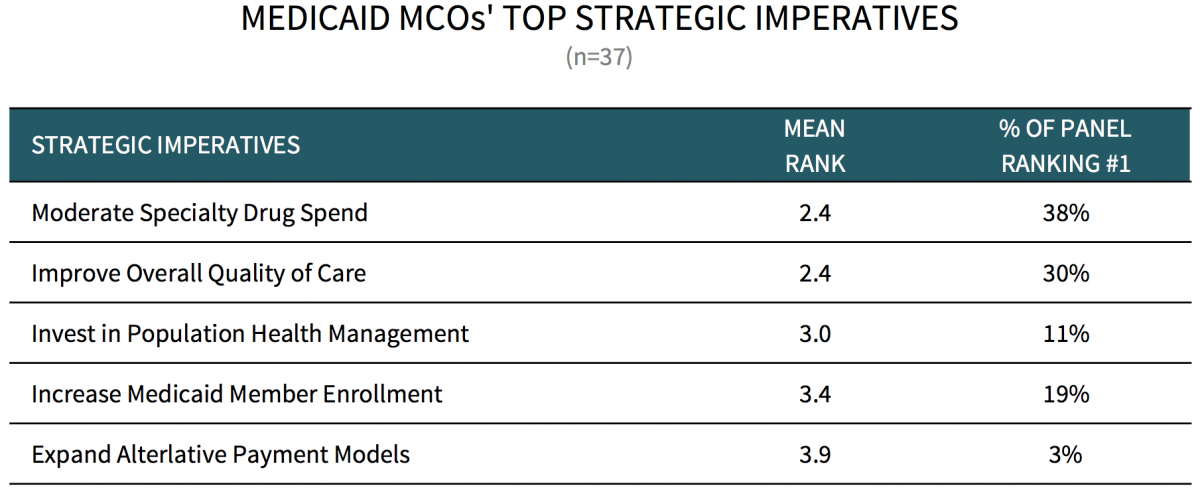

Moderating Specialty Drug Spend is Identified as Medicaid MCOs' Top Strategic Imperative in 2017. Medicaid MCO executives were asked to consider and rank order a list of strategic imperatives according to their level of priority and investment. Respondents rank 'Moderate Specialty Drug Spend' as their top strategic priority in 2017, followed by 'Improve Overall Quality of Care', and 'Invest in Population Health Management'.

The full report provides a complete analysis of Medicaid MCOs' top market trends and strategic imperatives and examines MCOs' activities to achieve their priorities in 2017.

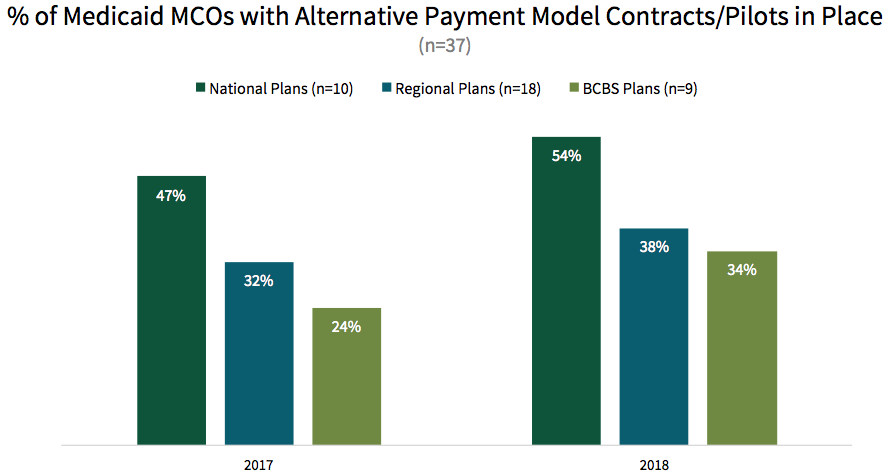

Medicaid MCOs Continue to Expand Use of Alternative Payment Models with Network Providers. The percentage of Medicaid MCO's reimbursing on a fee-for-service only basis continues to decrease, as MCOs increasingly utilize alternative payment model contracts with network providers. On average, nearly half (47%) of national plans are utilizing or piloting these agreements in 2017, and are expected to reach 54% by 2018. The most common payment model reported is capitation, followed by shared savings, care management fee/bonus incentive, and bundled/episode-based payments.

The full report also features the following to support Medicaid MCO account planning:

- A review of notable market activity and detailed analysis of government related, and non-government related market trends with the highest potential to change or disrupt the Medicaid MCO business plan.

- Manufacturer ratings of ability to limit access and willingness to partner with pharmaceutical firms for the following top Medicaid MCOs: Aetna, Anthem, Centene, L.A. Care, Molina, United Healthcare, and WellCare.

Research Methodology and Report Availability. In September/October 2017, HIRC surveyed 37 pharmacy and medical directors from national, regional, and BCBS Medicaid MCOs. Online surveys were used to gather information. The complete report, Medicaid MCOs: Market Landscape and Strategic Imperatives, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >