Market: Medicaid (Spring 2015)

Highlights of the report:

Download a PDF of these Highlights

Medicaid Organizations are Struggling with Rising Specialty Drug Costs and Improving Quality Measures

Managing specialty drug costs—and particularly hepatitis C—is a major issue for State Medicaid agencies and Medicaid MCOs.

- Medicaid agencies are struggling to manage costs associated with new drug therapies for hepatitis C and are acutely aware of the impact future high-priced products are likely to have on their budgets.

- Securing supplemental rebates while managing access to specialty drugs through established (e.g., prior authorizations) and new (e.g., clinical criteria) approaches is a critical priority.

“This year our top issue is the costly new drugs to treat hepatitis C. The high cost of hep C meds is moving us to request higher supplemental rebates more than ever before. The cost of the drugs is creating such a stir that we’re going to have to develop criteria and we’re in the process of doing that.” (State Medicaid)

“Our top issue this year for Medicaid is hepatitis C. About 13 months ago Sovaldi hit the market and since then we’ve been struggling and negotiating with the state to manage this category and the high drug cost. We’re responding by making sure that only what we determine is the right population gets the medication. The state has determined that we’re being too stingy, we didn’t follow their criteria, and we need to pay for more. Financially, something’s got to give; our payment rates are not enough to cover the proposed membership on hepatitis C therapy. If we covered everyone the way the state wants us to, it wouldn’t take long for us to be not much of a plan.” (Medicaid MCO)

The Medicaid population’s transiency and multiple chronic diseases make it difficult to effectively manage their members’ health.

- Compliance and adherence for costly chronic conditions and issues created by patients’ use of multiple drug regimens are significant areas of concern.

“The quality metric we find most difficult is polypharmacy, trying to corral patients that go to multiple providers and are on multiple drugs. Many times they take two and three different agents for the same disease state; we try to get that reduced because obviously the more drugs you take the greater chance of an adverse drug event.” (Medicaid MCO)

- Opioid medication therapy management to address substance abuse is a focus for many state Medicaid agencies.

“We have been trying to address substance misuse by putting quantity limits on short-acting and long-acting narcotics and benzos. We’ve always had long-acting narcotics like OxyContin and Fentanyl on PA, but recently we’ve taken a little more aggressive role that way. There are some legislative bills being proposed that address the pharmacies’ lack of self-policing. There’s another bill that will prohibit pharmacies from split billing so patients will not be able to pay cash for quantities in excess of those allowed by Medicaid.” (State Medicaid)

Key Finding: Managing access to specialty drugs and addressing the Medicaid populations’ multiple health needs are priorities for Medicaid organizations.

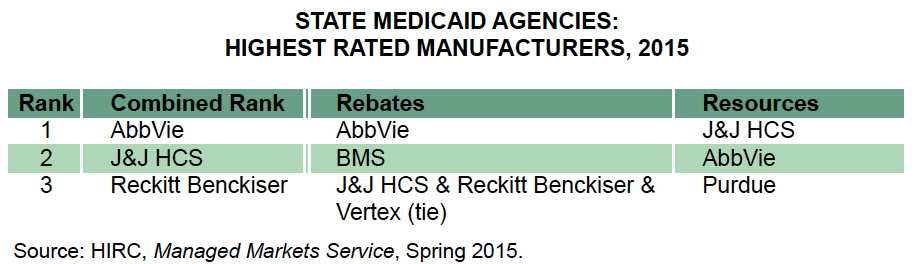

AbbVie and J&J Health Care Systems are the leaders in the State Medicaid market in 2015 based on their combined ratings of Value of Resources and Willingness to Offer Supplemental Rebates

- AbbVie is #1 overall and is recognized by State Medicaid agencies as a valued partner for its proactive and collaborative approach to contracting and its patient support materials for RA.

- State Medicaid agencies applaud J&J Health Care Systems for its customer-facing personnel and innovative teaching tools.

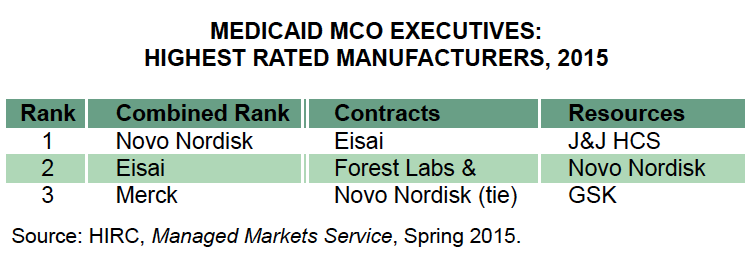

The top-rated manufacturers in HIRC’s spring 2015 benchmarking research with State Medicaid pharmacists and Medicaid MCO executives are highlighted in the tables below.

Novo Nordisk is Rated Highest Overall by Medicaid MCOs

Novo Nordisk is the leader in the Medicaid MCO market in 2015 based on its combined ratings of value of resources and willingness to negotiate contracts as well as its favorable positioning for each individual attribute.

- Also of note is the exceptional—although somewhat unbalanced—performance of Eisai and Forest for contracting and J&J HCS and GSK for resources.

Research Methodology and Report Availability

HIRC's benchmarking research was conducted in the first quarter of 2015 through a combination of more than 140 surveys and 55 in-depth interviews with decision makers in four Commercial and three Government managed markets. The full report, Medicaid: State Agencies and MCOs, is available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >