Health Exchange Plans: Specialty Medication Management and Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

Enrollment in the Health Insurance Marketplace is expected to increase dramatically between now and 2018, leveling off at 25 million members if projections hold. HIRC's report, "Health Insurance Marketplace Plans: Specialty Medication Market Access and Manufacturer Performance," examines exchange plan approaches to specialty medication formulary, benefit design, and utilization management. The report addresses the following questions:

- Which therapeutic classes do exchange plans invest in most to manage? What is their approach to specialty medication management?

- Which specialty brands demonstrate favorable coverage and preferred status in exchange plan formularies?

- What are patients' cost sharing responsibilities for specialty medications by metal tier?

- Which pharmaceutical manufacturers have best engaged plans in issues specific to their exchange membership?

Key Finding: Exchange plans primarily use high drug copays and narrow formularies to moderate their specialty medication spend. Follow-up interviews suggest that about half of plans expect to apply similar approaches to commercial populations in future years.

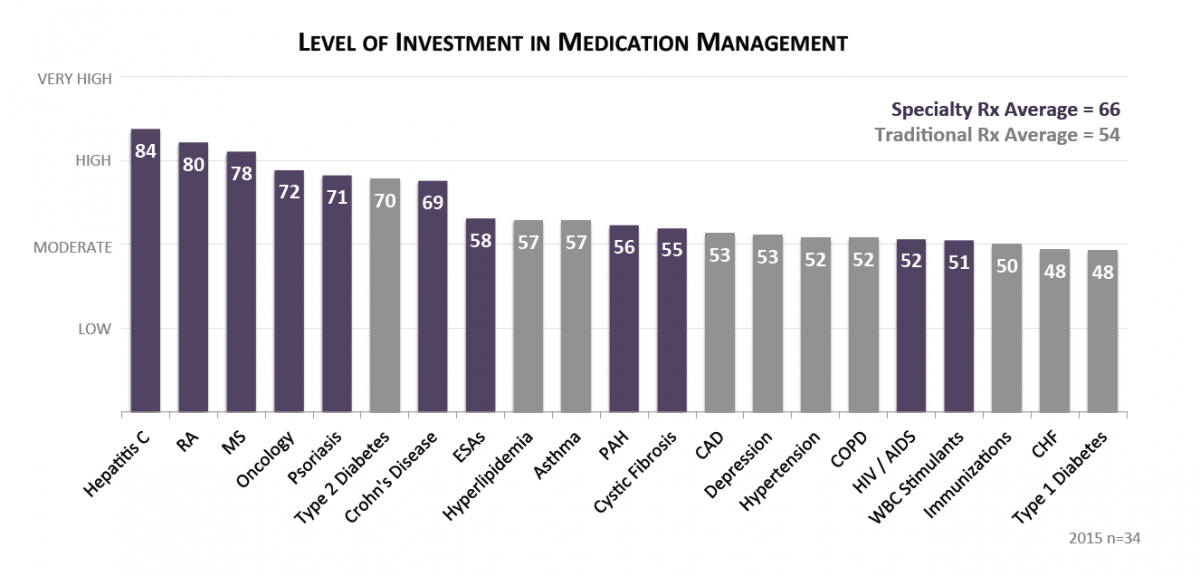

Marketplace Carriers Invest the Most in Managing Hepatitis C, RA, and MS Medications. Ratings from pharmacy and medical directors representing carriers in state-based and federally-facilitated exchanges indicate highest investment in managing the cost and utilization of specialty medications, with hepatitis C, RA, MS and oncology medication management of highest priority. Top investment activities include staff time spent on prior authorizations, case management, and specialty pharmacy clinical services.

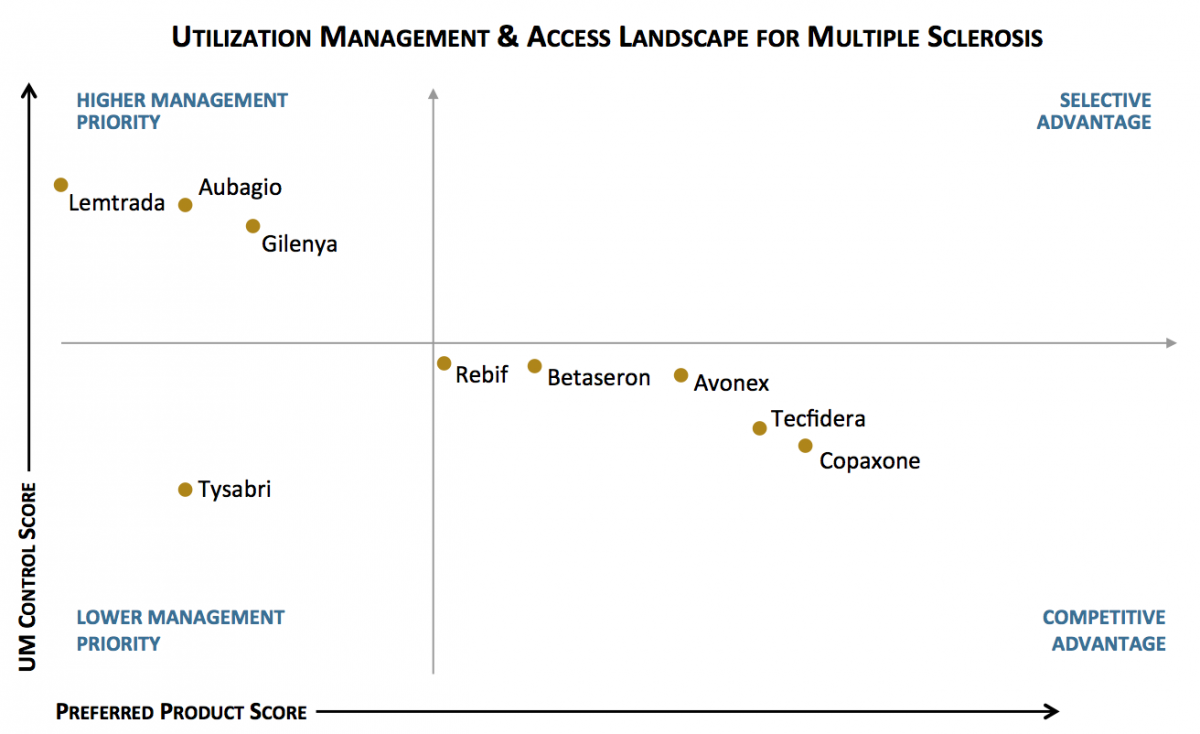

Copaxone and Tecfidera Maintain Favorable Access Position in Exchange Plans for Multiple Sclerosis. The utilization management (UM) landscape varies by class. Some products are more often designated as preferred, while others are subject to higher levels of UM control. In the MS class, Copaxone and Tecfidera are most often designated as preferred in exchange plan formularies, while Aubagio and Gilenya are subject to higher levels of UM control.

The full report provides coverage data and the market access landscape for 37 brands across seven specialty classes:

- RA/Psoriasis/Crohn's Disease: Actemra, Cimzia, Enbrel, Humira, Orencia, Remicade, Stelara, Xeljanz

- Multiple Sclerosis: Aubagio, Avonex, Betaseron, Copaxone, Gilenya, Lemtrada, Rebif, Tecfidera, Tysabri

- Hepatitis C*: Harvoni, Pegasys, Pegintron, Olysio, Sovaldi

- PAH: Adempas, Letairis, Tracleer, Opsumit, Orenitram

- Cystic Fibrosis: Cayston, Kalydeco, Pulmozyme

- Erythropoiesis-Stimulating Agents (ESAs): Aranesp, Procrit, Epogen

- White Blood Cell Stimulants: Granix, Neupogen, Neulasta, Leukine

* Viekira Pak was not yet approved at the launch of this study.

Research Methodology and Report Availability. In December-January, HIRC surveyed 34 pharmacy and medical directors from plans operating in the federally-facilitated and state-based exchange, representing 3.4 million lives (43% of the public exchange market). Online surveys and follow-up telephone interviews were used to gather information. The Health Insurance Marketplace Plans: Specialty Medication Market Access and Manufacturer Performance report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com/summary/sp.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >