Commercial Health Plans: Manufacturer Account Engagement and Contracting for Oncology Medications

Highlights of the report:

Download a PDF of these Highlights

As the oncology medication market becomes notably more competitive, manufacturers are increasing contracting efforts to build collaborative engagements with commercial health plans. HIRC's report, Commercial Health Plans: Manufacturer Account Engagement and Contracting for Oncology Medications, examines the contracting environment and payer evaluations of 22 firms active in oncology. The report addresses the following:

- Which manufacturers are most often nominated as plans' overall "Partner of Choice" in oncology, and what factors drive nominations?

- How do firms benchmark in contracting and support of oncology-related initiatives?

- How do payers perceive the current contracting environment for both oral and IV oncology medications across ten cancer types?

- Which manufacturer offerings are most compelling to commercial health plan decision-makers to support their oncology-related needs?

Key Finding: Commercial health plan respondents report "In-service/Workshop: Current state and future of oncology medication value and value frameworks (ASCO, NCCN, etc.)" as their primary unmet need in oncology-related support offerings from manufacturers.

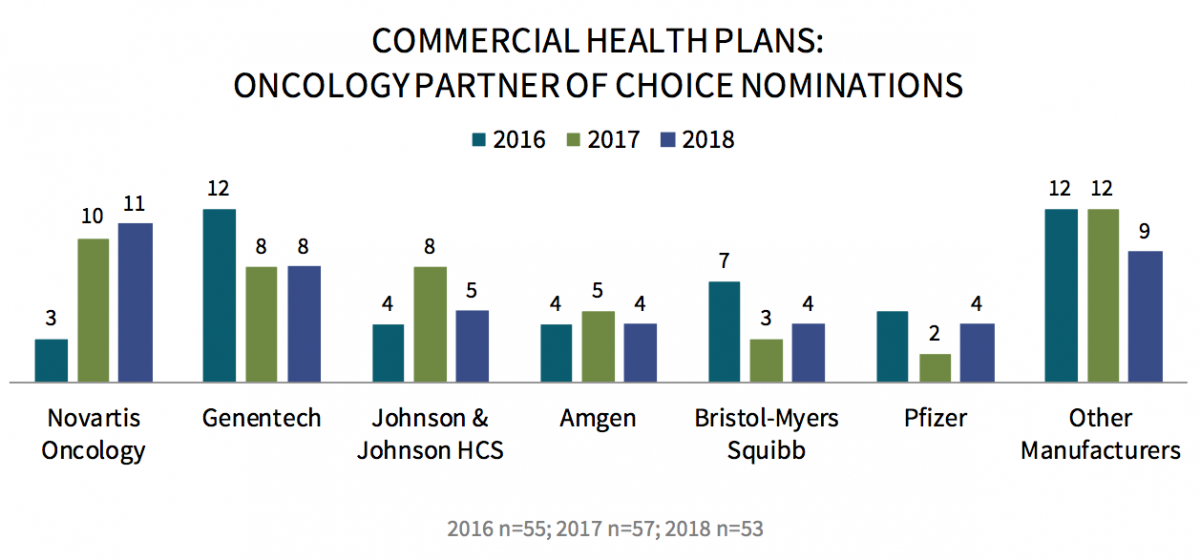

Novartis Oncology Receives the Most Oncology "Partner of Choice" Nominations. For the second year in a row, Novartis Oncology is most frequently nominated as the commercial health plan oncology partner of choice, followed by Genentech and J&J HCS. In the last year, Novartis Oncology, BMS, and Pfizer have increased in number of nominations. Factors driving partner of choice nominations include quality of account management support personnel and/or relationship, and oncology product portfolio.

The full report includes the complete listing of partner of choice nominations and a detailed analysis of the factors driving panelists' selections.

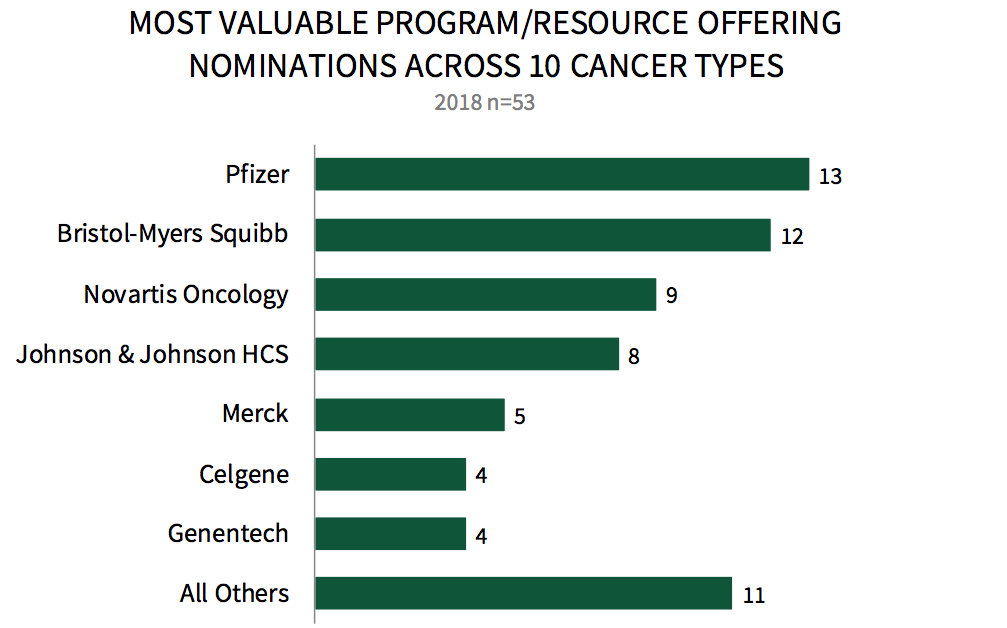

Pfizer Leads with Most Valuable Program/Resource Offering Nominations Across 10 Cancer Types. Panelists were asked to consider ten cancer types and nominate one manufacturer with the most valuable program/resource offering within each cancer type. A total of 15 manufacturers received 66 nominations. Pfizer leads with the most program/resource offering nominations, namely in breast cancer, prostate cancer, and renal cell carcinoma.

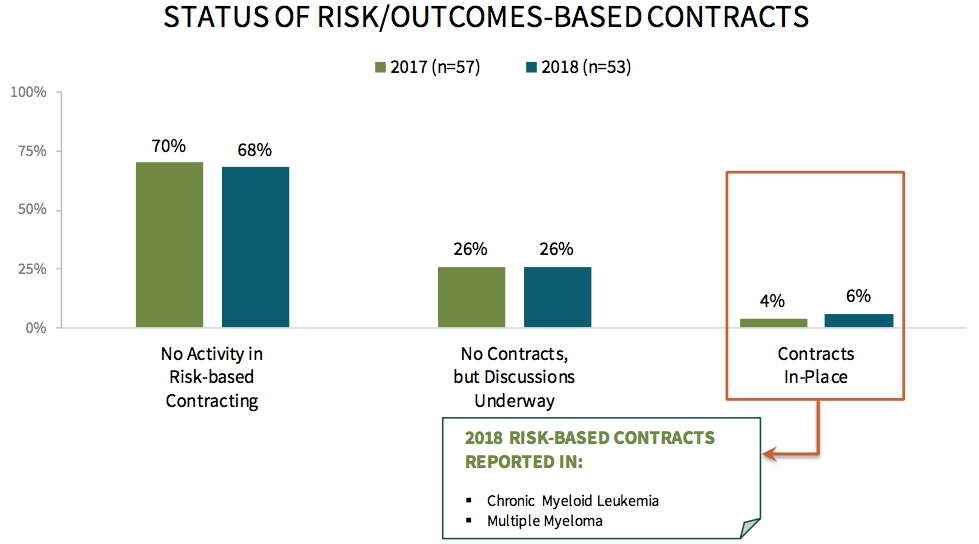

Risk/Outcomes-based Contracting for Oncology Medications Remains Low. Respondents were asked to share the status of risk-sharing contracts within their organization for oncology medications. The majority of respondents (68%) do not have risk/outcomes-based contracts in place for oncology medications due to numerous obstacles and challenges, however, plans are slowly starting to experiment with these contract types. Chronic myeloid leukemia and multiple myeloma have been targeted for risk/outcomes-based contracting in oncology.

Research Methodology and Report Availability. In March, HIRC surveyed 53 pharmacy and medical directors from national, regional, and BCBS plans representing 84 million lives. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Commercial Health Plans: Manufacturer Account Engagement and Contracting for Oncology Medications, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >