Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Positioning

Highlights of the report:

Download a PDF of these Highlights

As the industry evolves and consolidates, a robust contracting strategy and program/resource offerings are critical to maintaining market access. HIRC's report, Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Positioning, reviews health plan pharmacy and medical directors' evaluation of manufacturers, and focuses on trends in contracting. The report addresses the following questions:

- Which manufacturers lead in pharmacy and medical directors' evaluation of willingness to contract?

- What level of rebates/discounts are manufacturers offering for formulary access across therapeutic areas?

- Which contract types are most commonly offered? What are the headwinds and tailwinds of risk/outcomes and indication-based contracts?

- Which manufacturers are most often nominated as plans' overall "Partner of Choice"?

- What types of programs and resources are commercial plans' most interested in?

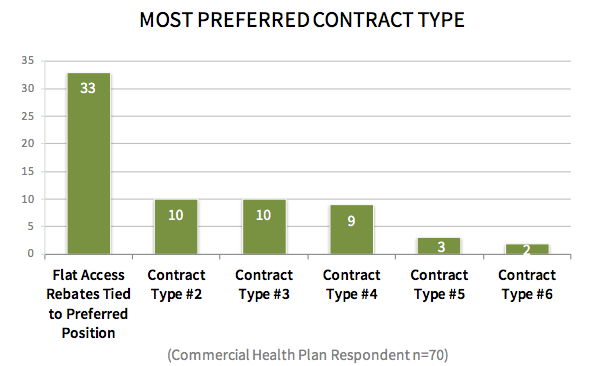

- Key Finding: Flat access rebates tied to preferred position is the most frequently available contract type offered to commercial health plans across traditional, specialty, and oncology products.

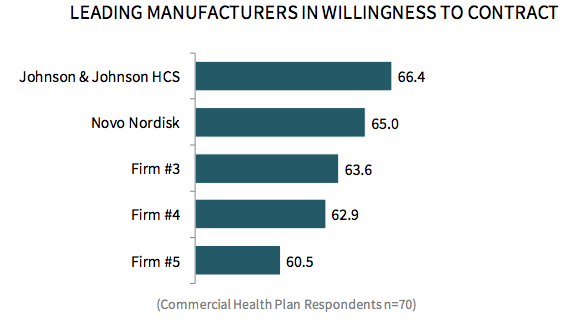

Johnson & Johnson HCS and Novo Nordisk Rate Highest in Willingness to Contract. Respondents were asked to consider and rate 42 very large, large, and mid-size pharmaceutical firms on their overall willingness to contract. Commercial health plans report that Johnson & Johnson HCS is the most willing to contract, followed by Novo Nordisk. Top firms are noted for their proactivity and flexibility in negotiations, array of contract types offered across therapeutic areas, and overall ease of the contracting process.

The full report provides a detailed list of all 42 manufacturers in willingness to contract ratings.

Flat Access Rebates Tied to Preferred Position is Plans' Most Preferred Contract Type. When asked to select one of seven contract types as most preferred, 49% of commercial health plan respondents chose flat access rebates tied to preferred position. An in-depth analysis of factors driving most preferred contract type nominations reveal that flat access rebates tied to preferred position arrangements are preferred due to ease of administration and operationalization, predictability, and because they allow for maximum savings.

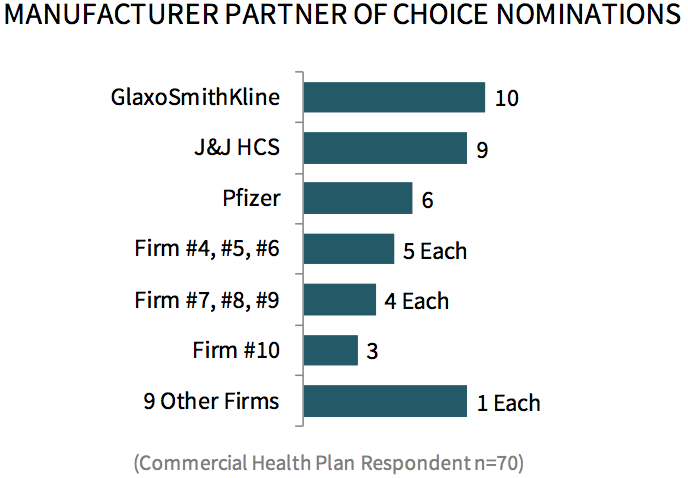

GlaxoSmithKline and Johnson & Johnson HCS Receive the Most "Partner of Choice" Nominations. GlaxoSmithKline is most frequently nominated as the commercial health plan partner of choice, followed closely by Johnson & Johnson HCS and Pfizer. The primary factors driving partner of choice nominations include a firm's ability to demonstrate an understanding of plan's business needs and providing relevant resources, and the quality of account management support/personnel.

Research Methodology and Report Availability. In December 2017 and January 2018, HIRC surveyed 70 commercial health plan pharmacy and medical directors from national, regional, and BCBS plans. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Positioning, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >