Community Oncology Practices: Market Trends and Manufacturer Competitive Assessment

Highlights of the report:

Download a PDF of these Highlights

Community oncology practices (COPs) continue to engage in activities that will position them for success as the market shifts from volume to value. HIRC's report, Community Oncology Practices: Market Trends and Manufacturer Competitive Assessment, reviews practices' strategic imperatives, quality of cancer care needs and challenges, perception of current account support offerings, and provides a competitive assessment of manufacturer performance. The report addresses the following:

- What are COPs' top market concerns, strategic imperatives, and operational objectives in 2019?

- What is the status of oncology preferred drug lists and clinical pathways across ten cancer types?

- What is the perceived reimbursement environment for top IV brands across ten cancer types? Which brands demonstrate a competitive advantage?

- Which firms are most often nominated as COPs' partner of choice and which firms have the"best-in-class" account managers?

- How do firms benchmark in access, account engagement, quality of reimbursement support services, and oncology-related account support?

Key Finding: Community oncology practices' top operational objectives in 2019 are to enhance quality outcomes tracking and reporting and expand oncology pharmacy capabilities.

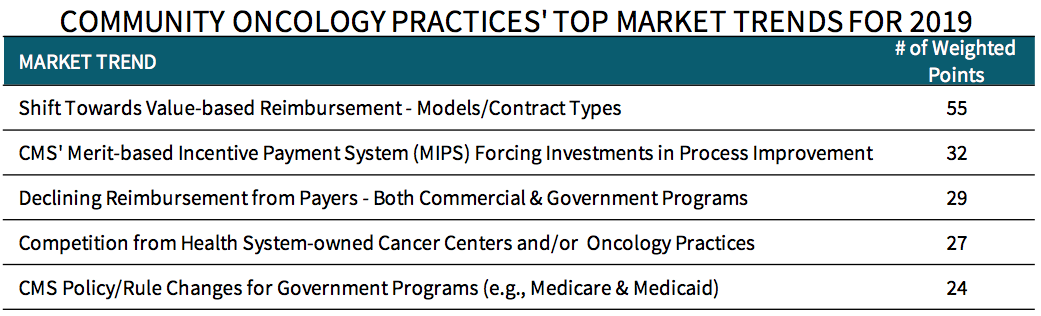

Respondents Identify the Shift Towards Value-based Reimbursement as the Top Market Trend in 2019. Respondents were asked to provide three market trends with the highest potential to impact the community oncology practice business in 2019. Panelists identify the shift towards value-based reimbursement models/contract types as the top market trend, followed by CMS' MIPS forcing investments in process improvement, and declining reimbursement from payers. Five of the top ten market trends directly impact COPs' revenue and viability of the current economic/business model.

The full report provides a complete list of community oncology practices' top national and/or regional market trends in 2019.

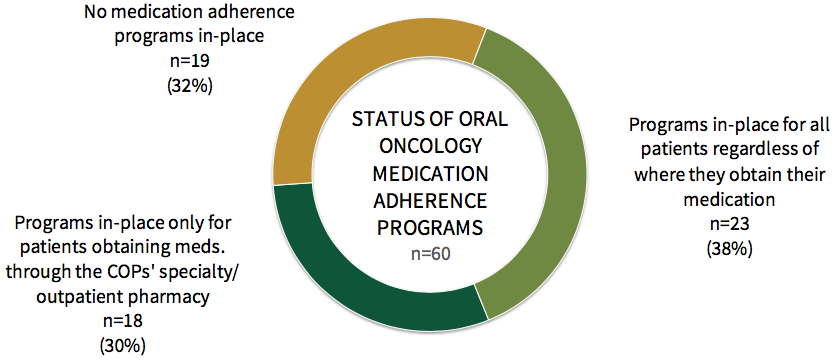

The Majority of COPs Have a Medication Adherence Program for Patients Taking Oral Oncology Medications. When asked about pharmacy services, the majority (68%) of respondents indicate their oncology practice has a medication adherence program for patients taking oral oncology/chemotherapy medications. However, 30% (18 of 60) practices narrow the scope of their program to only patients obtaining medications through their office or outpatient pharmacy. Patient progress is most commonly monitored through follow-up calls or visits.

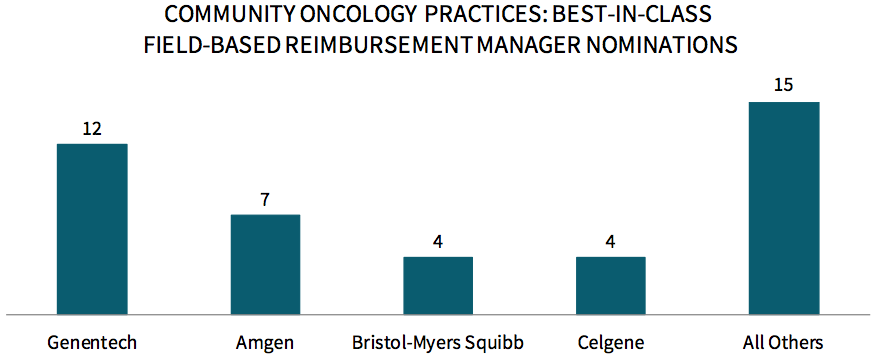

Genentech Receives the Most "Best-in-Class" Field-based Reimbursement Support Personnel Nominations. COP respondents most frequently nominate Genentech as having "best-in-class" in-person/field-based customer facing reimbursement support personnel, followed by Amgen, Celgene, and Bristol-Myers Squibb. Factors driving nominations include responsiveness and customer service, knowledge base and understanding of the reimbursement process and issues, and regular contact.

Research Methodology and Report Availability. In January, HIRC surveyed 60 executives from large, mid-size, and small community oncology practices. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Community Oncology Practices: Market Trends and Manufacturer Competitive Assessment, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >