Integrated Delivery Networks: Specialty Medication Management and Partnership Opportunities

Highlights of the report:

Download a PDF of these Highlights

The shift towards value-based care is likely to impact how providers think about and evaluate medications. HIRC’s report, Integrated Delivery Networks: Specialty Medication Management Initiatives and Partnership Opportunities, examines IDNs' activities in specialty medication management and their quality improvement priorities across 16 oncology and specialty therapeutic areas. The report addresses the following questions:

- How does the shift towards value-based reimbursement impact IDN decision-makers evaluation of medications?

- What are IDNs' quality improvement priorities across specialty disease states?

- How prevalent are IDN-owned specialty pharmacies? How is this projected to grow?

- What is the status of IDN formularies and how often do they include both inpatient and outpatient specialty medications?

- What is the status of physician decision-support systems for oncology and specialty therapeutic areas (e.g., evidence-based guidelines and clinical pathways)?

- Which areas of opportunity exist to foster collaborative partnerships with IDNs?

Key Finding: The growth of alternative payment models and the increasing specialty drug trend are driving IDNs to evaluate savings opportunities in high cost therapy categories and to assess medications based on their impact on total cost of care.

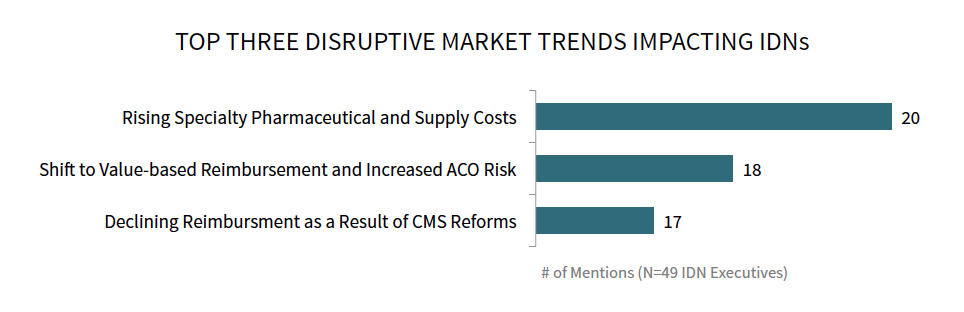

Rising Specialty Drug Costs and Value-based Reimbursement Identified as Top Disruptive IDN Market Trends. IDN executives were asked to identify the most disruptive market trends that have the potential to impact their business and industry over the next 1-3 years. Rising specialty pharmaceutical costs within a value-based care environment, and the evolution of the ACO model towards additional risk, were identified as top disruptive trends. These trends could drive IDNs toward tighter management of specialty medications in years to come.

The full report includes the full listing of 12 disruptive market trends and provides IDN executives' perspectives on how the shift towards value-based reimbursement has impacted their business.

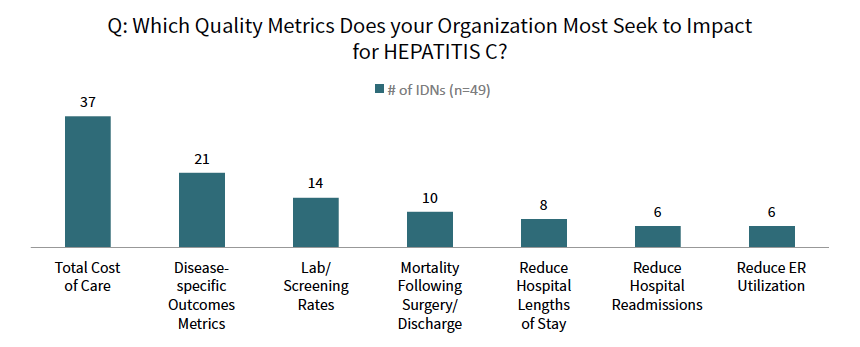

Total Cost of Care is IDNs' Top Key Performance Indicator in Specialty and Oncology. Quality improvement is a critically important IDN key performance indicator. When asked to identify the highest priority quality metrics across 16 specialty therapeutic areas and cancer types, IDNs most often selected total cost of care. Secondary and tertiary quality improvement priorities vary by disease state, with disease-specific outcomes metrics and screening rates most important in hepatitis C, for example.

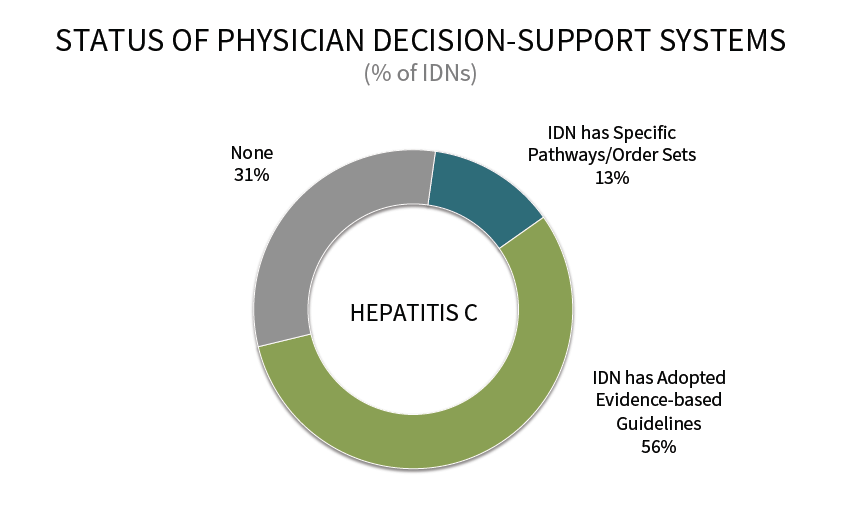

Advanced HIT Capabilities Provide IDNs with a Platform to Shape Physician Decision-making and Formulary Enforcement. IDNs use a number of mechanisms to ensure evidence-based care, such as clinical guidelines and pathways, which are often embedded in electronic health record systems. A majority of IDNs have implemented clinical pathways or evidence-based guidelines across oncology and specialty therapeutic areas. In hepatitis C, for example, 13% of IDNs have clinical pathways or order sets in-place, and another 56% report using evidence-based guidelines.

Research Methodology and Report Availability. In March, HIRC surveyed 49 IDN C-suite executives and pharmacy and medical directors. Online surveys and follow-up telephone interviews were used to gather information. The Integrated Delivery Networks: Specialty Medication Management Initiatives and Partnership Opportunities report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >