Academic Institution & Health System-based Cancer Centers: Market Trends and Manufacturer Competitive Assessment

Highlights of the report:

Download a PDF of these Highlights

Academic Institution & System-based Cancer Centers: Market Trends and Manufacturer Competitive Assessment The organizational complexity of Cancer Centers continues to grow as they add service capabilities and broaden their geographic coverage area to thrive in an increasingly value-based market environment. HIRC's report, Academic Institution & Health System-based Cancer Centers: Market Trends and Manufacturer Competitive Assessment, reviews Cancer Centers' strategic imperatives, quality of cancer care needs and challenges, perception of current account support offerings, and provides a competitive assessment of manufacturer performance. The report addresses the following:

- What are Cancer Centers' top market concerns, strategic imperatives, operational objectives in 2019?

- What is the status of oncology preferred drug lists and clinical pathways across ten cancer types?

- What is the perceived reimbursement environment for top IV brands across ten cancer types? Which brands demonstrate a competitive advantage?

- Which firms are most often nominated as Cancer Centers' partner of choice, and which firms have "best-in-class" account managers?

- How do firms benchmark in access, account engagement, quality of reimbursement support services, and oncology-related account support?

Key Finding: Panelists report declining reimbursement from payers, the emergence of ground-breaking advances/new therapies, and the shift toward value-based reimbursement as top market trends in 2019.

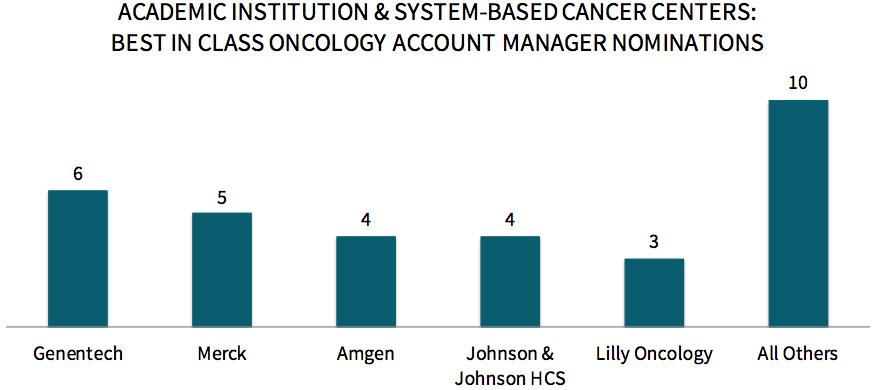

Genentech Receives the Most "Best-in-Class" Oncology Key Account Manager Nominations. Cancer Center respondents most frequently nominate Genentech as having "best-in-class" oncology key account managers, followed by Merck, Amgen, J&J HCS, and Lilly. Factors driving account manager nominations include accessibility, responsiveness, and being respectful of time, as well as understanding the market and business challenges of Cancer Centers and being able to provide relevant resources.

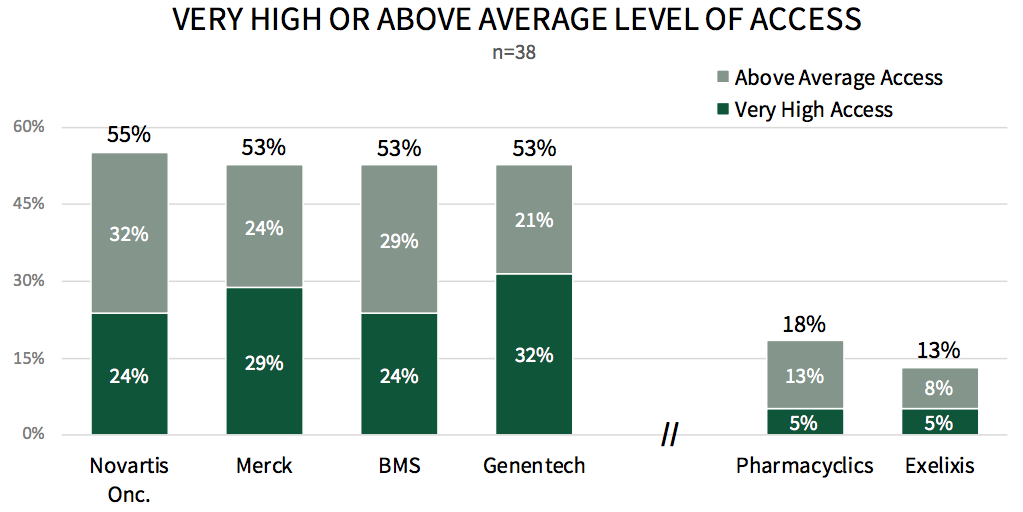

Novartis Oncology Earns Highest Ratings in Access to Cancer Centers' Senior Leadership. Respondents were asked to rate the level of access that manufacturers' customer-facing personnel has to the Cancer Center's senior level leadership. Novartis Oncology leads with very high and/or above average access ratings from 55% of panelists, followed by Merck, BMS, and Genentech (53%). In contrast, companies such as Pharmacyclics (18%), and Exelixis (13%) have far less access to Cancer Centers' senior leadership.

The full report provides a complete list of Cancer Centers' access ratings across 22 oncology medication manufacturers.

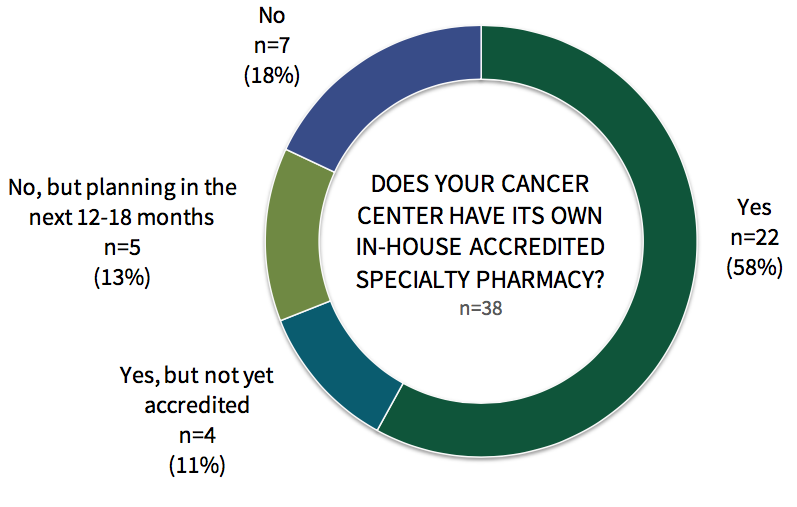

The Majority of Cancer Centers Have an In-House Accredited Specialty Pharmacy. When asked about Cancer Center pharmacy services, the majority (69%) of respondents indicate their Cancer Center has an in-house specialty pharmacy, increasing to about 82% of Cancer Centers by 2021. Additionally, 4 of the 12 Cancer Centers with no in-house specialty pharmacy offer on-site dispensing of oral oncology medications through outpatient pharmacy.

Research Methodology and Report Availability. In January, HIRC surveyed 38 executives from academic institution and hospital/health system-based Cancer Centers. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Academic Institution & Health System-based Cancer Centers: Market Trends and Manufacturer Competitive Assessment, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >